Catastrophe (11 page)

Authors: Dick Morris

Similarly, despite the fact that European jobs are “most carefully protected by government regulation and mandated benefits are the most lavish,” Murray points out that to Europeans the concept of work “is most often seen as a necessary evil, least often seen as a vocation and where the proportions of people who say they love their jobs are the lowest.”

103

Instead of having children and reveling in their work, Murray says, Europeans are having a “great time with their current sex partner and new BMW and the vacation home in Majorca, and [see] no voids in their lives that need filling.”

104

Citing Europeans’” self-absorption,” he says they increasingly see work as “something that interferes with the higher good of leisure.” He posits that much of the Europeans’ low birthrate stems from their asking that if leisure is “the purpose of life, why have a child? What good are they really?”

105

Murray views Obama’s desire to move us closer to the European socialist model as a threat to the American way of life. He warns that “irreversible damage [may] be done to the American project over the next few years. The

drift toward the European model…is going to be stopped only when we are all talking again about why America is exceptional, and why it is so important that America remain exceptional.”

106

He argues that we must again see:

the American project for what it is: a different way for people to live together, unique among the nations of the earth, and immeasurably precious…. Historically, Americans have been different as a people, even peculiar, and everyone around the world has recognized it. I’m thinking of qualities such as American optimism even when there doesn’t seem to be any good reason for it. That’s quite uncommon among the peoples of the world. There is the striking lack of class envy in America—by and large, Americans celebrate others’ success instead of resenting it. That’s just about unique, certainly compared to European countries, and something that drives European intellectuals crazy. And then there is perhaps the most important symptom of all, the signature of American exceptionalism—the assumption by most Americans that they are in control of their own destinies. It is hard to think of a more inspiring quality for a population to possess, and the American population still possesses it to an astonishing degree. No other country comes close.

107

It’s hard to imagine a better way to describe what we may lose in the leveling, bureaucratizing, and narcotizing of America that Obama seems bent on pursuing—all disguised as an economic recovery program.

The idea that work is just an interruption of our leisure time—and that we value leisure over work—runs counter to how most Americans live their lives. In his poem “When Earth’s Last Picture Is Painted,” the English poet Rudyard Kipling articulated best what we do think:

…And no one shall work for money.

And no one shall work for fame.

But each for the joy of working,

Each by his own separate star.

To draw the thing as he sees it.

For the God of things as they are.

ACTION AGENDA

Once you recognize how Barack Obama is trying to change our country, it’s easy to fall into passivity and depression. Right now, he seems invulnerable. He has huge majorities in Congress. He can always find a few weak Republican senators—such as Maine’s Olympia Snowe and Susan Collins—to defect and give him what he wants.

But Obama has a big weakness—the coming elections of 2010. Then, as happens every two years, the entire House of Representatives and one-third of the Senate will be up for reelection. That will be our chance to take back our country and rescue it from socialism.

The Democrats play a game with us. They run moderate candidates in swing districts and states. These candidates preach the virtues of a balanced budget, a strong military, and tough protections against terrorism. Some are even pro-life or side with the Right on cultural issues. Their moderation attracts swing voters, and they frequently defeat their Republican opponents. But when they hit Washington, they meekly vote the way they’re instructed by House speaker Nancy Pelosi and Senate majority leader Harry Reid. They shelve their moderation and become foot soldiers in the war to bring socialism to America.

We have to expose their game. But we can’t wait until 2010 to do it. Obama is changing America in important ways right now, and to let him continue his fundamental alterations in our economy, government, and even lifestyle is unthinkable.

These moderate Democrats are Obama’s Achilles’ heel. They are the weak links in his congressional majority. They won election as moderates, and they vote any way their leaders tell them to—and right now, that means that they are voting as socialists.

Never in history has Congress been more partisan than it is right now. It has never until now, for example, followed the model of the New York State Legislature. The New York lawmakers have a tradition they call a “short roll call”: to save time, rather than call the name of every legislator, they just ask the majority leader and minority leader how they vote and then ask if any member wants to vote differently from his leader. Usually, nobody does.

