No One Would Listen: A True Financial Thriller (57 page)

Read No One Would Listen: A True Financial Thriller Online

Authors: Harry Markopolos

BOOK: No One Would Listen: A True Financial Thriller

11.23Mb size Format: txt, pdf, ePub

Potential Fall Out if Bernie Madoff is found out to be front-running customer order flow:1. This would be just one more black eye among many for the brokerage industry and the NYSE and NASDAQ. At this point the reputations of both the NYSE and NASDAQ are already at rock bottom, so there’s likely little downside left for these two troubled organizations.2. The industry wouldn’t miss a beat other than for the liquidation of Madoff Investment Securities, LLC. Figure it will be similar to REFCO’s demise only there won’t be a buyer of the firm given that they cheated customers who would all be embarrassed to remain customers once the news they’ve been ripped off is on the front-pages. These former customers are more likely to sue for damages than remain customers. Unsecured lenders would face losses but other than that the industry would be better off.3. At least the returns are real, in which case determining restitution could keep the courts busy for years. The Class Action Bar would be thrilled. A lot of the FOF’s are registered offshore in places where the long arm of the law might not reach. My guess is that the fight for the money off-shore would keep dozens of lawyers happily employed for many years.4. The FOF’s would suffer little in the way of damage. All could be counted on to say

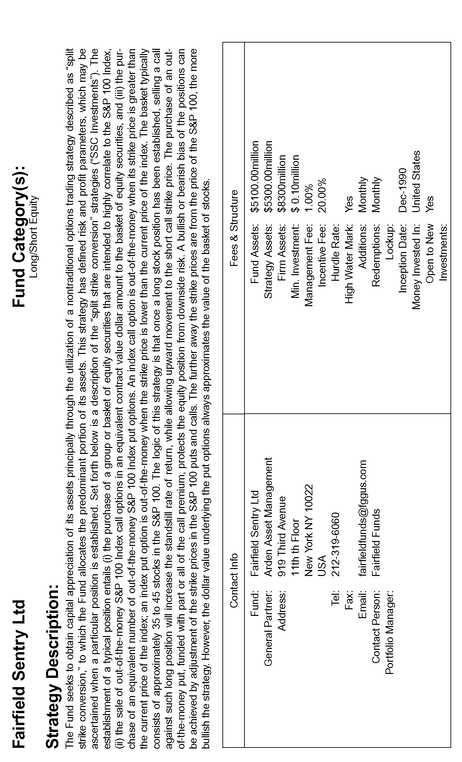

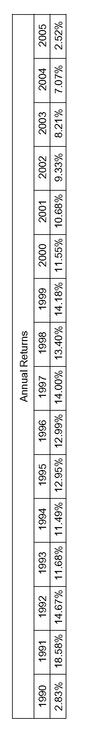

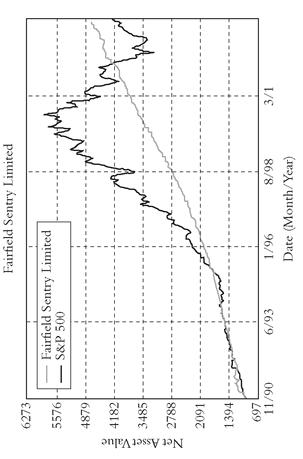

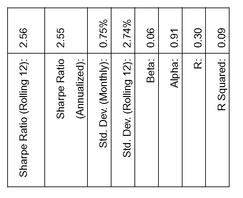

“We didn’t know the manager was generating returns illegally. We relied upon the NYSE and NASDAQ to regulate their markets and prevent front-running therefore we see no reason to return any funds. ”Attachments:1. 2 page Summary of Fairfield Sentry Ltd with performance data from December 1990 - May 2005.2. Copy of the May 7, 2001 Barrons’ article,

“Don’t Ask, Don’t Tell; Bernie Madoff is so secretetive, he even asks his investors to keep mum,”

written by Erin E. Arvedlund.3. Partial list of French and Swiss money-managers and private banks with investments in Bernie Madoff’s hedge fund. Undoubtedly there are dozens more European FOF’s and Private Banks that are invested with BM.4. 2 page offering memorandum, faxed March 29, 2001, for an investment in what I believe is Fairfield Sentry Ltd., one of several investment programs run by Madoff Investment Securities, LLC for third party hedge fund, fund of funds. I do not know who the source was who faxed this document since the fax heading is blank. The document number listed at the bottom of the page appears to read I:\Data\WPDOCS|AG_\94021597.

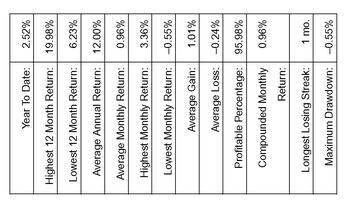

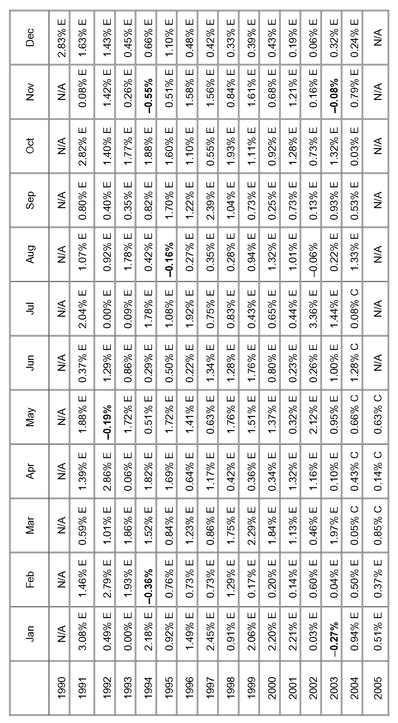

ATTACHEMENT 1: Fairfield Sentry Performance Data

Appendix C

Online Resource Guide for the Classroom and Beyond

The story of the Madoff fraud is far from over. Free downloadable resources are available for the general reader and for classroom use at

www.noonewouldlisten.com

, including:

www.noonewouldlisten.com

, including:

• Victims’ stories from news media

• Video clips

• Newspaper articles

• Research papers

• Written testimony

• The government’s criminal prosecution of the case

• Civil case proceedings against the accountants, banks, board members, custodians, feeder funds, fiduciaries, hedge funds of funds, plan administrators, and others

Additional materials will be added as they become available, so be sure to check back often.

