Unfair Advantage -The Power of Financial Education (22 page)

Read Unfair Advantage -The Power of Financial Education Online

Authors: Robert T. Kiyosaki

Tags: #Personal Finance, #unfair advantage, #financial education, #rich dad, #robert kiyosaki

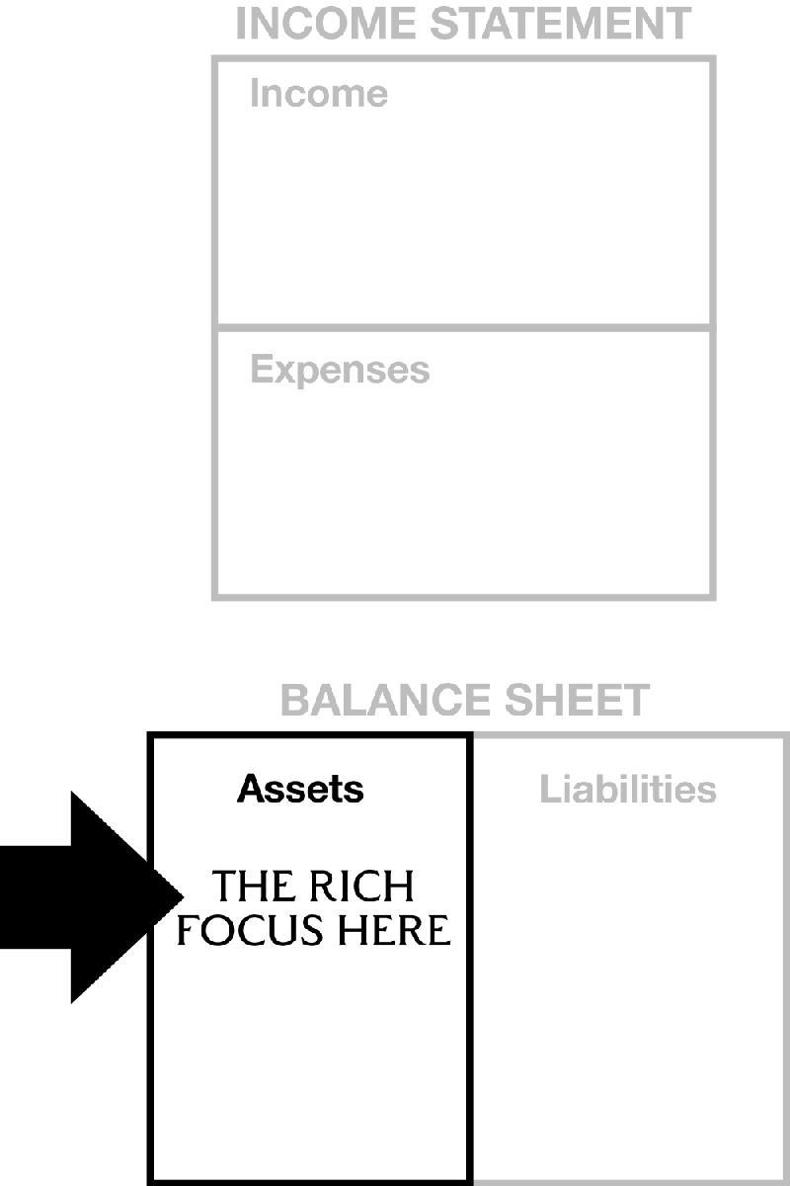

The middle class focuses on the liabilities column.

They want liabilities that improve their lifestyle. For the middle-class lifestyle, looking rich is more important than being rich. They want a bigger house, cars, fine food, vacations, education, and life’s luxuries… all paid for with debt. They spend more money than they make, and sink deeper and deeper into debt. Rather than buy an apartment house, they buy a bigger house in a better neighborhood that puts them in a better school district. If they invest, they turn their money over to financial planners because they would rather enjoy life than take classes and learn how to manage their own wealth.

The rich focus on the asset column.

They know if they focus on assets first, expenses and liabilities will be handled.

In the new economy, if you do not get your money into the asset column, converting your money into assets that cash flow, you will probably work hard for money all your life.