The U.S. Congress has always held itself to a higher standard of independence. Members of Congress—even junior members—have never been

shy about breaking ranks, and party whips traditionally have a difficult time keeping them in line.

Today, however, they might as well be using the short roll call in Washington. Few members vote differently from what their party leader wishes.

To derail Obama’s rush toward socialism, we need to bring incredible pressure on the moderate swing members of Congress.

Why have these normally independent members become such automatons? It’s not that they’re less bright or more inclined to follow the dictates of Gilbert and Sullivan in their play

H.M.S. Pinafore:

I grew so rich that

I was sent by a pocket borough into Parliament

I always voted at my party’s call

And I never thought of thinking for myself at all.

There’s one reason that these congressmen and senators are toeing the party line more faithfully than ever before: because the party increasingly controls their campaign money. No longer do candidates get most of their funds from loyal constituents back home. Instead, prominent donors from around the nation and PACs allied with the party give contributions to whomever the party leaders designate. Speaker Pelosi and Majority Leader Reid can turn the spigot on or off at will. And no one dares to cross them.

But if we call attention to the hypocrisy of these Democratic senators and congressmen—who campaign as moderates and vote as extreme leftists—we can make the cost of their party-line behavior too steep to bear and begin to fan the flames of independence and moderation.

But we need to focus our energies on the weakest links in the chain.

In 2010, the following Democratic senators will be up for reelection. It’s up to us to expose their socialist votes, pressure them to change course, and defeat them in 2010:

Blanche Lincoln of Arkansas

Barbara Boxer of California

Michael Bennet of Colorado

Christopher Dodd of Connecticut

Daniel Inouye of Hawaii

Roland Burris of Illinois

Evan Bayh of Indiana

Barbara Mikulski of Maryland

Harry Reid of Nevada

Kirsten Gillibrand of New York

Charles Schumer of New York

Byron Dorgan of North Dakota

Ron Wyden of Oregon

Patrick Leahy of Vermont

Patty Murray of Washington

Russell Feingold of Wisconsin

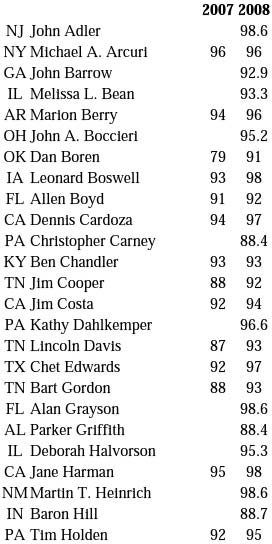

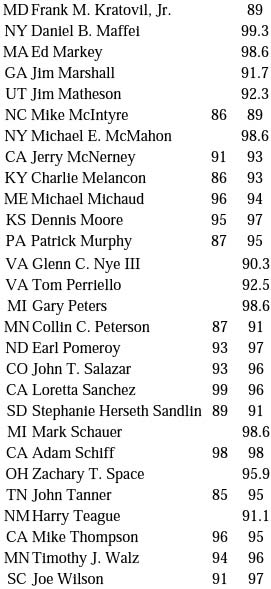

And here are the so-called moderate House Democrats who cave in to pressure, voting time and again to pass ultraliberal programs. It’s time to make them an endangered species!

PERCENTAGE OF TIME THEY VOTED ALONG WITH PARTY LEADERS

At www.dickmorris.com, we’ll be tracking how Obama’s program fares in Congress—and we’ll be asking supporters to direct their comments, letters, petitions, and donations at specific targets to stop this congressional move to the left. Log on and get involved!

THE BANK BAILOUT THAT BOMBED

As a result of massive government intervention and huge outlays of taxpayer money, the major banks and financial institutions are still afloat. But they might as well be dead as far as the economy is concerned. They’ve become floating mausoleums, closed to outsiders, making few if any loans, and trying hard to stay alive and out of trouble.

Their inability to lend is a catastrophe for the economy. And as you read this chapter, you’ll see that Barack Obama is likely to make things worse by using the current crisis as an excuse to nationalize the banks—the linchpin of his plan for a socialist economy.

