Understanding Business Accounting For Dummies, 2nd Edition (50 page)

Read Understanding Business Accounting For Dummies, 2nd Edition Online

Authors: Colin Barrow,John A. Tracy

Tags: #Finance, #Business

Before moving on, here's a short problem for you to solve. Using the three-way classification of cash flows explained earlier, below is a summary of the business's net cash flows (in thousands) for the year just ended, with one amount missing:

(1) From profit (operating activities) ?

(2) From investing activities - £1,275

(3) From financing activities

+ £160

Decrease in cash balance during year - £15

Note that the business's cash balance from all sources and uses decreased £15,000 during the year. The amounts of net cash flows from the company's investing and financing activities are given. So you can determine that the net cash flow from profit was £1,100,000 for the year. Understanding cash flows from investing activities and financing activities is fairly straightforward. Understanding the net cash flow from profit, in contrast, is more challenging - but business managers and investors should have a good grip on this very important number.

Setting the Stage: Changes in Balance Sheet Accounts

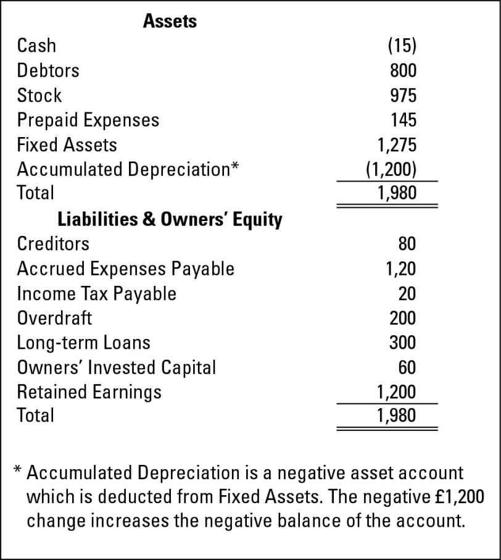

The first step in understanding the amounts reported by a business in its cash flow statement is to focus on the

changes

in the business's assets, liabilities, and owners' equity accounts during the period - the increases or decreases of each account from the start of the period to the end of the period. These changes are found in the comparative two-year balance sheet reported by a business. Figure 7-1 presents the increases and decreases during the year in the assets, liabilities, and owners' equity accounts for a business example. Figure 7-1 is not a balance sheet but only a summary of

changes

in account balances. We do not want to burden you with an entire balance sheet, which has much more detail than is needed here.

Take a moment to scan Figure 7-1. Note that the business's cash balance decreased £15,000 during the year. (An increase is not necessarily a good thing, and a decrease is not necessarily a bad thing; it depends on the overall financial situation of the business.) One purpose of reporting the cash flow statement is to summarise the main reasons for the change in cash - according to the three-way classification of cash flows explained earlier. One question on everyone's mind is this: How much cash did the profit for the year generate for the business? The cash flow statement begins by answering this question.

Figure 7-1:

Changes in balance sheet assets and operating liabilities that affect cash flow from profit.

Getting at the Cash Increase from Profit

Although all amounts reported on the cash flow statement are important, the one that usually gets the most attention is

cash flow from operating activities

, or

cash flow from profit

as we prefer to call it. This is the increase in cash generated by a business's profit-making operations during the year, exclusive of its other sources of cash during the year (such as borrowed money, sold-off fixed assets, and additional owners' investments in the business).

Cash flow from profit

indicates a business's ability to turn profit into available cash - cash in the bank that can be used for the needs of business. Cash flow from profit gets just as much attention as net income (the bottom-line profit number in the income statement).

Before presenting the cash flow statement - which is a rather formidable, three-part accounting report - in all its glory, in the following sections we build on the summary of changes in the business's assets, liabilities, and owners' equities shown in Figure 7-1 to explain the components of the £1,100,000 increase in cash from the business's profit activities during the year. (The £1,100,000 amount of cash flow from profit was determined earlier in the chapter by solving the unknown factor.)

The business in the example experienced a rather strong growth year. Its accounts receivable and stock increased by relatively large amounts. In fact, all the relevant accounts increased; their ending balances are larger than their beginning balances (which are the amounts carried forward from the end of the preceding year). At this point, we need to provide some additional information. The £1.2 million increase in retained earnings is the net difference of two quite different things.

The £1.6 million net income earned by the business increased retained earnings by this amount. As you see in Figure 7-1, the account increased only £1.2 million. Thus there must have been a £400,000 decrease in retained earnings during the year. The business paid £400,000 cash dividends from profit to its owners (the shareholders) during the year, which is recorded as a decrease in retained earnings. The amount of cash dividends is reported in the

financing activities

section of the cash flow statement. The entire amount of net income is reported in the

operating activities

section of the cash flow statement.

Computing cash flow from profit

Here's how to compute cash flow from profit based on the changes in the company's balance sheet accounts presented in Figure 7-1:

Computation of Cash Flow from Profit (in thousands of pounds)

Negative Cash Positive CashFlow Effects Flow Effects

Net income for the year £1,600

Debtors increase £800

Stock increase £975

Prepaid expenses increase £145

Depreciation expense £1,200

Creditors increase £80

Accrued expenses £120payable increase

Income tax payable increase £20

Totals £1,920 £3,020

Cash flow from profit (£3,020 positive increases minus £1,920negative increases) £1,100

Note that net income (profit) for the year - which is the correct amount of profit based on the accrual basis of accounting - is listed in the positive cash flow column. This is only the starting point. Think of this the following way: If the business had collected all its sales revenue for the year in cash, and if it had made cash payments for its expenses exactly equal to the amounts recorded for the expenses, then the net income amount would equal the increase in cash. These two conditions are virtually never true, and they are not true in this example. So the net income figure is just the jumping-off point for determining the amount of cash generated by the business's profit activities during the year.

We'll let you in on a little secret here. The analysis of cash flow from profit asks what amount of profit would have been recorded if the business had been on the cash basis of accounting instead of the accrual basis. This can be confusing and exasperating, because it seems that two different profit measures are provided in a business's financial report - the true economic profit number, which is the bottom line in the income statement (usually called

net income

), and a second profit number called

cash flow from operating activities

in the cash flow statement.

When the cash flow statement was made mandatory, many accountants worried about this problem, but the majority opinion was that the amount of cash increase (or decrease) generated from the profit activities of a business is very important to disclose in financial reports. In reading the income statement, you have to wear your accrual basis accounting lenses, and in the cash flow statement you have to put on your cash basis lenses. Who says accountants can't see two sides of something?

The following sections explain the effects on cash flow that each balance sheet account change causes (refer to Figure 7-1).

Getting specific about changes in assets and liabilities

As a business manager, you should keep a close watch on each of your assets and liabilities and understand the cash flow effects of increases (or decreases) caused by these changes. Investors should focus on the business's ability to generate a healthy cash flow from profit, so investors should be equally concerned about these changes.