Catastrophe (29 page)

Authors: Dick Morris

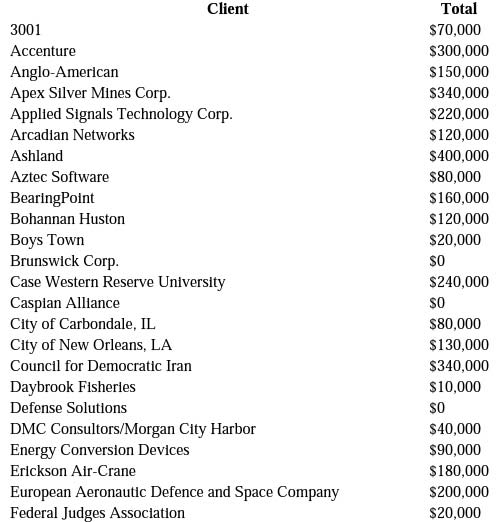

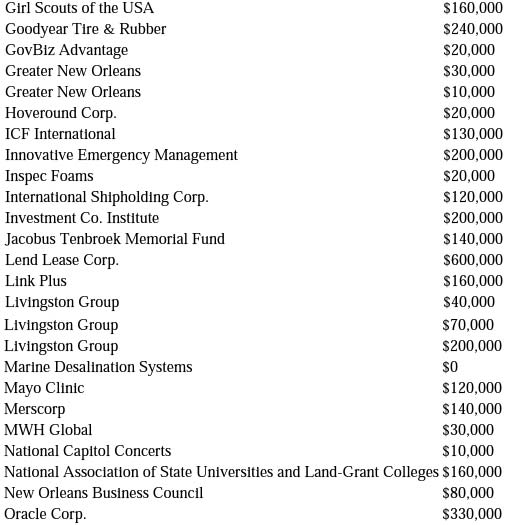

Livingston Group Lobbying Income, 1999–2008

LIVINGSTON GROUP

Total Lobbying Income, 2008: $9,040,000

Livingston’s client list is the best evidence of just how important leadership positions are to the lobbying industry, He’s everywhere!

OBAMA CAMPAIGN GURU BECOMES “ADVISER” TO LOBBYING FIRM

Shortly after President Obama’s inauguration, Matthew Nugen, former national political adviser to the Obama campaign, was hired by Ogilvy Government Relations, one of the top lobbying firms in D.C., as a “strategic adviser.”

Nugen insists he’s not a registered lobbyist in his new job at the mega-lobbying firm, which does nothing but lobby Congress and the administration. Instead, he says that his role will be “to help my clients interpret the thinking of the administration and what’s coming down the pike.”

354

After the Democratic National Convention, Nugen was assigned to travel with then vice presidential candidate Joe Biden. (The ever-talkative Biden must have been a great source of information!)

Nugen hit the ground running. According to Politico.com, Nugen immediately began “meeting Ogilvy clients and sharing his insight into the new administration and the thinking of its senior aides and policy advisers.”

355

That’s Washingtonspeak for using his contacts and friendships with former Obama campaign aides who now work in the administration to find out what’s going on inside the White House—and sell that information to lobbying clients outside the White House.

That’s the expanded definition of what a “strategic adviser” does.

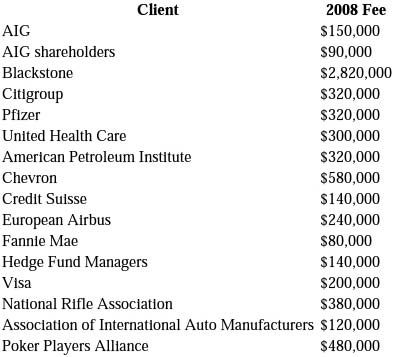

Ogilvy has plenty of clients who might be interested in the observations of Nugen, the firm’s well-connected nonlobbyist. Last year, the firm received $20 million in lobbying fees! Its clients included banks, hedge funds, and oil and pharmaceutical companies. Some of its illustrious clients, which will be seeking the support of the Obama administration, were:

OGILVY GOVERNMENT RELATIONS

Source:

“Ogilvy Government Relations,” Center for Responsive Politics, www.opensecrets.org/lobby/clientsum.php?lname=Ogilvy+Government+Relations&year=2008.

As the above indicates, Ogilvy represents plenty of banking and credit card interests, pharmaceutical firms, oil companies, hedge funds, car manufacturers, and health care clients—to name just a few.

What are they looking for in a firm like Ogilvy?

The banks are constantly seeking handouts from the government; they’ll want to know what the administration is thinking. Hedge funds and private equity funds are hoping to keep Congress and Obama from taxing their investors like the rest of American workers, instead of letting them pay only 15 percent in taxes. (Did you notice how the Obama stimulus bill avoided that issue?) The French aeronautics firm Airbus is trying to make sure a huge U.S. government contract goes its way. The oil companies want to limit support for alternative energy sources. And so on.

Get the picture?

The nonlobbyists at Olgivy do. And you can bet they’ll keep the information flowing.

ACTION AGENDA

The first thing we must do is press for new legislation that requires

all

employees of lobbying firms who have any contact with a client—other than secretarial staff—to register as lobbyists and disclose who they are “advising,” just as the “official” lobbyists must do.

We need to know what these people are doing.

We should also require all members of Congress and all congressional staff to disclose all meetings with lobbyists and the purpose of the meeting. This can be done on a Web site established by each member and each committee.

New York’s Senator Kirsten Gillibrand pledged to list her full schedule in detail on her Web site; it was an admirable promise, but some reports suggest she’s now listing only public meetings. That defeats the purpose:

all

such meetings, including private conferences, should be listed.

