Against the Gods: The Remarkable Story of Risk (19 page)

Read Against the Gods: The Remarkable Story of Risk Online

Authors: Peter L. Bernstein

Lloyd had grown up under Oliver Cromwell and he had lived

through plague, fire, the Dutch invasion up the Thames in 1667, and

the Glorious Revolution of 1688. He was a lot more than a skilled

coffee-house host. Recognizing the value of his customer base and

responding to the insistent demand for information, he launched

"Lloyd's List" in 1696 and filled it with information on the arrivals

and departures of ships and intelligence on conditions abroad and at

sea. That information was provided by a network of correspondents

in major ports on the Continent and in England. Ship auctions took

place regularly on the premises, and Lloyd obligingly furnished the

paper and ink needed to record the transactions. One corner was

reserved for ships' captains where they could compare notes on the

hazards of all the new routes that were opening up-routes that led

them farther east, farther south, and farther west than ever before.

Lloyd's establishment was open almost around the clock and was

always crowded.

Then as now, anyone who was seeking insurance would go to a

broker, who would then hawk the risk to the individual risk-takers

who gathered in the coffee houses or in the precincts of the Royal

Exchange. When a deal was closed, the risk-taker would confirm his

agreement to cover the loss in return for a specified premium by writing his name under the terms of the contract; soon these one-man

insurance operators came to be known as "underwriters."

The gambling spirit of that prosperous era fostered rapid innovation

in the London insurance industry. Underwriters were willing to write

insurance policies against almost any kind of risk, including, according to

one history, house-breaking, highway robbery, death by gin-drinking,

the death of horses, and "assurance of female chastity"-of which all

but the last are still insurable.20 On a more serious basis, the demand for

fire insurance had expanded rapidly after the great fire of London in

1666.

Lloyd's coffee house served from the start as the headquarters for

marine underwriters, in large part because of its excellent mercantile

and shipping connections. "Lloyd's List" was eventually enlarged to

provide daily news on stock prices, foreign markets, and high-water

times at London Bridge, along with the usual notices of ship arrivals

and departures and reports of accidents and sinkings.*

This publication was so well known that its correspondents sent their messages to the post office addressed simply "Lloyd's." The government even used "Lloyd's List" to publish the latest news of battles at sea.

In 1720, reputedly succumbing to a bribe of £300,000, King George I consented to the establishment of the Royal Exchange Assurance Corporation and the London Assurance Corporation, the first two insurance companies in England, setting them up "exclusive of all other corporations and societies." Although the granting of this monopoly did prevent the establishment of any other insurance company, "private and particular persons" were still allowed to operate as underwriters. In fact, the corporations were constantly in difficulty because of their inability to persuade experienced underwriters to join them.

In 1771, nearly a hundred years after Edward Lloyd opened his coffee house on Tower Street, seventy-nine of the underwriters who did business at Lloyd's subscribed 0100 each and joined together in the Society of Lloyd's, an unincorporated group of individual entrepreneurs operating under a self-regulated code of behavior. These were the original Members of Lloyd's; later, members came to be known as "Names." The Names committed all their worldly possessions and all their financial capital to secure their promise to make good on their customers' losses. That commitment was one of the principal reasons for the rapid growth of business underwritten at Lloyd's over the years. And thus did Canopius's cup of coffee lead to the establishment of the most famous insurance company in history.

By the 1770s an insurance industry had emerged in the American colonies as well, though most large policies were still being written in England. Benjamin Franklin had set up a fire-insurance company called First American in 1752; the first life insurance was written by the Presbyterian Ministers' Fund, established in 1759. Then, when the Revolution broke out, the Americans, deprived of Lloyd's services, had no choice but to form more insurance companies of their own. The first company to be owned by stockholders was the Insurance Company of North America in Philadelphia, which wrote policies on

fire and marine insurance and issued the first life-insurance policies in America-six-term policies on sea captains.*21

Insurance achieved its full development as a commercial concept only in the eighteenth century, but the business of insurance dates back beyond the eighteenth century BC. The Code of Hammurabi, which appeared about 1800 BC, devoted 282 clauses to the subject of "bottomry." Bottomry was a loan or a mortgage taken out by the owner of a ship to finance the ship's voyage. No premium as we know it was paid. If the ship was lost, the loan did not have to be repaid.t

This early version of marine insurance was still in use up to the Roman era, when underwriting began to make an appearance. The Emperor Claudius (10 BC-AD 54), eager to boost the corn trade, made himself a one-man, premium-free insurance company by taking personal responsibility for storm losses incurred by Roman merchants, not unlike the way governments today provide aid to areas hit by earthquakes, hurricanes, or floods.

