Read Understanding Business Accounting For Dummies, 2nd Edition Online

Authors: Colin Barrow,John A. Tracy

Tags: #Finance, #Business

Understanding Business Accounting For Dummies, 2nd Edition (42 page)

A balance sheet doesn't have a punch line like the profit and loss account does - the profit and loss account's punch line being the net income line (which is rarely humorous to the business itself, but can cause some sniggers among analysts). You can't look at just one item on the balance sheet, murmur an appreciative ‘ah-hah,' and rush home to watch the footy game. You have to read the whole thing (sigh) and make comparisons among the items. See Chapters 8 and 14 for more information on interpreting financial statements.

At the most basic level, the best way to understand a balance sheet (most of it, anyway) is to focus on the assets that are generated by the company's profit-making activities - in other words, the cause-and-effect relationship between an item that's reported in the profit and loss account and an item that's reported in the balance sheet.

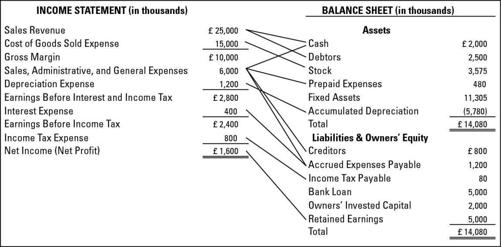

Figure 6-2 lays out the vital links between sales revenue and expenses and the assets and liabilities that are driven by these profit-seeking activities. You can refer back to each connection as sales revenue and expenses are discussed below. The format of the profit and loss account is virtually the same as the format introduced in Chapter 5, except that depreciation expense is reported on a separate line (in Chapter 5, depreciation is buried in the sales, administrative, and general expenses account).

The amounts reported in the profit and loss account are the cumulative totals for the whole year (or other time period). In contrast, the amounts reported in the balance sheet are the

balances

at the end of the year - the net amount, starting with the balance at the start of the year, adjusted for increases and decreases that occur during the year. For example, the total cash inflows and outflows over the course of the entire year were much more than the £2 million ending balance for cash.

Figure 6-2:

Connections between the assets and operating liabilities of a business and its sales revenue and expenses.

The purpose of Figure 6-2 is to highlight the connections between the particular assets and operating liabilities that are tightly interwoven with sales revenue and expenses. Business managers need a good grip on these connections to control assets and liabilities. And outside investors need to understand these connections to interpret the financial statements of a business (see Chapter 14).

Most people intuitively understand that sooner or later sales revenue increases cash and expenses decrease cash. (The exception is depreciation expense, as explained in Chapters 5 and 7.) It's the ‘sooner or later' that gives rise to the assets and liabilities involved in making profit.

The assets and liabilities driven by sales revenue and expenses are as follows:

Sales revenue derives from selling products and services to customers.

The cost of goods sold expense is what the business paid for the products that it sells to its customers. You can't charge the cost of products to this expense account until you actually sell the goods, so that cost goes into the

stock

asset account until the goods are sold.

The sales, administrative, and general expenses (SA&G) category covers many different operating expenses (such as advertising, travel, and telephone costs). SA&G expenses drive the following items on the balance sheet:

• The

prepaid expenses

asset account holds the total amount of cash payments for future expenses (for example, you pay insurance premiums before the policy goes into effect, so you charge those premiums to the months covered by the policy).

• The

creditor

liability account is the total amount of expenses that haven't been paid yet but that affect the current period. For example, you receive a bill for electricity that you used the month before, so you charge that bill to the month benefited by the electricity - thanks to the accrual basis of accounting.

• The

accrued expenses payable

account is the opposite of the prepaid expenses asset account: this liability account holds costs that are paid after the cost is recorded as an expense. An example is the accumulated holiday pay that the company's employees have earned by the end of the year; when the employees take their holidays next year the company pays this liability.

The purpose of depreciation is to spread out the original cost of a

fixed asset

over the course of the asset's life. If you buy a vehicle that's going to serve you for five years, you charge one-fifth of the cost to depreciation expense each of the five years. (Instead of charging this straight line, or level amount to each year, a business can choose an accelerated depreciation method, as explained in Chapter 13.) Rather than decreasing the fixed assets account directly (which would make some sense), accountants put depreciation expense in an offset account called

accumulated depreciation

, the balance of which is deducted from the original cost of fixed assets. Thus, both the original cost and the amount by which the original cost has been depreciated to date are available in separate accounts - both items of information are reported in the balance sheet.

Interest expense depends on the amount of money that the business borrows and the interest rate that the lender charges.

Debt

is the generic term for borrowed money; and debt bears interest.

Loans and overdrafts

are the most common terms you see for most debt because the borrower (the business) signs a legal instrument called a

note.

Normally, the total interest expense for a period hasn't been paid by the end of the period so the unpaid part is recorded in

accrued expenses payable

(or in a more specific account of this type called

accrued interest payable

).