Financial Markets Operations Management (32 page)

Read Financial Markets Operations Management Online

Authors: Keith Dickinson

CCPs will accept suitable assets with an appropriate haircut to cover initial margin calls. The Chicago Mercantile Exchange's clearing system (CME Clearing) will accept a variety of assets, known as Acceptable Performance Bond Collateral, including those shown in

Table 9.5

.

TABLE 9.5

CME â acceptable performance bond collateral

| Asset Class | Description | Haircut Applied |

| Cash | USD | 0% |

| Cash | AUD, GBP, CAD, CHF, EUR, JPY, NZD, NOK and SEK | 5% |

| Letters of credit (LCs) | LCs for performance bond (capped at 40% of core requirement) | 0% |

| US Treasuries | T-bills, T-FRNs, T-notes, T-bonds TIPS and T-strips | Depends on time to maturity, T-bonds: Â 0â1y @ 1% 1â3y @ 2% 3â5y @ 3% 5â10y @ 4.5% 10â30y @ 6% |

| Foreign sovereign debt | Canada, France, Germany, Japan, Sweden and UK | Depends on time to maturity, notes and bonds: Â 0â5y @ 6% 5â10y @ 7.5% 10â30y @ 9% >30y @ 10.5% |

| Foreign sovereign debt | Canada, France, Germany, Japan, Sweden and UK | Discount bills: Â 0â5y @ 5% |

| US equities | Shares from S&P 500 Index | 30% |

| Gold | Physical | 15% |

Source:

CME Group (online) “Acceptable Performance Bond Collateral for Futures, Options, Forwards, OTC FX and Commodity Swaps”. Available from

www.cmegroup.com/clearing/files/acceptable-collateral-futures-options-select-forwards.pdf

. [Accessed Thursday, 17 April 2014]

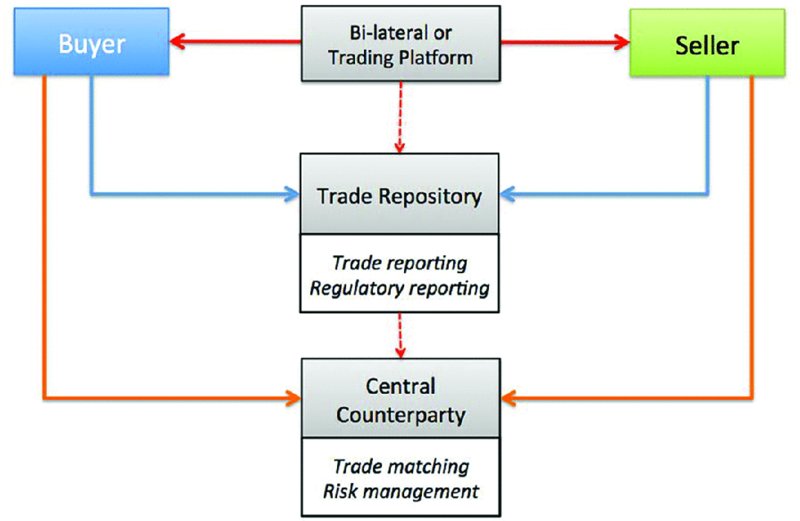

Following on from the requirement to report OTC derivatives contracts to a trade repository, there is the requirement to clear these contracts through a CCP. Clearing through a CCP is not a new concept; for example, LCH.Clearnet's SwapClear has been clearing OTC interest rate swaps since 1999.

10

Figure 9.6

illustrates the relationships in the trade and post-trade OTCD environment.

FIGURE 9.6

Trade and post-trade OTCD environment

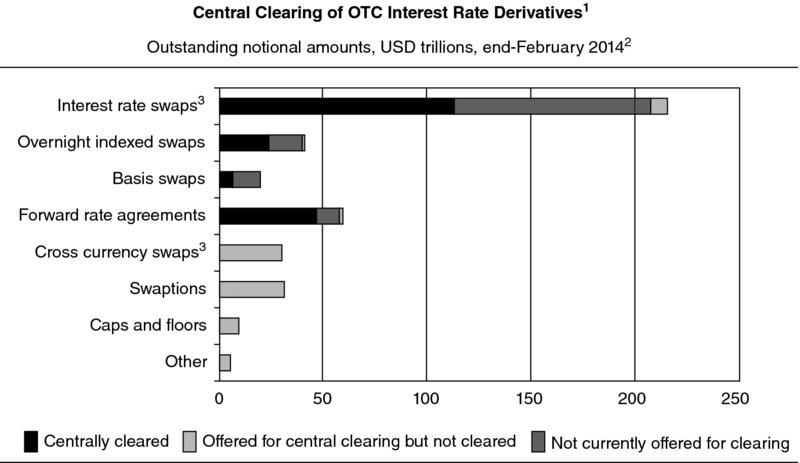

Although the expectation is that all types of OTCD are cleared centrally, the reality is that the more complex and complicated types are not currently offered for clearing. According to the FSB's April 2014 OTC derivatives markets reform progress report

11

, certain types such as swaptions and caps/floors are not offered for clearing whilst other types such as interest rate swaps have a high proportion that are cleared centrally (see

Figure 9.7

).

