Monkey Business (15 page)

Authors: John Rolfe,Peter Troob

During the underwriting process, bankers and analysts spend a lot of time working closely with each other. They work out the

details of a company’s valuation, and debate what approaches should be used to position and market the company to the prospective

buyers. In this close, intense atmosphere it’s not unheard of for a banker and an analyst to begin a deal as nothing more

than professional acquaintances but end up as lovers or, better yet, serial copulators. DLJ certainly wasn’t immune to these

semiprofessional trysts, and Troob and I heard scuttlebutt regarding bawdy romps, and subsequent spread-eagle delight, in

darkened boardrooms after hours between members of the banking teams and their research analyst counterparts.

The thing is, these romps had the potential to be seriously controversial. By design, bankers and analysts are professional

adversaries. Typically it is the banker’s responsibility to represent the client by pushing for the richest valuation, while

it is the analyst’s responsibility to defend the bank’s integrity by putting out unbiased valuation reports and buy/sell recommendations.

It wouldn’t be

too

much of a stretch to imagine that a devious banker might dangle the promise of some steamy

sex in front of an undersexed, eager-to-please research analyst in exchange for just a few extra multiple points on a valuation.

No matter what sort of research analyst support a banker has on a deal, it’s always the market that drives pricing at the

end of the day. The bankers can take management teams out on the road, and they can have their research analysts telling the

accounts that a new issue should be priced at fifteen times earnings, but if the market is unwilling to sign off on the proposed

valuation, the company won’t get the pricing and valuation points that they’ve been led to believe they can get. Since the

bankers are known to regularly overestimate the market’s willingness to pay a given price for a new issue, the banker’s job

uncomfortably becomes one of trying to figure out how to explain to the client at pricing time that the bank is going to be

delivering less money than they originally promised. That reality exists whether or not the banker on the account is banging

the research analyst.

Overall, investment bankers spend hours, days, and sometimes weeks of their lives trying to figure out a way to show a company

what a tremendous amount of money the company is worth. Then, if they’re lucky enough to win the business, they spend more

hours, days, and weeks slowly persuading the salespeople, the capital markets guys, and the markets that the company is truly

worth the value that the bank attributed to it. It’s like catching a fish and then trying to hold on to it with your bare

hands. Some investment bankers are just better fishermen than others.

No passion in the world is equal to the passion to alter someone else’s draft

.

—H. G. Wells

A

s Rolfe and I learned, the initial rounds of valuation work are just the first steps in the investment banking process. These

inaugural throes are the opening volley in what will become a barrage of documentation necessary to, first, win the business

and, second, process the deal. The associate has the task of making all the valuation numbers look good and the reasons behind

the numbers look even better. The bullshit is set to accelerate. This is where the word processing department comes in.

Professional word processing is performed on any and every document an investment banking associate works on. When an associate

does a pitch there is word processing, on internal memos there is word processing, on anything that leaves the investment

bank to be seen by a client or prospective client there is word processing. Every sole, single, solitary document has to look

good because this constitutes 90 percent of the associate’s value-added.

If an investment banking associate is able to word process effectively and efficiently, then he or she will be successful

for at least four years on Wall Street.

The word processing portion of an associate’s work is like the boxes of Raisinets at the movie theater. They’re a staple across

the country, no one likes them and they should be rid from the planet, but they’re still there. Every associate detests word

processing, but it’s a necessary evil in investment banking.

Unfortunately, that necessary evil occupies 40 to 50 percent of an associate’s time. This equates to anywhere between thirty

to fifty hours per week of word processing per associate. The amount of time associates on Wall Street spend submitting documents

to word processing, proofing the documents after they come back from word processing, reworking the drafts that were first

submitted to correct some of the errors the word processing gnomes made, again submitting the documents to the word processing

department, and then again proofing them is mind-boggling. After completing all this work, the vice president on the deal

usually scraps 80 percent of the stuff the associate wrote, and the word processing cycle begins all over again.

At DLJ, the word processing department was staffed by a crew that seemed like they belonged on the brig of the good ship

Lollipop

. Rolfe boarded this ship many times and got to know the crew pretty well.

There were two basic groups of word processing people. The struggling actors and actresses and the Christopher Street fairies.

All of them were temperamental and

refused to take shit from any junior bankers. They were competent, but if they didn’t like us it seemed as though they would

make lots of mistakes on purpose. They would fuck up fonts and underlines and paragraphs and make any long night even longer.

It wasn’t easy to get on their good side. We had to be nice. We couldn’t pay them off. They got paid about twenty bucks an

hour and didn’t give a flying fuck about money. They just wanted respect. It was a beautiful thing to watch a snot-nosed,

stuck-up banker groveling to a guy who only wanted to go down to Christopher Street to pick up his boyfriend. Usually, the

banker had a hard time relating to the word processing guy, but the word processing guy held the associates’ balls in his

hip pocket. To cross the word processing department was one of the worst mistakes any of us could make.

The best way to convey the futility of the word processing merry-go-round is through an illustration. But keep in mind this

won’t give full justice to the actual pain inflicted upon us by the word processing merry-go-round. We had to deal with this

crap on a daily basis for just about everything we did.