The crisis began in March 2008, when Bear Stearns, the brokerage house that had pioneered the securitization of mortgages, failed. Uncle Sam stepped in, injected capital, and forced it into a marriage with J.P. Morgan Chase. On September 15, 2008, Lehman Brothers failed, and in a fit of free-market bravado, the Bush administration let it go into bankruptcy. Chaos and panic gripped the financial markets. After that, the Federal Reserve, the Treasury Department, and the Bush administration resolved not to permit any more catastrophes.

In September and October 2008, we learned that more and more of America’s leading financial institutions were insolvent and faced imminent collapse. All of the big banks, brokerage houses, and insurance companies tottered on the brink of bankruptcy so Bush pumped in money.

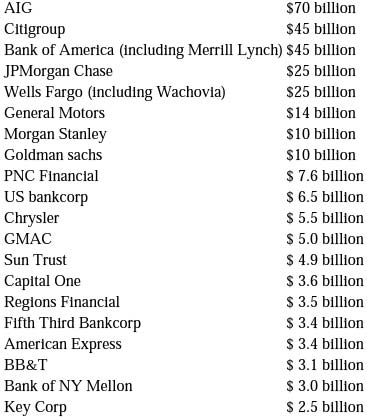

So twenty financial institutions divided up most of the initial $350 billion of government spending under the Troubled Assets Relief Program (TARP). By March 2009, almost $700 billion had been spent. As of this writing, 495 banks and other financial institutions have received money; they are now subject to the regulations the government will impose on them.

But the media’s relentless focus on the major TARP recipients has obscured one important fact: that almost every U.S. bank is on the dole. It’s sobering but true: most banks in America have their hands in this particular till.

Here’s the list of the main welfare recipients. For a full list, go to Appendix A. Check to see if your bank is on the list. We think you ought to know, don’t you?

THE TOP TWENTY PANHANDLERS IN AMERICA

Main recipients of TARP money as of March 2009

Source:

http://www.propublica.org/special/show-me-the-tarp-money.

Even when banks want to give back the TARP money to escape federal regulation, they’re finding that the Treasury discourages them. Washington wants to pass out the money as broadly as possible so that it can use the funds as a lever to control the banks.

TARP stopped any institution from disappearing beneath the waves, but it has done nothing to restore consumer lending and liquidity in our economy. In the wake of the massive TARP spending, the banks have been saved, but our economy has not. The U.S. financial system is like a patient in ICU whose surgery went well but who may die anyway.

TARP may have forestalled bank bankruptcies, but the fact is that the American people still can’t get loans. In the first few months of 2009, the twenty largest banks to get government funds not only failed to increase their lending to consumers and businesses—they actually cut it slightly! Though they’re now wallowing in federal funds, the Treasury Department said that the banks that got TARP aid cut their mortgage and business loans by 1 percent and also reduced their credit card lending. Sixty percent of the banks said they had tightened their lending standards on credit cards and other consumer loans during the quarter.

108

Typical of the banks’ reaction to the taxpayer bailout largesse was that of John C. Hope III, the chairman of the board of Whitney National Bank in New Orleans. In a comment that recalls Marie Antoinette’s suggestion to the starving people of France (“Let them eat cake!”), Hope told a gathering of Wall Street analysts what he was going to do with his $300 million bailout. The

New York Times

reported on the scene:

“Make more loans?” he asked rhetorically—as if the very notion was ridiculous. Stuffily he intoned, “We’re not going to change our business model or our credit policies to accommodate the needs of the public sector as they see it to have us make more loans.”

This from a man whose bank’s “business model” was so sound that it needed taxpayers to cough up $300 million to keep it in business!

WHERE IS THE MONEY?

So where did all the money go? What happened to the massive bailout cash if it hasn’t been lent to consumers or businesses?

It’s sitting in a vault at the Federal Reserve Board! Most banks used the bailout money to correct their balance sheets and reassure investors that they weren’t about to tank but never actually took most of the money. Their ruse didn’t work, of course. For the most part their stock prices tanked anyway, and the bankers were content to let the cash sit at the Fed. No need to alter their business models!

And the Federal Reserve Board, ever accommodating, decided to start paying interest on the TARP reserves the banks left in its vault! (As if to create an incentive

not

to help the economy by lending it out!)

