5000 Year Leap (19 page)

Locke then deals with a very important question: If all things were originally enjoyed in common with the rest of humanity, would a person not have to get the consent of every other person on earth before he could call certain things his own? Locke answers by saying:

"That labor ... added something to them [the acorns or apples] more than Nature, the common mother of all, had done, and so they became his private right. And will any one say he had no right to those acorns or apples he thus appropriated because he had not the consent of all mankind to make them his?.... If such a consent as that was necessary, [the] man [would have] starved, notwithstanding the plenty God had given him....

"It is the taking any part of what is common, and removing it out of the state Nature leaves it in, which begins the property, without which the common [

gift

from God] is of no use.... Thus this

law of reason

makes the deer that [property of the Indian] who hath killed it; it is allowed to be his goods who hath bestowed his labor upon it, though, before, it was the common right of every one."

169

It is important to recognize that the common law does not make property sacred, but only the right which someone has acquired in that property. Justice George Sutherland of the U.S. Supreme Court once told the New York State Bar Association:

"It is not the right of property which is protected, but the right to property. Property, per se, has no rights; but the individual -- the man -- has three great rights, equally sacred from arbitrary interference: the right to his

life

, the right to his

liberty

, the right to his

property

.... The three rights are so bound together as to be essentially one right. To give a man his life but deny him his liberty, is to take from him all that makes his life worth living. To give him his liberty but take from him the property which is the fruit and badge of his liberty, is to still leave him a slave."

170

In this same spirit Abraham Lincoln once said:

"Property is the fruit of labor. Property is desirable, is a positive good in the world. That some should be rich shows that others may become rich and hence is just encouragement to industry and enterprise. Let not him who is houseless pull down the house of another, but let him work diligently to build one for himself, thus by example assuring that his own shall be safe from violence.... I take it that it is best for all to leave each man free to acquire property as fast as he can. Some will get wealthy. I don't believe in a law to prevent a man from getting rich; it would do more harm than good."

171

The early American colonists had much to say about property and property rights because it was a critical issue leading to the Revolutionary War. The effort of the Crown to take their property through various kinds of taxation without their consent (either individually or through their representatives) was denounced as a violation of the English constitution and English common law. They often quoted John Locke, who had said:

"The supreme power cannot take from any man any part of his property without his own consent. For the preservation of property being the end of government, and that for which men enter into society, it necessarily supposes and requires that the people should have property, without which they must be supposed to lose that [property] by entering into society, which was the end for which they entered into it."

172

John Adams saw private property as the most important single foundation stone undergirding human liberty and human happiness. He said:

"The moment the idea is admitted into society that property is not as sacred as the laws of God, and that there is not a force of law and public justice to protect it, anarchy and tyranny commence.

Property must be secured or liberty cannot exist.

"

173

and Give to the "Have Nots"?

As we have pointed out earlier, one of the worst sins of government, according to the Founders, was the exercise of its coercive taxing powers to take property from one group and give it to another. In our own day, when the government has imposed a multi-hundred-billion-dollar budget on the American people with about one half being "transfer payments" from the tax-paying public to the wards of the government, the following words of James Madison may sound strange:

"Government is instituted to protect property of every sort.... This being the end of government, that alone is not a just government, ... nor is property secure under it, where the property which a man has in his personal safety and personal liberty is violated by arbitrary seizures of one class of citizens for the service of the rest."

174

In earlier years the American courts held that the expropriating of property to transfer to other citizens was unlawful, being completely outside the constitutional power delegated to the government. It was not until after 1936 (the Butler case) that the Supreme Court began arbitrarily distorting the meaning of the "general welfare" clause to permit the distribution of federal bounties as a demonstration of "concern" for the poor and the needy. Before that time, this practice was prohibited. The Supreme Court had declared:

"No man would become a member of a community in which he could not enjoy the fruits of his honest labor and industry. The preservation of property, then, is a primary object of the social compact.... The legislature, therefore, had no authority to make an act divesting one citizen of his freehold, and vesting it in another, without a just compensation. It is inconsistent with the principles of reason, justice and moral rectitude; it is incompatible with the comfort, peace and happiness of mankind; it is contrary to the principles of social alliance in every free government; and lastly,

it is contrary to the letter and spirit of the Constitution

."

175

One of the world's foremost economists, Dr. Ludwig von Mises, pointed out that the preservation of private property has tremendous social implications as well as legal ramifications. He wrote:

"If history could prove and teach us anything, it would be the private ownership of the means of production as a necessary requisite of civilization and material well-being. All civilizations have up to now been based on private property. Only nations committed to the principle of private property have risen above penury and produced science, art, and literature. There is no experience to show that any other social system could provide mankind with any of the achievements of civilization."

