The Millionaire Fastlane (23 page)

Read The Millionaire Fastlane Online

Authors: M.J. DeMarco

Tags: #Business & Economics, #Entrepreneurship, #Motivational, #New Business Enterprises, #Personal Finance, #General

Imagine opening your mailbox every month to a $40,000 check-and you didn't have to do anything for it. What kind of trouble can you get into earning $40,000 per month? I bet a lot.

Unrealistic? It isn't. This is how I live.

Even in this low-interest-rate environment I can find safe investment yields in the 4%–6% range, some tax-free. While most people shudder at the thought of an interest rate increase, I love it. I get a pay raise. A 1% interest rate hike translates into thousands per month for me. And since inflation rises in unison with interest rates, my income has an element of inflation protection. If inflation rises, so do interest rates.

So how does all of this become a reality? I created a passive income stream via my Internet businesses (a business money tree seedling), which funded my passive income system from lending. While my Internet business was 85% passive (yes, I had to work several hours per week), my lending passivity is 99.5%. I do virtually nothing and the checks arrive.

Instead of trading my time for dollars, I invested my time into an autonomous system simultaneously capable of passivity and capable of funding my money system. It was a dual-flanked attack where passive income was both the short and long term goal.

Amass Your Army of Freedom Fighters

Every dollar saved is another freedom fighter in your army. If your money is fighting for you, your time is freed and you break the equation of “time for money.”

Money is your army

. The more you have, the more they will fight for freedom. Slowlaners focus on the expense variable in the wealth equation when

they should be focused on the income variable

. Income is the key to growing your army of freedom fighters. You aren't going to recruit a massive army detailing cars down at the Jimmy's Auto Salon.

And I'm not referring to just the U.S. dollar, but all international dollar-denominated assets. As I write this, much of my income is derived from non-U.S.-dollar assets in other countries with stronger currencies and better yields. Fastlaners think globally, not locally.

What does a dollar represent to you? A mechanism that gets you bottle service at the club every Friday? Or is it the seed of your money tree? Is it your freedom fighter? Make money fight for you instead of you fighting for money.

How Fastlaners (the Rich) Use Compound Interest

While examining the Slowlane, I impugned “compound interest” as an impotent wealth accelerator because of its attachment to time. When the Slowlane media darlings read that assertion I'll be crucified because lambasting compound interest is the pinnacle of financial blasphemy.

But I also exclaimed it to be a powerful passive income generator when leveraged against large sums of money. Contradictory? Just like education, Fastlaners and Slowlaners leverage compound interest differently. Slowlaners (the middle-class) use compound interest to get wealthy while Fastlaners (the rich) use it to create income and liquidity.

Slowlaners start with $5; Fastlaners start with $5 million.

Compound interest pays my bills. It's my tool. It's my passive income source. Yet,

compound interest is not responsible for my wealth

. This is critical. Fastlaners aren't using compound interest to build wealth, because it's not in their wealth equation. The heavy lifting of wealth creation is left to their Fastlane business.

When a rich politician or public figure comes forth and discloses his finances, notice the common themes. The source of their wealth comes from their business interests, while their liquid cash reserves are tied into fixed-income securities like municipal bonds, treasuries, and other highly liquid and safe investments. The rich aren't using the markets to create wealth; they're increasing their existing wealth with leveraged business assets.

Remember, that 25-year-old multimillionaire who got rich investing in mutual funds is a fairy tale. The millionaires are the guys running the funds! They're the producers!

