Eat the Rich: A Treatise on Economics (16 page)

Read Eat the Rich: A Treatise on Economics Online

Authors: P.J. O'Rourke

Tags: #Non-Fiction, #Business, #Humour, #Philosophy, #Politics, #History

After an hour the big guy shook his head. It couldn’t be fixed. Which was fine with me. The car smelled like dead crabs, and I’d get another one from FlubaTour at the hotel. But now I had a problem in diplomacy. My crowd of mechanics didn’t want to take any money. I could, I gathered with some translating help from a cabdriver, pay for the gasoline. Gasoline was hard to get. But as for working on the car, well, they hadn’t fixed it. But they should get some money for their time, I said. They shrugged. They looked at the ground. They were embarrassed, time being the only thing everyone’s got lots of in Cuba. It was with negotiating effort worthy of Jimmy Carter fishing for a Nobel Peace Prize that I managed to get their price up to fifty dollars.

Che Guevara believed that socialism would create a “New Man,” someone who worked not for personal gain but for the good of humanity in general. All the murders, imprisonings, harassments, and deprivations of Cuba have supposedly been aimed at creating this New Man—somebody who would act like the big guy. Except the big guy wasn’t one of them. He had a handmade sign hanging over his door:

PARKING

24

HOURS I CARE FOR YOUR CAR I DO SOME REPAIRS ON BICYCLES MOTORCYCLES AND CARS

, written, with obvious hope of future capitalist imperialism, in English.

TO BUSINESS MAJOR

TAKING ECON

101

FOR KICKS

After two years of wandering around in different economic locales, trying to look at various societies from an economic point of view, and generally poking my nose into other people’s business, I thought I should make another attempt to answer the question, “What am I talking about?” I went back to the books about economic theory and the college Econ texts, and even Samuelson’s dreadful

Economics.

And this time I was…still bored, I’m afraid. And I was still overwhelmed. But the tedium had become more interesting, if that makes sense. And my incomprehension was better informed.

Reading about economics after watching a lot of economic activity is like reading the assembly instructions after the Christmas toy has been put together. Certain significant patterns begin to take shape in the mind—even though the instructions are still gobbledygook and the toy doesn’t work.

I make no claim to understand economics. But I have begun to understand how economics is understood. This is how economics is understood after two semesters at most colleges:

I. There are a lot of graphs.

II. I’d better memorize them.

III. Or get last year’s test.

And this is how economics is understood after three drinks at most bars:

I. There are only so many things in the world, and somebody is taking my share.

II. All payment for work is underpayment.

III. All business is crime.

A. Retailers are thieves.

B. Wholesalers are pimps.

C. Manufacturers are slave drivers.

IV. All wealth is the result of criminal conspiracy among:

A. Jews.

B. Japanese.

C. Pirates in neckties on Wall Street.

That is also pretty much the way economics is understood by socialists. Perhaps the problems of socialism in this century have something to do with socialists stopping off for a snort before going to work running economies all over the world. Or maybe the socialists got fuddled by reading the works of professional economists. Here, for instance, is how economics is understood by followers of John Maynard Keynes:

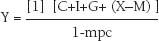

THE KEYNESIAN EQUATION—SHOWING THE RELATIONSHIP BETWEEN AUTONOMOUS EXPENDITURES AND THE EQUILIBRIUM LEVEL OF INCOME

Equilibrium level of income (Y) equals aggregate autonomous expenditures [Consumption (C) plus Investment (I) plus Government Expenditure (G) plus the total of Exports (X) minus Imports(M)] times 1 divided by the marginal propensity to save (mps) where mps equals 1 minus the marginal propensity to consume (mpc). Thus:

It’s hard to imagine applying the above formula to any ordinary economic question, e.g., should I put my bonus in a certificate of deposit or buy new stereo speakers?

When we look at economics in general terms, all of us—pirates in neckties, Albanians, Swedes, Cubans—are daunted. It’s worse than any tricycle from Santa. We feel as though we’re confronting an enormous piece of machinery that we can’t comprehend and don’t know how to operate. In fact, we feel like we’re being run through that machinery. We are wheat, rice, and corn being delivered to the Nabisco factory, and we’re going to come out the other end definitely toasted, possibly shredded, and, maybe, we hope, coated with sugar.

Yet, although this is how we feel, this is not how we behave. When we engage in any specific economic activity—when we buy, sell, mooch, or work—each of us acts as if he knows what he’s doing. Even Fidel Castro does. In July 1997,

Forbes

magazine estimated Castro’s net worth to be $1.4 billion.

So we do understand economics. We just think we don’t. And sometimes, unfortunately, we’re right.

Economists claim to study production, distribution, and consumption. But production requires actual skills and so can’t be taught by economics professors, because they’d have to know how to do something. And consumption is a very private matter. Consider the consumption of toilet paper, condoms, frozen pizza-for-one eaten straight out of the microwave in the middle of the night, and cigarettes in the carport when your spouse thinks you’ve stopped smoking. Therefore, economics tends to concentrate on distribution.

When economists say “distribution,” however, they mean the distribution of everything, not just the distribution of such finished products as the pizzas and the microwave ovens to thaw them. There is also the distribution of raw materials—the seeds and fertilizer needed to grow the pizza toppings and the petrochemicals necessary to make the wood-grain plastic laminates decorating the ovens. Then there’s the distribution of labor—the effort required to freeze the pizza and round up all the microwaves. And the distribution of capital—the money required to buy plastic laminates and market pizzas that taste like them. There’s distribution of ideas, too. (Whose idea was it to put pineapple chunks on a pizza?) And there’s even distribution of space and time, which is what grocery and appliance stores really sell us. They gather the things we want in a place we can get to on a day we can get there and, voilà, a fattening midnight snack.