176

But, of course, the nagging question still remains. If it corrupts a society for the government to take care of the poor by violating the principle of property rights, who will take care of the poor? The answer of those who built America seems to be: "Anybody

but

the federal government."

Americans have never tolerated the suffering and starvation which have plagued the rest of the world, but until the present generation help was given almost exclusively by the private sector or on the community or state level. President Grover Cleveland vetoed legislation in his day designed to spend federal taxes for private welfare problems. He wrote:

"I can find no warrant for such an appropriation in the Constitution, and I do not believe that the power and duty of the General Government ought to be extended to the relief of individual suffering which is in no manner properly related to the public service or benefit. A prevalent tendency to disregard the limited mission of this power and duty should, I think, be steadfastly resisted, to the end that the lesson should be constantly enforced that

though the people support the Government the Government should not support the people

.

"

The friendliness and charity of our countrymen can always be relied upon to relieve their fellow-citizens in misfortune

. This has been repeatedly and quite lately demonstrated. Federal aid in such cases encourages the expectation of paternal care on the part of the Government and weakens the sturdiness of our national character, while it prevents the indulgence among our people of that kindly sentiment and conduct which strengthens the bonds of a common brotherhood."

177

is a free-market economy and a minimum of government regulations.

The Founders were fascinated with the possibility of setting up a political and social structure based on natural law, but what about economics? Were there natural laws for the marketplace?

A tome of five books on the subject was published just in the nick of time which gave them the answer. It came out in 1776 and was called

The Wealth of Nations

. It was written by a college professor in Scotland named Adam Smith.

This brilliant work is not easy reading, but it became the watershed between mercantilism and the doctrines of freemarket economics. It fit into the thinking and experiences of the Founders like a hand in a glove. Thomas Jefferson wrote: "In political economy, I think Smith's

Wealth of Nations [page 180]

the best book extant."

178

The Four Laws of Economic Freedom

The Role of Government in Economics

After 1900 Adam Smith Got Lost in the Shuffle

John Chamberlain Describes What Happened to Adam Smith

Adam Smith Out, Karl Marx In

The Rediscovery of Adam Smith

One Responsibility of Government Never Completely Fulfilled

What Went Wrong?

Fractional Banking

An Economy of Debt Instead of Wealth

A Pressing Opportunity

Other writers in Europe, such as the Physiocrats in France, were advocating a free-market economy, but nowhere on earth were these principles being practiced by any nation of size or consequence. Therefore, the United States was the first people to undertake the structuring of a whole national economy on the basis of natural law and the free-market concept described by Adam Smith. Among other things, this formula called for the following:

1. Specialized production -- let each person or corporation persons do what they do best.

2. Exchange of goods takes place in a free-market environment without governmental interference in production, prices, or wages.

3. The free market provides the needs of the people on the basis of supply and demand, with no government imposed monopolies.

4. Prices are regulated by competition on the basis of supply and demand.

5. Profits are looked upon as the means by which production of goods and services is made worthwhile.

6. Competition is looked upon as the means by which quality is improved, quantity is increased, and prices are reduced.

Prosperity also depends on a climate of wholesome stimulation protected by law. Reduced to its simplest formula, there are four laws of economic freedom which a nation must maintain if its people are to prosper at the maximum level. These are:

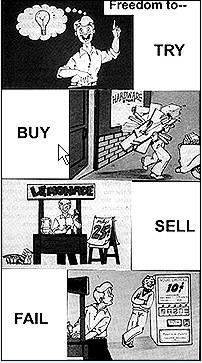

1. The Freedom to try.

2. The Freedom to buy.

3. The Freedom to sell.

4. The Freedom to fail.

By 1905 the United States had become the richest industrial nation in the world. With only 5 percent of the earth's continental land area and merely 6 percent of the world's population, the American people were producing over half of almost everything -- clothes, food, houses, transportation, communications, even luxuries. It was a great tribute to Adam Smith.

The Founding Fathers agreed with Adam Smith that the greatest threat to economic prosperity is the arbitrary intervention of the government into the economic affairs of private business and the buying public. Historically, this has usually involved fixing prices, fixing wages, controlling production, controlling distribution, granting monopolies, or subsidizing certain products.

Nevertheless, there are four areas of legitimate responsibility which properly belong to government. These involve the policing responsibilities of government to prevent:

1.

Illegal Force

in the market place to compel purchase or sale of products.