The rise of trade during the Middle Ages accelerated the growth of finance and insurance. Major financial centers grew up in Amsterdam, Augsburg, Antwerp, Frankfurt, Lyons, and Venice; Bruges established a Chamber of Assurance in 1310. Not all of these cities were seaports; most trade still traveled over land. New instruments such as bills of exchange came into use to facilitate the transfer of money from cus tomer to shipper, from lender to borrower and from borrower to lender,

and, in huge sums, from the Church's widespread domain to Rome.

Quite aside from financial forms of risk management, merchants

learned early on to employ diversification to spread their risks. Antonio,

Shakespeare's merchant of Venice, followed this practice:

(Act I, Scene 1)

The use of insurance was by no means limited to shipments of

goods. Farmers, for example, are so completely dependent on nature

that their fortunes are peculiarly vulnerable to unpredictable but devastating disasters such as drought, flood, or pestilence. As these events are

essentially independent of one another and hardly under the influence

of the farmer, they provide a perfect environment for insurance. In

Italy, for example, farmers set up agricultural cooperatives to insure one

another against bad weather; farmers in areas with a good growing season would agree to compensate those whose weather had been less

favorable. The Monte del Paschi, which became one of the largest

banks in Italy, was established in Siena in 1473 to serve as an intermediary for such arrangements.22 Similar arrangements exist today in lessdeveloped countries that are heavily dependent on agriculture.23

Although these are all cases in which one group agrees to indemnify

another group against losses, the insurance process as a whole functions

in precisely the same manner. Insurance companies use the premiums

paid by people who have not sustained losses to pay off people who

have. The same holds true of gambling casinos, which pay off the winners from the pot that is constantly being replenished by the losers.

Because of the anonymity provided by the insurance company or the

gambling casino that acts as intermediary, the actual exchange is less visible. And yet the most elaborate insurance and gambling schemes are

merely variations on the Monte del Paschi theme.

The underwriters active in Italy during the fourteenth century did

not always perform to the satisfaction of their customers, and the complaints are familiar. A Florentine merchant named Francesco di Marco Datini, who did business as far away as Barcelona and Southampton,

wrote his wife a letter complaining about his underwriters. "For whom

they insure," he wrote, "it is sweet to them to take the monies; but

when disaster comes, it is otherwise, and each man draws his rump back

and strives not to pay."24 Francesco knew what he was talking about,

for he left four hundred marine insurance policies in his estate when

he died.

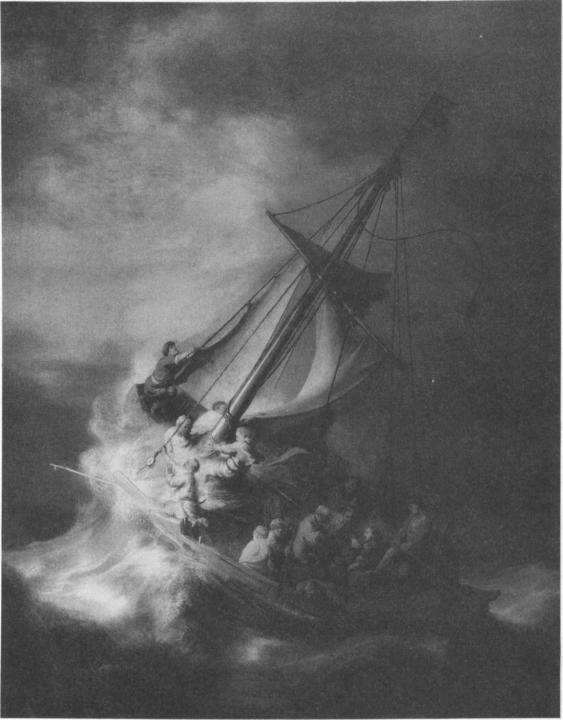

Rembrandt's Storm on the Sea of Galilee.

(Reproduction courtesy of the Isabella Stewart Gardner Museum, Boston.)

(Act I, Scene 1)

Activity in the insurance business gained momentum around 1600.

The term "policy," which was already in general use by then, comes

from the Italian "polizza," which meant a promise or an undertaking. In

1601, Francis Bacon introduced a bill in Parliament to regulate insurance

policies, which were "tyme out of mynde an usage amonste merchants,

both of this realm and of forraine nacyons."