In March 2009, according to reports from the Fed, a total of $800 billion in reserves owned by banks was still sitting in its vaults, happily earning interest and doing nothing to help our economy. How big is this pile of unlent money? So big that it equals all the currency in circulation in the United States at the moment. For every dollar in wallets, purses, and cash registers in the United States, there is another dollar lounging in the Fed’s vault!

And what was the Fed’s solution? To put more money into the vault. As we write this, the Fed has decided to pump another trillion dollars into the system—hoping it won’t just sit in the vault next to the $800 billion already there.

WHY WON’T BANKS LEND?

As Christopher Boyd wrote in the

Orlando Business Journal:

“To borrow a line from Bill Clinton’s 1992 presidential campaign, ‘It’s the economy, stupid.’”

110

Now that the banks have gulped down the $350 billion in the initial bailout package (as of March 11, 2009), why aren’t they lending?

Craig Polejes, president of the Florida Bank of Commerce in Orlando,

says, “It’s unreasonable to expect banks to loan money to companies that aren’t making money.”

111

With consumers losing their homes and jobs while businesses see the red ink of the recession adding up on their balance sheets, the banks won’t risk their money.

And the lesson of the stunning failures that impelled the bailout in the first place isn’t lost on a generation of managers of financial institutions:

Don’t stick your neck out. Rein in risky investments. Play it safe and conservative.

Which is, of course, precisely the opposite of what the Fed, the Treasury, and Congress had in mind when they approved the bailout. But this Catch-22—banks won’t lend while the economy is bad, and the economy won’t improve until banks lend—shows no signs of letting up in the near future.

Until the inevitable happens, that is, and the government takes over the banks. The futility of waiting for terrified, trembling bankers to make new loans will become more and more apparent until government takeover is the only remedy.

And who can shed the sneaking suspicion that Obama has always wanted it that way?

OBAMA’S SOLUTION

For now, Obama vehemently denies wanting to nationalize the banks. Instead, he, his Treasury Department, and the Federal Reserve have trotted out one scheme after another to rekindle lending, all to no avail. In the meantime, when you read between the lines of federal regulatory policy, it is evident that Obama not only wants to take over the banks, but is stacking the deck so that the financial institutions fall into his grasp.

But Obama can’t come out and admit that he wants nationalization, so his latest plan is to lend money to hedge funds and other investors on very favorable terms if they agree to use the money to buy securities based on auto loans, credit card debt, and other consumer financing. These loans would go to banks, but also to nonbank lenders that regularly dole out funds for college costs, cars, and mortgage loans.

In other words, the hedge funds will tell the banks and other credit institutions just what Fannie Mae told the mortgage lenders that started the

whole financial crisis in the first place: “Go ahead, lend money, even if you have doubts about whether the loans will ever be repaid. Don’t worry. As soon as you make the loan, we’ll buy it with the money the Fed is lending us. That way, even if the borrower defaults, it won’t be your problem.”

This sleight-of-hand finance is just like the dodgy practices that got us into this fix. And, perhaps for that reason, the new program, called TALF (Term Asset-Backed Securities Loan Facility), is off to what the

Wall Street Journal

charitably describes as “a slow start.” As the

Journal

has reported, though the government is preparing to make loans up to $200 billion (and possibly to expand it to $1 trillion) so far only three deals, worth a combined $5 billion, have been cut up.

112

Michael Ferolli, a J.P. Morgan economist, says that to call the new plan “stillborn would be too harsh, but it [TALF] is off to a rough start.”

113

The

Journal

reports that “a month ago, bankers say, they thought they would be selling at least ten deals in the first round of the program. Most of these have been put on hold.”

114

What’s the problem? When the Fed is making buyout money available to hedge funds, the threat of making bad loans wouldn’t seem to be much of a risk. So what’s the reason for the holdup?

It’s the administration’s own policies.

As the

Journal

says, “one reason for the slow start: the outcry over bonuses paid by AIG, the troubled insurer that received federal money. Some investors are concerned that they too could be exposed to a political storm should they take too much money from the taxpayer-funded program.”