We pay our representatives to do the people’s work. We have the right to know what they’re up to.

HOW SPECIAL INTERESTS CAUSE CATASTROPHE

THE SHEER CHUTZPAH OF COUNTRYWIDE FINANCIAL EXECUTIVES

In his classic best seller

The Joys of Yiddish

, Leo Rosten defined the word “chutzpah” as:

gall, brazen nerve, effrontery, incredible “guts,” presumption plus arrogance such as no other word and no other language can do justice to.

356

Is there any better description for the astounding decision by a number of former high-level executives at Countrywide Financial to set up a new business, Private National Mortgage Acceptance Company, known as PennyMac—a joint venture with the investment management firms BlackRock and Highfields Capital Management? PennyMac is buying “delinquent home mortgages that the government took over from other failed banks, sometimes for pennies on the dollar. They get a piece of what they can collect.”

357

PennyMac—even the name seems like a cruel insider joke. What does it stand for,

P

enny

M

ortgages

A

fter

C

ountrywide?

Countrywide Financial, of course, is the company blamed by many for the subprime mortgage crisis that detonated the current global financial meltdown. As the largest mortgage company in the United States, Country

wide lost $1.6 million in the final months of 2007 because of the huge number of mortgage defaults on its creative mortgages, which left hundreds of thousands of people unable to pay. During that same period, the company paid megamillion-dollar bonuses to its top executives.

And now the former architects of the Countrywide debacle are buying distressed mortgages from failing banks at the lowest possible prices, working out affordable deals with home owners, and making millions on them by turning around and selling the mortgages once again. But this time they’re selling

performing

mortgages, which, of course, are more valuable. They can easily make the mortgages work now. Why? Because they bought them for so little money and can afford to give the borrowers a good deal. For example, PennyMac recently bought $558 million of home mortgages from the FDIC, which acquitted the notes after the collapse of the First National Bank of Nevada. PennyMac paid $42.2 million, averaging 30 to 50 cents on the dollar. It keeps 20 cents on every dollar that it initially recovers, with an increase to 40 cents down the line.

358

So now some of the same Countrywide folks who benefited the most from the heady days of the precollapse mortgage market are now also benefiting from the traumatic downturn that Countrywide helped to create. Now, that’s chutzpah.

Commenting on PennyMac,

New York Times

columnist Gail Collins put it best: “It’s like Jeffrey Dahmer selling body parts to a clinic.”

359

PennyMac is headed by Stanford L. Kurland, who was president of Countrywide until September 2006. Kurland used to be the number two man at the company, second only to CEO Angelo Mozilo. Kurland is considered to be one of the architects of the creative mortgages at Countrywide. He escaped and sold $200 million worth of stock before the company crashed a few months later. He’s brought along some of his old pals: David M. Walker, the former chief lending officer for Countrywide Bank, a subsidiary of Countrywide Financial, who will be the chief credit officer at PennyMac; Mark P. Suter, the former chief strategy officer for Countrywide Bank, who will be chief portfolio strategy officer at PennyMac; and Michael L. Muir, the former chief financial officer for Countrywide Bank, who will be chief capital markets officer.

360

Kurland claims that he left Countrywide before the problems began and had nothing to do with the bad mortgages that destroyed the company. But

not everyone agrees with him. As Eric Lipton notes in the

New York Times

, “lawsuits against Countrywide raise questions about Mr. Kurland’s portrayal of his role. They accuse him of being at the center of a culture shift at Countrywide that started in 2003, as the company popularized a type of loan that often came with low ‘teaser’ interest rates and that, for some, became unaffordable when the low rate expired.”

361

The teaser rates at the beginning of a loan were sometimes even below 1 percent for adjustable-rate mortgages. According to a lawsuit filed by California attorney general Jerry Brown, “Countrywide obscured the negative effects—including rising rates, prepayment penalties and negative amortization—which would inevitably result from making minimum payments or trying to refinance. The company misrepresented or hid the fact that borrowers who obtained its home loans—including exploding adjustable rates and negatively amortizing loans—would experience dramatic increases in monthly payments.”

362

Many of the defaulted mortgage loans at Countrywide began with those teaser interest rates. When the interest rates suddenly increased dramatically, the home owners were, understandably, in no position to pay.

But that was then, this is now, and the PennyMac folks don’t look back. Instead, they’re aggressively focused on making money on the failed mortgages they own. According to the

New York Times

, the company has telemarketers working fifteen hours a day trying to speak to the overdue home owners whose mortgages they now own. The results range from a workout to the filing of a foreclosure for those who won’t play ball with them.

363

So it’s a good deal for PennyMac either way.

Kurland is highly optimistic about the future profits of his new venture. One of his partners, Jonathon S. Jacobson, a cofounder of Highfields Capital Management, seems to be looking forward to more mortgage losses to scoop us. Sounding rather like a vulture, Johnson told Reuters of the bright future he foresees for PennyMac: “whole loan losses have barely begun to materialize” so far, he says, but he expects the losses to soar over the next two to three years. When that happens, “PennyMac will be extraordinarily well positioned as both a buyer and servicer of these assets.”

364

Translation: As more banks and mortgages fail, PennyMac stands to make a killing.

Kurland and his team have even boasted that PennyMac can teach the

government a thing or two about how to solve the housing and financial crisis, calling their operation a “role model.”

365

Talk about chutzpah.

Too bad they weren’t thinking about becoming role models when they were luring in all those people who bought untenable mortgages during their tenure at Countrywide.