We Do Not Live Below Our Means

Most financial advisors recommend living below your means. This is good advice for the poor and middle class. It is not good advice for people who want to be rich. Kim and I do not live below our means. We believe living below our means only depresses our spirit.

So rather than live below our means, we invest in education and assets. For example, when we were building The Rich Dad Company, we took classes almost every weekend, learning as much as we could about business in the new economy. We did the same for real estate, technical trading, and commodities.

Today when we want a new liability, maybe a new car or vacation house, all we have to do is acquire or develop an asset first, and that the rich focus here asset will pay for the liability.

A year ago, in the midst of the financial chaos, I wanted a new Ferrari. When I told Kim what I was going to buy, she did not say, “You can’t have a new Ferrari. We can’t afford it.” Nor did she say, “Why do you need a Ferrari? You already have a Lamborghini, Porsche, Bentley and a Ford truck.” And she didn’t say, “Which car are you going to sell?”

She does not say those words because she knows a new liability will make us richer. Rather than remind me of how many cars I already have, she simply said, “What are you going to invest in?” In other words, what asset are you going to buy that will pay for the liability?

I had already found a new oil well project and invested in the well. When the oil well produced, the income from the well’s production paid for the Ferrari. The well is estimated to produce oil for about 20 years. The Ferrari will be paid for long before that oil runs dry.

Kim is happy because she has a new asset, and I am happy because I have a new Ferrari.

Our rule is simple:

Assets buy our liabilities.

Rather than live below our means, we expand our means by focusing on the asset column. Over the years, I have written books, bought a mini-warehouse, and subdivided land to buy liabilities. Some of the liabilities, such as the cars, are long gone, but the assets still provide cash flow. Our liabilities inspire us to become richer.

We also forbid ourselves from saying, “I can’t afford it,” or “You can’t have this or that.” We know we can afford anything we want if we acquire assets first. Knowing how to create or acquire assets is why the rich do not work for money.

FAQ

But if you’re acquiring assets for cash flow, aren’t you still working for money?

Short Answer

Yes, but there are differences. The difference is why the rich get richer, regardless of the economy.

Explanation

Rather than work for money, the rich follow the Laws of Compensation.

The Laws of Compensation

The following section explains three different variations on the Laws of Compensation. To be better compensated, you must follow these laws.

Law of Compensation #1

Reciprocity: Give, and you shall receive.

I learned this law long ago in Sunday school. As obvious as it is, when it comes to money, many people seem to forget this law. They want to receive, but not give, or give only after they receive.

Many people want to be paid more and do less. My poor dad was one of those people. As head of the teachers’ union of Hawaii, he worked hard to secure more pay and less work for his teachers. I remember a fight he took on, demanding that teachers teach fewer students for more pay, with more days off and better benefits. To my poor dad, this made sense.

To my rich dad, my poor dad’s philosophy violated one of the laws of compensation. Rich dad believed in giving more if you want to receive more.

It always seemed strange to me that many people thought my rich dad was greedy and my poor dad was right in fighting for higher pay and less work for his teachers.

When I graduated from the Merchant Marine Academy at Kings Point, New York, I joined a non-union company, Standard Oil, because I did not want to join the MM&P (Masters, Mates, and Pilots), a professional union for ships’ officers. I would have made more money as a union member, but being around my poor dad and his friends, teachers’ union officials, I could not subscribe to the union philosophy. In my opinion, the concept of wanting to work less and be paid more ultimately makes everyone poorer, regardless of the amount of money they earn.

One of the reasons there are fewer U.S. cargo ships today and fewer jobs on those ships is because union wages forced shipping companies to move their operations to countries with lower wage scales. One reason why General Motors is in trouble is because the union leaders were stronger than the company leaders. Today, the true cost of unionized labor in the U.S. auto industry is millions of jobs lost, factories moving overseas, and a weaker economy.

This does not mean I am anti-union. Unions have done a lot of good for workers, protecting them from cruel and greedy business owners. Unions gave us the two-day weekend. I respect a person’s right to choose their work affiliations and philosophy. When I graduated from the academy, I chose to be non-union. I made my choice because I would rather focus on giving more to receive more, rather than working less and earning more. Kim becomes richer every year because every year she produces more.