115

When these investors see the names and bonuses of executives at AIG being published and their homes deluged with angry protestors, their reaction is to steer clear from taking tax money in any form. So every time Obama lets loose with a new volley of populist rhetoric, condemning corporate bonuses at the same firms that are receiving federal help, he shoots himself—or, rather, us—in the foot. The more he protests and condemns the bonuses and threatens to tax them away, the more he deters the very partners he needs to get the economy rolling again.

The deterrent effect of shifting federal policies, political posturing, and changing—and punitive—tax legislation is huge. Investors don’t know what the rules are since they keep shifting. They’re perpetually worried that a business-as-usual decision, easy in more normal times, will land them on

the front page of newspapers throughout the country. It’s like the situation Voltaire described in

Candide

, where the Romanian army officers shoot every tenth soldier “in order to encourage the others.”

The second prong of Obama’s pathetically inadequate response to the lack of bank lending is to seek to take “toxic assets” off the banks’ books. (For those who enjoy pain, the following narrative explains how these assets came to festoon bank balance sheets in the first place.)

HOW THE CATASTROPHE STARTED

Thirteen Steps to Doom

Step 1

Under the Clinton administration, Congress calls for Fannie Mae and Freddie Mac to encourage more mortgage loans to low and middle income families. In 1996, Secretary of Housing and Urban Development (HUD) Henry Cisneros sets a quota requiring that 42 percent of Freddie or Fannie loan purchases or insurance be for families in the low or middle income bracket. In 2000, his successor, Andrew Cuomo, raises it to 50 percent.

Step 2

Fannie and Freddie step up their program to buy low-income mortgages and encourage lenders to issue them. To meet the Clinton administration quotas, they waive the requirements for down payments and income verification.

Step 3

Hustlers like Countrywide Financial take advantage of the opportunity and issue subprime mortgages they know cannot be repaid. They lend mortgages that cover the entire property value—no down payment needed—as well as some of the early years’ interest payments and the brokers’ and bankers’ and lawyers’ fees. Often this practice leads to a loan that exceeds the value of the property. After three years, typically, these special loans for interest will lapse and the family will have to pay the full mortgage debt. But to many families that seems like a distant, far-off threat—especially when they’re looking at a nice new house.

Step 4

Fannie and Freddie buy these subprime loans, as Congress and HUD want them to do. They and other financial institutions then bundle their good and bad loans together (in a process called “securitization”) and sell Wall Street investors a share of the package.

Step 5

Eager to get in on the mortgage boom, banks, brokerage houses, pension funds, and other investors flock to buy these securitized mortgages.

Step 6

To permit them to lend out more money based on these mortgage assets (called “leverage”), the banks get insurance firms such as AIG to insure the securitized mortgages. With insurance, the bond rating firms give a triple-A rating, which lets the financial institution lend as much as ten times the value of the mortgage assets.

Step 7

Eager to squeeze even more leverage out of these mortgage-backed securities, the financial institutions get other banks around the world to insure them by buying credit default swaps. With this extra backing, the financial institutions holding the mortgage-backed securities can lend many additional multiples of loans based on these assets. Credit default swaps increased from $900 billion in 1999 to $60 trillion in 2007.

116

Step 8

With a glut of both new and existing homes on the market, real estate prices stop increasing and begin to level off.

Step 9

After three years, families holding subprime mortgages get hit with big interest rate increases, which they can’t afford, and they start to default on the loans. The creditors consider foreclosing, but with real estate prices stagnant, the loan is often worth more than the house—so even taking the property entirely wouldn’t pay off the debt.

Step 10

With so many homes in default, real estate prices drop and more home owners find that their mortgage outstrips their property’s value. Banks have to count these loans as losses on their balance sheets.

Step 11

As the underlying mortgages go bad, the mortgage-backed securities that are based on them also go into the red. Banks call on insurance companies and holders of credit default swaps to make good on their insurance.

Step 12

The balance sheets of banks all over the world turn negative; insurance companies are unable to pay out on their policies insuring the mortgage-backed securities. These now-toxic assets drive the portfolios of major financial institutions into the red.

Step 13

Faced with huge losses and negative balance sheets, banks stop lending. Credit dries up, companies go bankrupt, and layoffs pile up. The recession begins.