Understanding Business Accounting For Dummies, 2nd Edition (64 page)

Read Understanding Business Accounting For Dummies, 2nd Edition Online

Authors: Colin Barrow,John A. Tracy

Tags: #Finance, #Business

The quality of financial reports varies from company to company. The Investor Relations Society (go to

www.irs.org.uk

and click on ‘IR Best Practice') makes an award each year to the company producing the best (in other words, ‘complete' and ‘clear') set of reports and accounts.

Part III

In this part . . .

B

usiness managers and owners depend on financial statements as well as other internal accounting reports to know how much profit they're making, where that profit is at the end of the period, and whether the business is in good financial shape or needs improvement. They also use financial statements to keep a close watch on the lifeblood of the business: cash flows. Managers must know how to read their financial statements. Also, they should take advantage of proven accounting tools and techniques to assist them in making profit, controlling cash flow, and keeping the business in good financial condition.

Managers need a good accounting model for analysing profit; they can use budgeting to plan, make projections, and achieve the financial goals of the business, which is the essence of management control. Business managers and owners must decide which ownership structure to use, taking into account risk to personal wealth and the prospects for tax minimisation. Finally, managers should clearly understand how the costs of the business are determined, and they should get involved in choosing the basic accounting methods for measuring profit and for recording values of their assets and liabilities. This part of the book, in short, explains how accounting helps managers achieve the financial goals of the business.

Chapter 9

:

Managing Profit Performance

In This Chapter

Recasting the profit and loss account to focus on profit factors

Following two trails to profit

Breaking even - not the goal, but a useful point of reference

Doing what-if analysis

Making trade-offs: Be very careful!

A

s a manager you get paid to make profit happen. That's what separates you from the non-manager employees at your business. Of course, you have to be a motivator, innovator, consensus builder, lobbyist, and maybe sometimes a babysitter too. But the real purpose of your job is to control and improve the profit of your business. No matter how much your staff love you (or do they love those doughnuts you bring in every Monday?), if you don't meet your profit goals, you're facing the unemployment line.

You have to be relentless in your search for better ways to do things. Competition in most industries is fierce, and you can never take profit performance for granted. Changes take place all the time - changes initiated by the business and changes pressured by outside forces. Maybe a new superstore down the street is causing your profit to fall off, and you realise that you'll have a huge sale, complete with splashy ads on TV, to draw customers into the shop.

Slow down, not so fast! First make sure that you can afford to cut prices and spend money on advertising and still turn a profit. Maybe price cuts and splashy ads will keep your cash register singing and the kiddies smiling, but you need to remember that making sales does not guarantee that you make a profit. As all you experienced business managers know, profit is a two-headed beast - profit comes from making sales

and

controlling expenses.

So how do you determine what effect price cuts and advertising costs may have on your bottom line? By turning to your beloved accounting staff, of course, and asking for some

what-if

reports (like ‘What if we offer a 15 per cent discount?').

This chapter shows you how to identify the key variables that determine what your profit would be if you changed certain factors (such as prices).

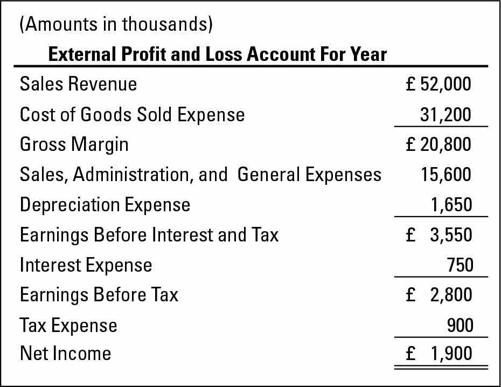

Redesigning the External Profit and Loss Account

To begin, Figure 9-1 presents the profit and loss account of a business (the same example as is used in Chapter 8). Figure 9-1 shows an

external profit and loss account

- the profit and loss account that's reported to the outside investors and creditors of the business. The expenses in Figure 9-1 are presented as they are usually disclosed in an external statement. (Chapter 5 explains sales revenue, expenses, and the format of the external profit and loss account.)

Figure 9-1:

Example of a business's external profit and loss account.

The managers of the business should understand this profit and loss account, of course. But, the external profit and loss account is not entirely adequate for management decision-making; this profit report falls short of providing all the information about expenses needed by managers. But, before moving on to the additional information managers need, take a quick look at the external profit and loss account (Figure 9-1) before the train leaves the station.

For more information about the external profit and loss account and all its sundry parts, see Chapter 5. Let us just point out the following here about this particular financial statement:

The business represented by this profit and loss account sells products and therefore has a

cost of goods sold expense.

In contrast, companies that sell services (airlines, cinemas, law firms, and so on) don't have a cost of goods sold expense, as all their sales revenue goes toward meeting operating expenses and then providing profit.

The external profit and loss account shown in Figure 9-1 is prepared according to accounting methods and disclosure standards called

generally accepted accounting principles

(GAAP) but keep in mind that these financial reporting standards are designed for reporting information

outside

the business. Once a profit and loss account is released to people outside the business, a business has no control over the circulation of its statement. The accounting profession, in deciding on the information for disclosure in external profit and loss accounts, has attempted to strike a balance. On the one side are the needs of those who have invested capital in the business and have loaned money to the business; clearly they have the right to receive enough information to evaluate their investments in the business and their loans to the business. On the other side is the need of the business to keep certain information confidential and out of the hands of its competitors. What it comes down to is that certain information that outside investors and creditors might find interesting and helpful does not, in fact, have to be disclosed according to GAAP.