In 1989, she started with one rental house. Today, she has over 3,000 rental units. Today she earns more because she provides more housing for more people. In ten years, she may have 20,000 units and she should earn more because she follows the law of compensation. I know some people may say Kim is greedy. I know my poor dad would.

From my rich dad’s point of view, Kim is being generous because she obeys the first law of compensation: Give, and you shall receive. The law of reciprocity also works in reverse. If you cheat people, people will give back to you what you gave them. This is what happened to Bernie Madoff. He took people’s money and wound up in jail. He got what he deserved.

Unfortunately, many of the biggest crooks do not get caught. Some of them are still running the economy.

Law of Compensation #2

Learn to give more.

Most people go to school to learn how to earn money, but only for themselves and their family. Few people go to school to learn how to produce more and produce more for more people.

Most people go to school to become E’s and S’s. The problem with the left side of the quadrant is that the number of people I can serve is limited. For example, when I graduated from Kings Point, I could work for only one company, Standard Oil, as an employee. Most people in the S quadrant—a medical doctor, for example—can only work on one patient at a time.

The reason I chose to follow my rich dad into the B and I quadrants was because my success would serve more people. The more people I could serve, the more I earned.

When a person is successful in serving more people, taxes and debt also swing to their favor. This is why debt and taxes make people on the B and I side of the quadrant rich.

If you focus on making money just for yourself, or improving life only for yourself and your family, then taxes and debt work against you.

One reason why so many people are limited financially is because they went to school and learned to work for money on the E and S side of the quadrant, rather than learn to serve more people on the B and I side.

Law of Compensation #3

Leverage the power of compounding financial education.

The more you learn on the B and I side, the more you’ll earn. Over time, as your education compounds, so do your returns.

In other words, you earn more and more with less and less effort.