A Note for Educators:

These resources are intended for use in business, business ethics, business law, and forensic accounting courses at the undergraduate and graduate levels.

These resources are intended for use in business, business ethics, business law, and forensic accounting courses at the undergraduate and graduate levels.

A Note on Sources

This book is a first-hand account of my experience investigating the Madoff fraud from 1999 through 2009. Direct quotations are to the best of my remembrance. As noted in the text, several sources provided valuable insight into what went on at the government organizations and financial firms during this time. Those interviewed for the research of this book include Inspector General David Kotz, Sergeant Harry Bates, and each member of my investigation team—Frank Casey, Neil Chelo, Michael Ocrant, and Gaytri Kachroo.

Other books and articles have been written on the subject of the Madoff investigation. Those referenced in this book include Erin Arvedlund’s article, “Don’t Ask, Don’t Tell,” (

Barron‘s,

May 7, 2001,

http://online.barrons.com/article/SB989019667829349012.html

); her book,

Too Good to Be True: The Rise and Fall of Bernie Madoff

(Portfolio, 2009); Michael Ocrant’s article, “Madoff Tops Charts; Skeptics Ask How” (

MARHedge

89, May 2001, page 1)—also printed in full as Appendix A of this book; and Gregory Zuckerman and Kara Scannell’s article, “Madoff Misled SEC in ’06, Got Off,” (

Wall

Street

Journal,

December 18, 2008, page A1,

http://online.wsj.com/article/SB122956182184616625.html

). Portions of an August 10, 2007 posting on Greg Newton’s blog,

Nakedshorts

(

http://nakedshorts.typepad.com/nakedshorts/2007/08/weekend-reading.html

), are also referenced.

Barron‘s,

May 7, 2001,

http://online.barrons.com/article/SB989019667829349012.html

); her book,

Too Good to Be True: The Rise and Fall of Bernie Madoff

(Portfolio, 2009); Michael Ocrant’s article, “Madoff Tops Charts; Skeptics Ask How” (

MARHedge

89, May 2001, page 1)—also printed in full as Appendix A of this book; and Gregory Zuckerman and Kara Scannell’s article, “Madoff Misled SEC in ’06, Got Off,” (

Wall

Street

Journal,

December 18, 2008, page A1,

http://online.wsj.com/article/SB122956182184616625.html

). Portions of an August 10, 2007 posting on Greg Newton’s blog,

Nakedshorts

(

http://nakedshorts.typepad.com/nakedshorts/2007/08/weekend-reading.html

), are also referenced.

Publicly available court documents and transcriptions from my February 4, 2009, hearing before the House Subcommittee on Capital Markets and September 10, 2009, hearing before the Senate Banking Committee are quoted at length, and can be accessed through government web sites or through the links available at

www.noonewouldlisten.com

.

www.noonewouldlisten.com

.

About the Author

Harry Markopolos attended high school at Cathedral Prep in his hometown of Erie, Pennsylvania. He received his bachelor of arts degree in business administration from Loyola University of Maryland and then went on to Boston College for his master of science in finance degree.

He received a reserve commission as a second lieutenant, Infantry, in the U.S. Army and is a graduate of several Army postgraduate schools, including the Infantry Officers’ Basic and Advanced Courses, the Civil Affairs Officers’ Advanced Course, and the U.S. Army Command & General Staff College. Mr. Markopolos has commanded troops at every rank from second lieutenant to major during 17 years of part-time service in the Maryland Army National Guard and Army Reserve.

He earned his Chartered Financial Analyst designation in 1996 and his Certified Fraud Examiner designation in 2008. From 2002 to 2003 he served as president and CEO of the 4,000-member Boston Security Analysts Society. He has also held board seats on the Boston chapters of both the Global Association of Risk Professionals and the Quantitative Work Alliance for Applied Finance, Education and Wisdom (QWAFAFEW), a quantitative finance lecture group.

He was assistant controller, assistant manager, store manager, and district manager for his family’s chain of 12 Arthur Treacher’s Fish & Chips restaurants before joining Makefield Securities in 1987. In 1988 he joined Darien Capital Management in Greenwich, Connecticut, as an assistant portfolio manager, leaving to become an equity derivatives portfolio manager at Rampart Investment Management Company in Boston, Massachusetts. In 2002 he was promoted to chief investment officer but decided to leave the industry in 2004 to pursue fraud investigations full-time against Fortune 500 companies in the financial services and health care industries. He brings fraud cases to the U.S. Department of Justice, Internal Revenue Service, and various state attorney generals under existing whistleblower programs.

Other books

Falling Angel by William Hjortsberg

Wedding on the Baby Ward / Special Care Baby Miracle by Lucy Clark

Single (Stockton Beavers #1) by Collette West

Against the Wall by Jill Sorenson

Improper Relations by Juliana Ross

Look at me: by Jennifer Egan

Any Shape or Form by Elizabeth Daly

Me encontrarás en el fin del mundo by Nicolas Barreau

The Perils of Command by David Donachie