How to Really Use Compound Interest

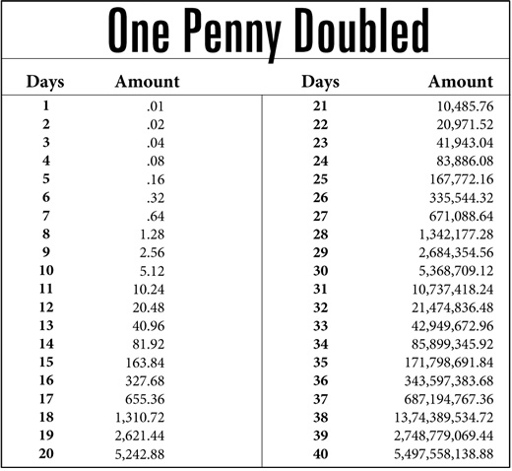

Would you rather have $5 million right now, or a penny doubled every day for forty days? No-brainer, right? You'd take the $5 million bucks. But that would be a serious mistake. Accept $5 million now and you forsake nearly $5,500,000,000. That's $5.5 BILLION dollars. Examine the chart below that demonstrates the force of doubling.

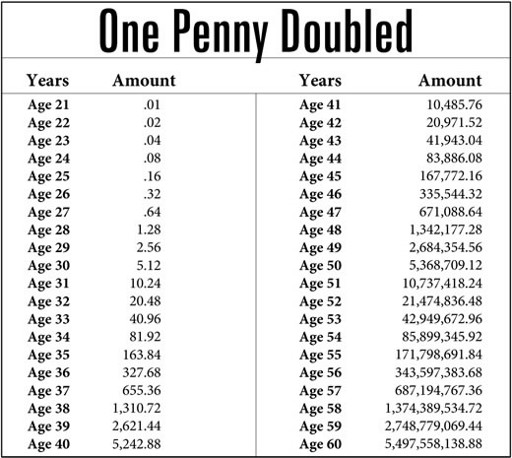

Now transform the previous chart and replace the days with YEARS. Make day-one a person-you-at 21 years old.

The transformed chart is indicative of a Slowlaner's journey where compound interest doesn't enforce power until most of life has evaporated. Big money doesn't come until you are in your fifties and sixties, and this is with 100% returns year after year. Average market returns would be 7%. Yet at a doubling, at age 40 you have barely six grand. Again, this is the Slowlaner's predicament: Imprisoned in time and uncontrollable yield.

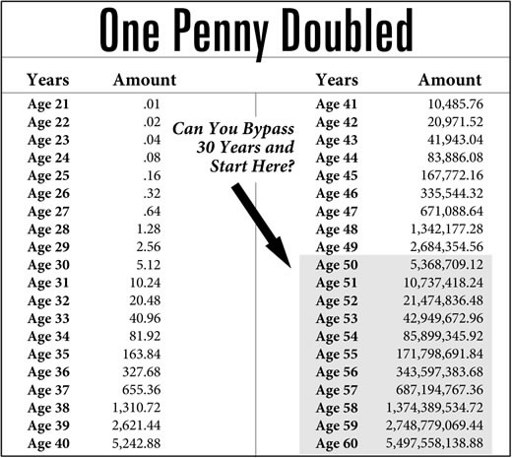

Fastlaners understand this weakness and realize that

the compound interest weapon is most effective with large sums of money

. For compound interest to be effective, you must bypass 30 years of mathematical ineptitude by riding the crest where it is effective.

The Tidal Wave of Compound Interest

Like a tidal wave far out to sea, compound interest's strength isn't visible until it moves near land. As the wave approaches land, its force becomes incredibly powerful. Slowlaners ride the compound interest tidal wave a million miles out at sea. And guess what-nothing happens. They float aimlessly, going nowhere. Ten percent interest on $5,000 doesn't make millionaires. Saving $200 a month from your paycheck in a 3% savings account isn't going to make you rich fast. You simply can't ride a wave miles out at sea.

The Fastlaner observes the tidal forces near land and seeks to meet it at the shore. At the shore, the tidal wave can be ridden with impact. To actuate compound interest's power, start at the shore, with a large number that can be leveraged. Ten percent interest on $10 million is $1 million a year-$83,333 every single month. Exploit compound interest at its crest, not a million miles out to sea.