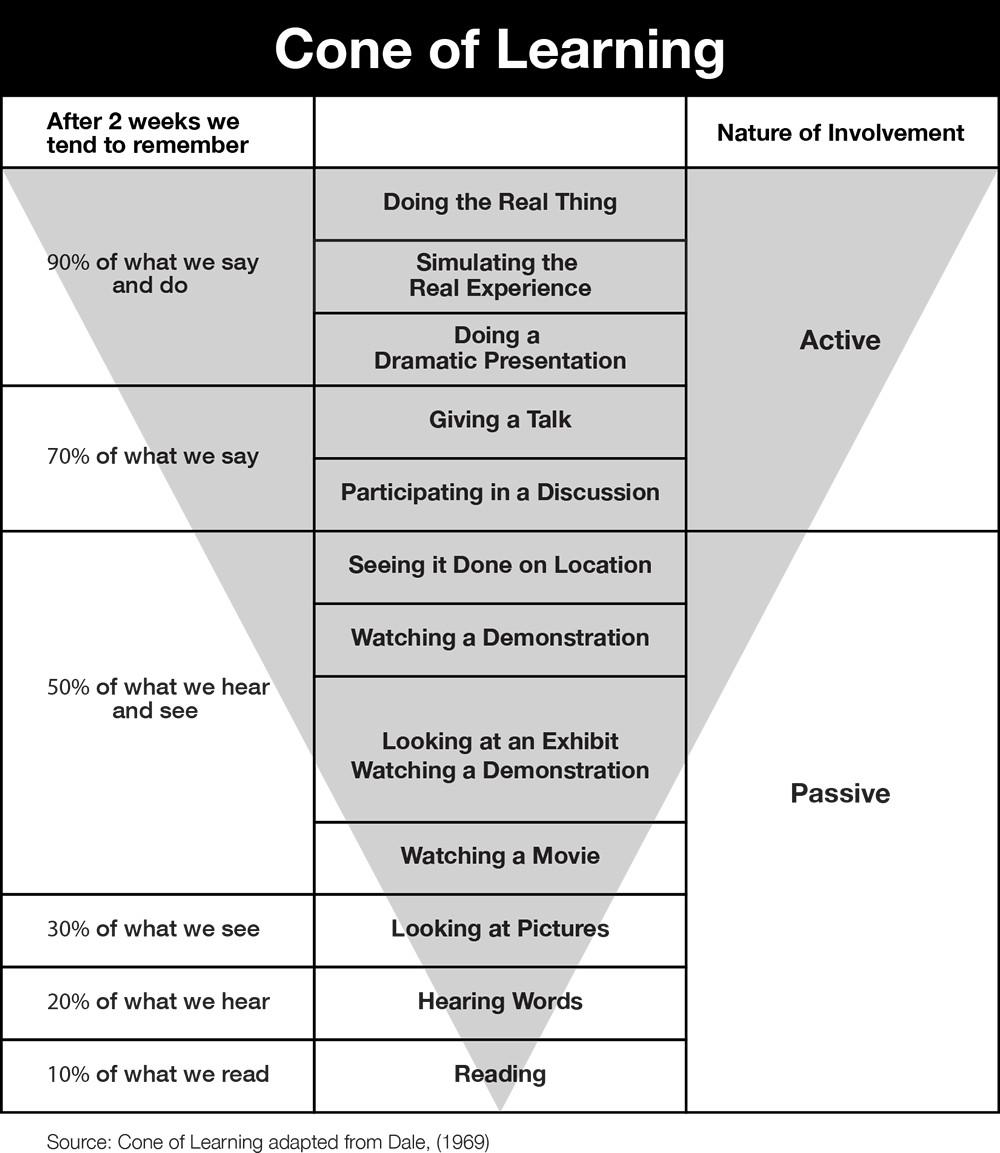

This is the true power of financial education. To better understand the Law of Compensation #3, a person needs to understand that the true power in education is not found in a classroom, seminar, books, report cards, or diplomas.

Simply put, “You can

teach

a person to fish, but you cannot force a person to

learn

to fish.” There are two important points related to this statement:

1. The power of education is unleashed after you leave school, take a class, seminar, or read a book and begin applying your education.

This is why medical doctors go to four years of college, four years of medical school, and then become interns or resident doctors for another four to eight years. Throughout this process they gain real-life experience before becoming real doctors.

I did not become a ship’s officer until after I left the academy. And I did not become a pilot until I had finished two years of flight school. I did not become a competent combat pilot until I was in Vietnam for six months. Incompetent pilots were often dead in the first two months.

People who have no financial education often fail. Rather than take classes on entrepreneurship or investing, they begin trading stocks, flipping real estate, or become entrepreneurs. Then they wonder why they failed or failed to produce extraordinary results. If they fail, many just quit, blaming something or someone for their failure.

As you may recall from a previous chapter, I stated that in 1973 when my flying career was over, I signed up for real estate-investment classes and sales training with Xerox.

Today people will say to me, “Can I take you to lunch? I want to pick your brains on investing in real estate.” It makes me sick to see people so naïve about financial education. Becoming financially educated is not something you do over lunch.

I also have had financial morons tell me, “I have bought and sold a number of personal residences. I know how to invest in real estate.”

There is a massive difference between buying a home and buying 300-unit apartment houses. Success or failure lies in the power of financial education. Taking a three-day seminar gave me the fundamentals to become a real estate investor, an investor who uses debt to acquire wealth.

While the fundamentals are the same for a single rental property or a 300-unit apartment house, the difference in profitability is found in education and years of experience.

My poor dad failed in his first and only business venture, an ice-cream franchise. In his mind, it was the franchisor that cheated him. In my opinion, it was his lack of entrepreneurial education and his inexperience that cost him two years of his life and his life savings.

The strange thing about people who did well in school, like my dad, is that they respect academic education, but fail to respect financial education. They seem to think that, just because they hold a PhD or are an attorney, accountant or medical doctor, business and investing should be easy for them.

To me this is academic arrogance. It is also very expensive arrogance.

2. Learning also compounds. The true abundance of money is found in the power of compounding financial education.

In other words, the more you learn about money in the B and I quadrants, the more money you’ll make.

Education’s Failure

Pictured below is the Cone of Learning. It was developed by Edgar Dale in 1969.