All these things that get distributed are called “economic goods.” To an economist, anything is an economic good if it can be defined by the concept of “scarcity.” And the economist’s definition of scarcity is so broad that practically everything can be called scarce. Air is an economic good. If air gets polluted, we have to pay for catalytic converters and unleaded gasoline to make it breathable again. (And Woody Harrelson is reportedly opening an oxygen bar in Los Angeles.) Even if the air is free, we have limited lung capacity. The more so if we’ve been out in the carport huffing Camels. Air is an economic good for each of our bodies, and we hope that body is using the air economically—getting lots of O

2

into the bloodstream, or whatever, and not just making farts with it.

From an economist’s point of view, everything is scarce except desires. Random sexual fantasies are not economic goods. But if we try to act on them, they rapidly become economic (or highly uneconomic, as the case may be). Goods are limited; wants are unlimited. This observation leads economists to say that the fundamental purpose of economics is finding the best way to make finite goods meet infinite wants (though it never seems to work with random sexual fantasies).

While trying to make finite goods meet infinite wants, economists spend a lot of time mulling over something they call “efficiency.” Economists explain efficiency as being the situation where an economy cannot produce more of one good without producing less of another good. If you have two jobs, you’ve probably reached labor efficiency. You can’t put in more overtime on job A without putting in less overtime on job B or the child-welfare authorities will come. You’re efficient, although neither of your bosses may think so.

The example of efficiency that economists usually give is guns and butter. A society can produce both guns and butter, they say, but if the society wants to produce more guns, it will have to—because of allocation of resources, capital, and labor—produce less butter. Using this example you’ll notice that at the far reaches of gun-producing efficiency, howitzers are being manufactured by cows. And this is just one of the reasons we can’t take economists too seriously.

In fact, efficiency is a condition that’s never been achieved, as you’ve seen from watching your job A and job B coworkers. Economists don’t really know much about efficiency, and neither does anyone else. Doubtless the citizens of eighteenth-century England thought they were producing as many lumps of coal and wads of knitting as they possibly could. One more coal miner would mean one less stocking knitter. Then, James Watt invents the steam engine. Pretty soon, coal carts are hauling themselves, and knitting mills are clicking away automatically, and everybody has more socks and more fires to put wet, smelly stocking feet up in front of. Efficiency is constantly changing, and economists can’t keep up with this because they have to grade papers and figure out what Y equals.

One thing that economists do know is that the study of economics is divided into two fields, “microeconomics” and “macroeconomics.” Micro is the study of individual economic behavior, and macro is the study of how economies behave as a whole. That is, microeconomics concerns things that economists are specifically wrong about, while macroeconomics concerns things economists are wrong about generally. Or to be more technical, microeconomics is about money you don’t have, and macroeconomics is about money the government is out of. These two concerns seem hopelessly meshed in real life, and therefore I’ve tangled them together in this book.

Economists also make a distinction—for no good reason I can figure—between “inputs” and “outputs.” Inputs are the jobs, resources, and money we use in order to make the outputs we want, such as money, resources, and jobs. All outputs, even shit, heartbreak, and enormous illegal profits, turn out to be inputs: manure, movie plots, and capital investment in video-poker machines in Tirana.

Two additional unimportant economic terms are “supply” and “demand.” Scarcity has already explained these. There’s lots of demand and not much supply.

Economists measure supply and demand with curves on graphs. When the supply curve goes up, the demand curve goes down. But how true is this? Do I get less hungry because I know I have a freezerful of pizza? My experience with the microwave at 2

A.M

. argues otherwise. And can we really know how much people want something? The kid “really, really, really” wants a snowboard. Does he really want it? Or after three times falling on his butt at Mt. Barntop, is he going to leave the thing propped in the carport for the next twenty years? As for the supply curve, the concept of efficiency shows us that we don’t know how many snowboards can be produced, or how cheaply, and if we wait until next winter, they may be giving them out free with Burrito Supremes.

So far, from an examination of the basic principles of economics, we’ve learned that things are scarce. We knew that. Fortunately the less-basic principles of economics are more interesting.

TEN LESS-BASIC PRINCIPLES OF ECONOMICS

1. The Market Is Never Wrong

.

A thing is worth what people will give for it, and it isn’t worth anything else. If you have some shares of Apple Computer and you go into the NASDAQ market offering those shares for $1,000 apiece, you may be brilliant. Apple stock may be worth $1,000, easy. And all the NASDAQ customers may be idiots for buying Apple at a mere thirty dollars. A Macintosh is a much better computer than an IBM PC. But, smart as you are and dumb as everybody else is, the market says your shares didn’t sell. And the market is right.

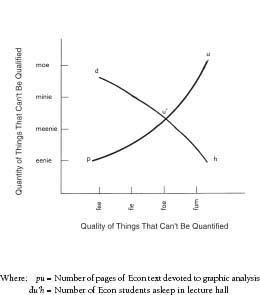

HOW TO READ A GRAPH

Also, a thing may be “priceless.” You’d rather die than trade your Macintosh for an IBM. But that’s still a price, albeit a very high one.

2. So You Die. Things Still Cost What They Cost.

It’s no use trying to fix prices. To do so, you must have a product that can’t be replaced, and you must have complete agreement among all the people who control that product. They’re greedy or they wouldn’t have gotten into the agreement, and they’re greedy so they sneak out of it. This is what was wrong with Paul Samuelson’s idea about crop restrictions in Chapter I, and this is why the members of OPEC are still wandering around in their bathrobes, pestering camels.

Any good drug dealer can tell you that to ensure a monopoly, you need force. To ensure a large monopoly, you need the kind of force only a government usually has. And it still doesn’t work.

*