The point of this illustration is to show that the rich aren't using compound interest to get wealthy; they're using it for income and liquidity. A 5% tax-free yield on $10 million suddenly creates a $500,000 per year passive income. Like a tidal wave at the seashore, compound interest rears excruciating force when pitted against large sums of money. This is where money transforms into a fully passive income stream.

As for earning your $10 million, that solution lies in

exponential leveraged growth stemming from a Fastlane business

-net income plus asset value-NOT in expenses, NOT in the stock market, and NOT in a job.

Chapter Summary: Fastlane Distinctions

- One saved dollar is the seed to a money tree.

- A mere 5% interest on $10 million dollars is $40,000 a month in passive income.

- A saved dollar is the best passive income instrument.

- Fastlaners (the rich) don't use compound interest or the markets to get wealthy but to create income and preserve liquidity.

- A saved dollar is a freedom fighter added to your army.

- The rich leverage compound interest at its crest, applied against large sums of money.

- Fastlaners eventually become net lenders.

CHAPTER 21: THE REAL LAW OF WEALTH

Try not to become a man of success, but a man of value.

~ Albert Einstein

Effection, Not Attraction

The Law of Effection. Nope, not a misprint. Mathematics is the transcendent language of the universe. It cannot be controverted nor debated. Two plus two equals four. The number 10 million will always be greater than 24. These statements are facts and not subject to interpretation by some mystical theory of philosophy. Math is law. “Secrets” and mystical philosophies are not.

If you want to get rich, start observing the true law of the universe-MATH-and not some hocus-pocus law that can neither be proved nor documented. Singing positive platitudes around the campfire isn't going to make you rich. Oh, don't get your panties in a wad; I know the Law of Attraction sounds great and has practical applications.

For those not familiar with The Law of Attraction (“LOA”), it's a mystical philosophy that states you become what you think and that your conscious and unconscious thoughts make your reality. The LOA contends that if you know exactly what you want, ask the universe for it, see it coming, then you will eventually receive it. Think riches and you will have riches! Sounds easy, huh?

I won't hide my candid sacrilege to the LOA crowd; I think it's a bunch of baloney orchestrated to sell books to those who think “thinking” will make you rich. In fact, the LOA is nothing but old principles of belief and visualization repackaged and remarketed for mass consumption. Who are the true Fastlaners? The LOA marketers!

Bake a Cake Without Sugar?

Why did this book take me so long to write? I spent two years wishing and thinking positively about it. I let the Law of Attraction do the work. I asked the universe for this book. I was open to it. I saw it before my eyes. I even snapped a picture of a bookstore shelf and Photoshopped my book on the shelf. What happened?

Absolutely nothing. Nada. Zilch.

The universe never gave me my finished book. The fact is, despite all my positive thinking and meditations to the universe for my book, it never materialized until I sat my butt down in a chair and started to write it. I made a coordinated commitment to ACTION, a conscious choice, and then a commitment to that choice in the form of massive action.

If you're a Law of Attraction fan and find this critique offensive, that's OK; I didn't write

The Millionaire Fastlane

to make friends or to book speaking engagements about being a positive thinker. I wrote it to tell you exactly what you need to do to get rich. Thinking never made anyone rich, unless that thinking manifests itself into consistent action toward application of laws that work.

In fact, I find it insulting that someone might assume my success is due to positive thinking. I'm a realist who understands human nature, and that nature is to take the path of least resistance. It doesn't surprise me that these “attraction” books sell millions. The books that promise the easiest roads to wealth do well because, like sex, easiness sells.

Events of wealth sell. Process does not.

Yes, positivity is favored over cynicism. Belief is the starting point to change. Visualization is crucial. Yes, if you don't believe you can do it, I've got news for you-you can't. This stuff isn't new, it's OLD. While The Law of Attraction is a nice hammer in the toolbox, its flaw is that it ignores the real secret behind wealth, the real secret that transcends all wealth, all people, all cultures, and all roads-and that is the

Law of Effection

. The “Flaw of Attraction” is that it ignores mathematics.

The Law of Effection: The Fastlane Primer