How to Create the Next Facebook: Seeing Your Startup Through, From Idea to IPO (11 page)

Read How to Create the Next Facebook: Seeing Your Startup Through, From Idea to IPO Online

Authors: Tom Taulli

Unless you have a good track record of starting successful companies, you need to assemble a reliable, committed, full-time, and preferably experienced team prior to launching your venture. Otherwise, potential VCs may view your company with trepidation and be reluctant to pull the trigger on funding. We hope you have already filled some of the key spots on your team and identified, say, your lead technology person, or someone who has deep domain experience. But don’t feel as though you have to sign on partners purely for the sake of impressing potential VCs with a huge team roster. Your core team need only consist of three or four people, as long as you can offer VCs some tangible evidence that these are the people who will take your company to great heights.

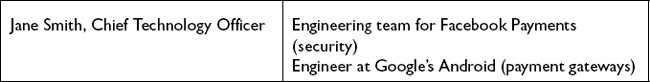

On your team slide, you should include simple bios for each member of your company.

Figure 5-1

gives an example.

Figure 5-1.

Example of showing your team member on a slide

Focus on each team member’s relevant experience, and, yes, be concise. When discussing your team in your pitch deck, you should also cover these additional factors:

- What’s your approach to compensation?

- What additional talent are you planning to recruit?

- How do you plan to recruit them?

Be sure to include a slide or two in your deck that shows potential VCs how your venture will make money. After all, the main reason you’re pitching to them in the first place is because you want them to fund your company in return for a slice of its equity. If you haven’t developed at least an initial strategy to monetize your business and earn your VCs a return on their investment, well, then, what incentive do they have to invest? Sure, it’s tough to know how your product will evolve and what types of customers you’ll have, so your company’s initial business model may very well be off the mark. Facebook’s original business model, for example, was local advertising! But crafting a well-thought-out business model demonstrates to VCs that your company is a worthwhile investment.

Your business model need not be complicated. Airbnb’s pitch deck included a straightforward slide that detailed the company’s business model. It said, simply, “We take a 10% commission on each transaction.” The slide then indicated that, based on its sales history, the company received roughly $20 per transaction. This sent a compelling message to Airbnb’s VCs, because they could immediately do the mental math and realize that a few million transactions would ensure that the company becomes a breakout success.

Turn to

Chapter 9

for more details on the various approaches your company can take to generating revenue.

Often, new ventures pay little attention to their go-to-market strategy in their pitch deck, despite the fact that it is absolutely critical to demonstrate that they have rigorously analyzed and mapped out their product’s distribution channels. After all, few products sell themselves or somehow go viral.

VCs want to see that a startup has some creative, grassroots marketing strategies. If you’re looking for examples of startups with unconventional marketing tactics, look no further than Mint’s Aaron Patzer. Before Patzer launched his app, he started a financial blog that catered to his app’s eventual target demographic—twentysomethings—and covered topics like credit cards, school loans, and career tips. As it turned out, Patzer’s blog helped so much with his branding efforts and collected so many e-mail addresses—by the time Mint was ready to be launched, he had amassed more than 20,000 members—that he was able to catch the attention of VCs, who felt better about funding the company.

Chapter 7

looks at various approaches to distribution in much more detail. For now, remember that no matter what go-to-market strategy (or strategies!) fit your product best, you should make sure your deck covers this key topic.

Name your company’s top rivals in your deck, and explain how your product and company are different from the competition. Never say, “We have no competition,” a phrase that is almost always untrue and has the unique ability to make potential VCs cringe.

Sometimes your competition may not even be a company. Instead, you could be competing against an old and established way that customers do something. Just look at the highly popular music streaming service Spotify, whose founder and CEO, Daniel Ek, says his competition is piracy. To ensure his company’s success, Ek built a service with an easy-to-use, fast interface that makes music sharing among friends not just possible but a cinch. Thanks to Spotify, music piracy doesn’t seem all that attractive any more.

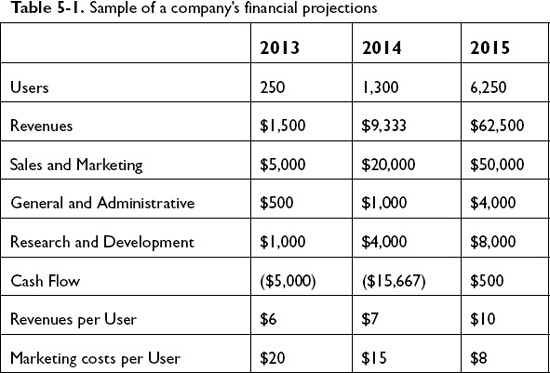

Early-stage VCs expect you to divulge your company’s monthly revenue and expense forecast for its first year of operations in your pitch deck. Then, after your company has celebrated its one-year anniversary, you’re expected to revise these figures and break out your forecasts on an annualized—rather than monthly—basis for the next two years your company is in business. Insert all this information into a spreadsheet, and don’t forget to include some

basic financial modeling, such as a formula that shows how many customers you will attract for a given amount of expenditures on sales and marketing, as well as an estimate of the average revenue your company will take in per customer. Once you compile these financial details, you will have created a decent revenue forecast.