On most pitches, when the initial valuation work is complete, the vice president tells the associate, “Take a crack at writing

the executive summary.” The executive summary is used to state the business that the company being pitched is involved in,

and to tell the company that the

investment bank making the pitch should be chosen to lead manage the deal. The rest of the pitch book shows why the investment

bank doing the pitching should get that business.

“Taking a crack” at something in investment banking is like jerking off on yourself in the corner. It’s bad enough that you’ve

got to go and jerk off in the corner, but to add insult to injury you have to do it on yourself and it’s a mess to clean up.

The associate works on the executive summary and sends it through the word processing department. When it comes back, the

vice president rewrites the executive summary and the associate sends it back through the word processing department, gets

it back, and proofs it. Then the senior vice president rewrites the executive summary once again, the associate sends it back

through the word processing department, gets it back, and proofs it. Eventually, the managing director rewrites the executive

summary for the fourth time. You get the idea. The shit continues ad nauseam. Rolfe experienced this clusterfuck firsthand

while he was writing an executive summary for a telecommunications company:

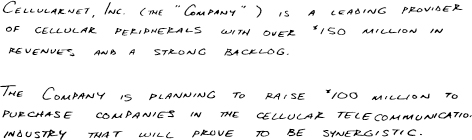

I wrote

I walked up to the word processing department so that I could submit the document and get the ball rolling. Fausto was sitting

there looking haggard when I walked in. Fausto was the Grand Poo-Bah of word processing. He was responsible for allocating

all the work in the word processing department. I don’t know why he looked so haggard. Maybe he’d had a long night at the

Vault, a sex club, or maybe he was just tired. I wrote out a word processing ticket and clipped my handwritten document to

it. I was neither nice nor mean to Fausto. But I think he thought that I was a little curt with him so he gave my job to Elena.

Elena was a beauty, but she hardly spoke English and I believed that if she tilted her head too far to one side pebbles would

fall out. Two hours later a document came back that looked like this:

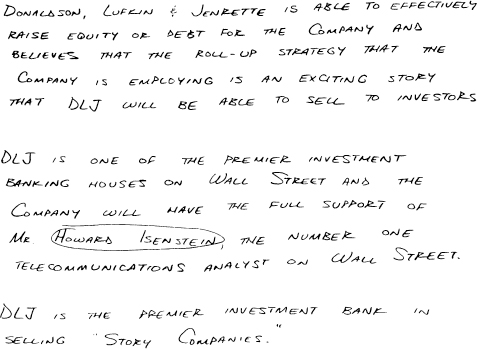

Cellular-net, Inc. (the “Company”) is a leeding provdier of cellulare periherals company with over $150 million in revenues

and a strong backlo.

The Copany is planning to raise $1000 million to purchas companies in the cellul telecommunicationss industry that will be.

Don aldson, Luskin & Jenrette is able to effectively raise equity or debt for Company and believes that the roll-up strategie.

DLJ is one of the premier investment banking houses on Wall Street and the Copany will have the full support of Mr. Howerd

Isensteen, the number one telecommunications analyst on Wall Street.

DLH is the premier investment bank in selling “Story Companies.”.

I was pissed off. I made the corrections and submitted the marked-up document. I spoke to Fausto very nicely and told him

that I appreciated all his hard work throughout the year and that I really didn’t know how he did it. This made him happy.

An hour later a perfect document came out.

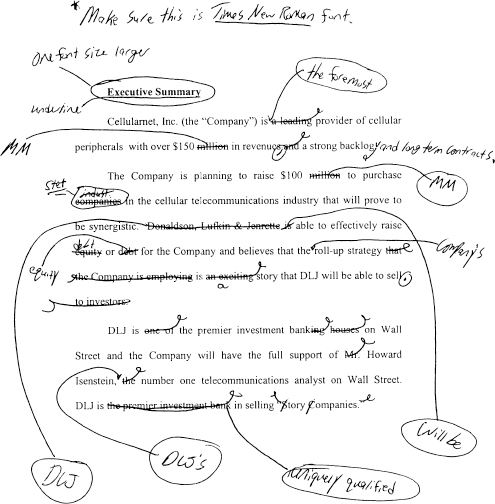

The following day I gave this “first crack” at the executive summary to the vice president and he scrapped it. He marked it

up like this:

After he was done hacking at the executive summary it was about 9:00

P.M

. I submitted it to word processing. Inevitably what came out of word processing was not perfect, so I had to resubmit it.

I waited for it to come out of word processing and got it back around 11:30

P.M

. The vice president asked me to fax the finished product to him after it went through

word processing. So I faxed it. Of course, he was awake because he only had left the office a half hour ago. When he answered

the phone I heard his TV in the background. There was a familiar theme song playing and I was pretty sure that it was the

Robin Byrd Show’s

“Baby, Let Me Bang Your Box.” I vowed to myself that if I ever made it to vice president I’d go ahead and spring for either

Spice or the Playboy Channel, so that I could at least watch some quality hoochie while my associates faxed me pitch books.

The vice president made more changes and faxed them back to me and asked me to have it to him by the morning. I could have

either submitted his changes to word processing, waited for them to be done, checked them, and left the finished product on

his desk, or I could have submitted the changes, gone home for some shut-eye, and then come to work early the next morning

and checked the job that word processing had done. Either way I wouldn’t have gotten more than five hours of sleep.