FIGURE 9.7

Central clearing of interest rate OTCDs

Sources:

DTCC; various CCPs; FSB calculations.

1

Estimate based on public trade repository information and present central clearing offerings of ASX, BM&F BOVESPA, CCIL, CME, Eurex, HKEx, JSCC, KDPW, LCH.Clearnet, Nasdaq OMX, SCH and SGX. Amounts cleared include transactions subject to mandatory clearing requirements in certain jurisdictions and those cleared voluntarily.

2

Adjusted for double-counting of dealers centrally cleared trades amounts reported to DICC by 16 large dealers.

3

Includes vanilla (>98% of total) and exotic (<2%Â of total) products as classified by DTCC.

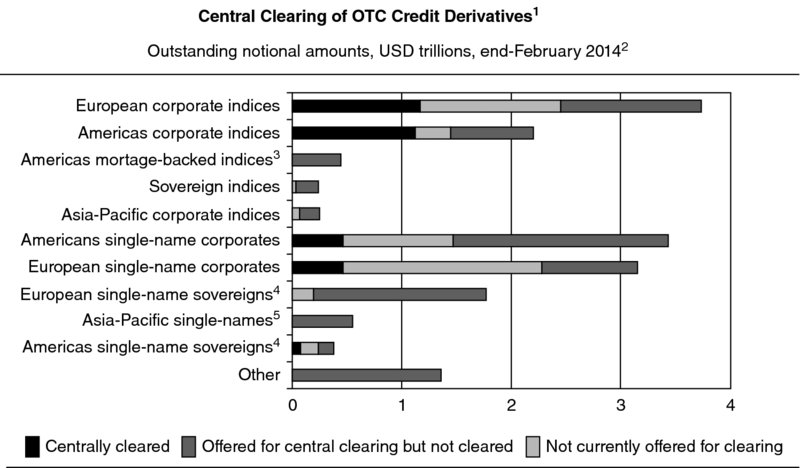

Furthermore, a higher proportion of OTC credit derivatives are not currently cleared centrally (see

Figure 9.8

).

FIGURE 9.8

Central clearing of credit OTCDs

Sources:

DTCC; various CCPs; FSB calculations.

1

Estimates based on public trade reapository information and present central clearing offerings of CME, Eurex, ICE Clear Credit, ICE Clear Europe, JSCC and LCH Clearnet. Amounts cleared include transctions subject to mandatory clearing requirements in certain jurisdictions and those cleared voluntarily.

2

Adjusted for doublecounting of dealers' centrally cleared trades and triple-counting of clients' centrally cleared trades; amounts reported to DTCC for all counterparties.

3

Includes both residential and commercial mortage-backed indices.

4

Includes sovereigns, sub-sovereign states and state-owned enterprises.

5

Includes corporates, sovereigns and state-owned enterprises for Japan, Asia ex-Japan and Australia/NZ.

In Section 9.2, we saw that one of the key market reforms was the trading of OTCDs on exchanges or electronic trading platforms, and that China, Indonesia and the USA have regulations in place that require organised platform trading. There are several types of trading platform, as defined by IOSCO,

12

and these are shown in

Table 9.6

.

TABLE 9.6

Trading platforms

| Platform Type | Definition | Definition Proposed By: |

| Broker crossing system (BCS) | A facility to assist the execution of client orders against other client orders and/or house orders. | European Commission |

| Designated contract markets (DCM) | DCMs are boards of trade (or exchanges) that operate under the regulatory oversight of the CTFC (USA). | CTFC (USA) |

| Multilateral trading facility (MTF) | An MTF is a multilateral system, operated by an investment firm or a market operator, which brings together multiple third-party buying and selling interests in financial instruments in a way that results in a contract. | MiFID (EU) |

| National securities exchange (NSE) | An NSE is a securities exchange that has registered with the US Securities and Exchange Commission under Section 6 of the Securities Exchange Act of 1934. | SEC (USA) |