Although educated guesses suffice on the revenue side of the financial forecast equation, be sure to provide your VCs with a detailed analysis of your company’s expected expenses, the majority of which will most likely result from hiring new employees. But keep in mind that even though you will delve deeply into the details when considering your company’s likely expenses, you still will almost certainly underestimate the costs of running your business. Trust me on this one: for any given period of operations, take the total amount of your expected costs and multiply that figure by 1.5. The result of this calculation is a much more realistic estimate of your company’s overall costs for that period.

When you have finished your spreadsheet, summarize the key points of your financial forecast on a slide in your pitch deck. Check out the sample financial forecast slide pictured in

Table 5-1

(the numbers are in thousands).

Do not insert any fancy financial metrics, like your company’s discounted cash flow or your internal rate of return, into your financial forecast spreadsheet. Such details are overkill and provide potential VCs with little information about the opportunity your venture presents. Be an entrepreneur—not an MBA!

Be sure to review your company’s financing history in your pitch deck, including the specific amount of money you want to raise during the round of funding in which you are currently immersed. And do not suggest that you are open to receiving a range of funding, because VCs may take this as a reason to fund your venture at the low end of your specified range.

When you are ready to wrap up your pitch deck, you need a final slide that gives your VCs an overview of the most important takeaways from your presentation and is sure to leave a long-lasting impression. Think about reemphasizing your company’s mission and revisiting the ways in which your product will help to change the world. This way, you begin your presentation powerfully and conclude it just as powerfully.

A pitch deck is an important component of your presentation to potential VCs, but it can only take you so far. If you truly want to grab the attention of investors, show up at your pitch meetings with a prototype of your product. It does not have to be a finished product; it can be a crude version of what’s to come. As long as potential investors can toy around with your prototype (which they love to do, by the way!), they can better visualize the opportunity your company and product represent—and they may come up with some ideas that prove invaluable to your company’s and product’s future development.

A working prototype certainly was advantageous to Facebook’s funding efforts. After all, the site was already up and running—and gaining hordes of new users every day—by the time Zuckerberg began pitching to VCs. To be sure, Facebook’s potential investors still had many questions and concerns about the site, but it was hard to argue about the fact that the company was gaining traction with its users on a daily basis.

In some instances, in lieu of presenting a deck at its pitch meetings, a company simply chooses to demo its product for potential investors. Instagram went this route when its product was still a minimum viable product (MVP)—which, in tech lingo, means the product was in its raw stages and focused on just a few core functions. The concept of what qualifies as an MVP is fuzzy, though. Some entrepreneurs believe that a handful of screenshots or an extremely crude prototype can be considered an MVP; but when it comes to securing

funding, these looser definitions are probably too minimal. This is not to say that you must spend months developing a prototype of your product. Countless great products, from Facebook to GroupMe, have had short development cycles and were created in a minimal amount of time. But in the end, your prototype should be robust enough to demonstrate to potential investors that your product is a source of value for users.

Before you walk into a pitch meeting with potential VCs, you should draft a concise executive summary whose purpose it is to express the core elements of your business by transforming your deck into paragraph form. Try to limit your executive summary to one page, which should be enough space for you to give investors a good idea of what your business is all about. If you must go over that in length, be sure to cap the document at no more than three pages.

Some general rules to follow when writing your executive summary are as follows:

- Avoid buzzwords, which annoy VCs and may give the impression that your business is a farce.

- Write in clear sentences. It’s okay for your executive summary to be conversational in nature, but don’t fill the document with jokes and witticisms. The purpose of an executive summary is not to draw a laugh; it’s to get to the point.

- Keep the graphics to a minimum. It may be a good idea to include a screenshot of your product and a chart of your company’s progress, but don’t forget that the document should be heavier on text and lighter on images.

What about a formal business plan? Forget about it; formal business plans are a waste of time—so much so that, nowadays, VCs do not expect you to provide one. But it is a good idea to craft an operating plan, whose purpose it is to act as a guide to your business’s objectives for the next year and provide a detailed, month-by-month description of stated goals. An operating plan is an extremely useful tool for keeping a venture on track and measuring the progress it makes. If things begin to slip and your company fails to meet its monthly goals, an operating plan can help put you back on course.

An operating plan may include the following components:

- Product specification:

Generally a few pages in length, your product specification should describe the main objectives of

your product. Limit your description to include three or four features. - Product map:

Anticipate how your users will navigate your product, and describe that process in your product map. - Product copy:

The messaging of your product is vital, so don’t forget to consider the copy you use to describe your web site or mobile app. If your value proposition is instantly clear to users when they check out your product, they are more likely to adopt it. - Hiring plan:

List the open positions for which you still need to hire. Include the ideal skill sets of and compensation levels for each of these future employees. Also define each future recruit’s goals.

You can include your operating plan in the due-diligence materials you gather for your VCs. Although drafting an operating plan may feel like a lot of work at first, the forethought you put into this document is likely to provide comfort to VCs and increase their willingness to invest. After all, a well-thought-out operating plan shows that you have a disciplined approach to growing your company.