| Organised trading facility (OTF) | An OTF is a facility or system operated by an investment firm or a market operator which, on an organised basis, brings together buying and selling interests or orders relating to financial instruments, whether discretionary or non-discretionary, excluding facilities or systems already regulated as a regulated market, MTF or systematic internaliser. | MiFID (EU) |

| Regulated market (RM) | An RM is a multilateral system operated and/or managed by a market operator, which brings together or facilitates the bringing together of multiple third-party buying and selling interests in financial instruments â in the system and in accordance with its non-discretionary rules â in a way that results in a contract, in respect of the financial instruments admitted to trading under its rules and/or systems, and which is authorised and functions regularly and in accordance with further provisions outlined in MiFID. | MiFID (EU) |

| Swap execution facility (SEF) or security-based SEF (SB-SEF) | An SEF (or SB-SEF) is a trading system or platform in which multiple participants have the ability to execute or trade swaps (or security-based swaps) by accepting bids and offers made by multiple participants in the facility or system, through any means of interstate commerce. | DoddâFrank Act (USA) |

| Systematic internaliser (SI) | An SI is an investment firm which, on an organised, frequent and systematic basis, deals on its own account by executing client orders outside a regulated market or a multilateral trading facility. | MiFID (EU) |

Source:

IOSCO (February 2011).

We have seen that all OTCD contracts should be reported to a trade repository (TR). This is the means through which regulators can access trade information as part of their management of systemic risk. The result is that reported trades will become as transparent as ETD transactions.

According to the FSB's 7th Progress Report, most of the member jurisdictions have operational TRs, with only a few not yet operational, as shown in

Table 9.7

.

TABLE 9.7

Operational trade repositories

| OTCD Type | Commodity | Credit | Equity | Foreign Exchange | Interest Rate |

| Operational | 18 | 18 | 17 | 20 | 22 |

| Not yet operational | Â 1 | Â 2 | Â 1 | Â 2 | Â 1 |

| Total: | 19 | 20 | 18 | 22 | 23 |

Source:

FSB (April 2014).

Most TRs are unique to one particular market (e.g. SAMA in Saudi Arabia) and others are more global. An example of this is the DTCC Global Trade Repository (USA), which has a presence in six markets (see

Table 9.8

).

13

TABLE 9.8

DTCC Global Trade Repository

| Name of Trade Repository | Market |

| DTCC Data Repository (U.S.) LLC | USA |

| DTCC Derivatives Repository Ltd., London | Europe |

| DTCC Data Repository (Japan) KK | Japan |

| DTCC Derivatives Repository Ltd., London | Hong Kong |

| DTCC Data Repository (Singapore) PTE Ltd | Singapore |

| DTCC Data Repository (Singapore) PTE Ltd | Australia |

Trade matching and risk management take place at the appropriate CCP, in much the same way as with ETDs above.

According to the FSB's 7th Progress Report, operational CCPs are as shown in

Table 9.9

.

TABLE 9.9

Operational CCPs

| OTCD Type | Commodity | Credit | Equity | Foreign Exchange | Interest Rate |

| Operational | 12 | 6 | 7 | Â 9 | 16 |

| Not yet operational | Â 0 | 1 | 0 | Â 4 | Â 0 |

| Total: | 12 | 7 | 7 | 13 | 16 |

Source:

FSB (April 2014).

No single CCP clears all five types of OTCD; some clear only one type and others clear up to four (see

Table 9.10

for examples).

TABLE 9.10

Types of OTCD cleared by CCPs

| OTCD Type | Commodity | Credit | Equity | Foreign Exchange | Interest Rate |

| Cantor Clearinghouse (US) | Yes | ||||

| ICE Clear Credit (US) | Yes | ||||

| BM&F BOVESPA (Brazil) | Yes | Yes | Yes | Yes | |

| Nasdaq OMX Stockholm (Sweden) | Yes | Yes | Yes  (not yet operational) | Yes |

Source:

FSB (April 2014).

All the CCPs are licensed in their own jurisdiction, with some being licensed, registered or holding an exemption in foreign jurisdictions (see

Table 9.11

for examples).

TABLE 9.11

Local/foreign registered CCPs

| CCP | Location | Authorities With Which CCP is Licensed |

| ASX Clear (Futures) | Australia | Local: ASIC and RBA Foreign: None |

| CME Clearing Europe | UK | Local: BoE Foreign: None |

| Eurex Clearing | Germany | Local: BaFIN and Bundesbank Foreign: BoE (UK) and pending with CFTC (US) |

| LCH.Clearnet Limited | UK | Local: FCA and BoE Foreign: CFTC (US), ASIC and RBA (both Australia) plus exemptions in Canada, Germany and Switzerland. |

Source:

FSB (April 2014).