Financial Shenanigans: How to Detect Accounting Gimmicks & Fraud in Financial Reports, 3rd Edition (11 page)

Authors: Howard Schilit,Jeremy Perler

Tags: #Business & Economics, #Accounting & Finance, #Nonfiction, #Reference, #Mathematics, #Management

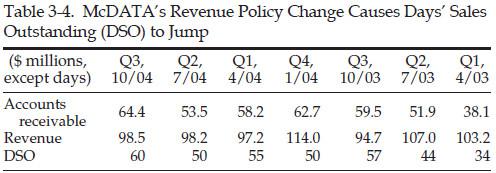

MCDATA’S CHANGE IN REVENUE RECOGNITION POLICY, 10/04 10-Q

Through the second quarter of fiscal 2004 McDATA had recognized revenue on distributor sales of non-configured products when proof of sell-through was obtained.

This was due to insufficient historical experience regarding returns or credits under price protection or inventory rotation rights. McDATA has been monitoring and tracking distributor returns and purchasing patterns since 2001. We believe we have obtained sufficient historical experience as of the end of the second quarter of fiscal 2004. Therefore, during the

third quarter of fiscal 2004 we began recognizing distributor revenue at the time of shipment

. [Italics added for emphasis.]

Seller Records Revenue, but Buyer Can Still Reject the Sale

The final part of the section will discuss revenue that is recorded prematurely even though product was shipped and received by the customer. This may occur if

(1)

the customer received the wrong product

(2)

the customer received the correct product, but too early, or

(3)

the customer received the correct product at the right time but still reserves the right to reject the sale

When a buyer has received a product but can still reject the sale, the seller must either wait until final acceptance to record revenue or recognize the revenue but record a reserve estimating the amount of anticipated returns.

Be Wary of Sellers Deliberately Shipping Incorrect or Incomplete Products.

Sometimes companies scheme to inflate revenue by intentionally shipping out the wrong product and recording the related revenue, although they know full well that the product will be returned. Not surprisingly, our friends at Symbol Technologies allegedly shipped incorrect product without customer approval. Similarly, at the end of the fourth quarter of 1996, Informix recorded a sale but failed to deliver the required software code prior to yearend. Then, in January 1997, Informix delivered a “beta” version of the software code that did not function with the hardware. It took the company another six months to deliver usable software code. As a result, Informix recorded revenue in the fourth quarter of 1996 rather than the third quarter of 1997.

Be Alert to Sellers Shipping Product Before the Agreed-Upon Shipping Date

. The fiscal quarter is coming to a close, and profits are sagging. What can a company do? Why not simply start shipping out merchandise and recording revenue, thereby boosting sales and profits? Merchandise is rushed out of the warehouse to customers toward the end of the year (even before the sales have taken place), and sales revenue is recorded. Since under this method, revenue is recognized when an item is

shipped

to retailers or wholesalers, some manufacturers may be tempted to keep shipping their products during slow times—even if the retailers’ shelves are overstocked. Automobile manufacturers have been doing this for years, thereby artificially increasing their sales. By shipping a product late in a quarter, rather than during the following quarter when a customer expects to receive it, a seller can improperly record revenue too soon. An increase in DSO can often be an indicator that a product was shipped late in a quarter.

Even if a company ships products to the actual customer and the customer receives them, the company still may not be permitted to recognize revenue. The final hitch involves terms in many contracts that give the customer an unconditional right of return for a specified period. The accounting rules require that revenue recognition be deferred until final acceptance or the expiration of the return period.

Be Mindful of Sellers Recording Revenue Before the Lapse of the Right of Return.

Many businesses permit the buyer a “right of return” if it is not satisfied with the goods. Companies are required to either delay revenue recognition until the right of return lapses or estimate an amount of expected returns and reduce revenue by that amount. If the amount of product being returned is in excess of the company’s plans or estimates, the company may be guilty of recognizing too much revenue up front.

4. Recording Revenue When the Buyer’s Payment Remains Uncertain or Unnecessary

Continuing our focus on the buyer, we turn our attention to the revenue recognition requirement concerning customer payment. The seller may be accelerating revenue recognition if it records sales when the buyer lacks the ability to pay (payment remains uncertain) or when the seller aggressively induces the sale by not requiring the customer to pay until long after the sale (payment remains unnecessary).

Buyer Lacks the Ability or the Necessary Approval to Pay

In earlier sections, we discussed the requirement that the seller complete its obligations and the requirement that a buyer convey final acceptance. At computer systems maker Kendall Square Research Corporation, all of that took place—the product was shipped, and the customer accepted it. The final question was whether the customer had the wherewithal and the intention to pay. Many of Kendall Square’s customers—mainly universities and research institutions—required a third party to provide the funds. In reality, the sale was contingent on the receipt of outside funding, and no revenue should have been recognized until such funding had been secured. In addition, Kendall Square provided customers with “side letter” agreements that essentially voided the sale if they failed to receive funding.

A shareholder lawsuit charged that nearly half of Kendall Square’s reported revenue in the first quarter of 1993 had been improperly booked. Most of this revenue came from shipments to the University of Colorado and the Applied Computer Systems Institute of Massachusetts before these customers had received the required funding. The company eventually restated its financial statements for fiscal 1992 and the first half of 1993, reversing approximately half of its previously reported revenue.

Another company that recognized revenue before its customers had secured the necessary financing was Stirling Homex Corporation, a manufacturer of completely installed modular dwelling units. Stirling sold homes to low-income buyers who had limited resources, most of whom obtained financing through the U.S. Department of Housing and Urban Development (HUD). Stirling improperly recorded revenue when HUD signed a preliminary commitment of funding, rather than waiting for the final approval. As a result, Stirling recorded revenue for certain customers who ultimately failed to receive financing. Thus, the financial statements that portrayed Stirling as a healthy, prosperous company with increasing sales and earnings in reality covered up the company’s serious business and financial problems.

Watch for Companies That Change Their Assessment of Customers’ Ability to Pay.

Management’s assessment of a customer’s ability to pay is what determines the estimates used to account for uncollectible receivables. Changes in these assessments may provide companies with a nonrecurring boost to revenue. Consider the revenue recognition policy change made by software company Openwave Systems in December 2005.

Openwave initially waited until the receipt of cash before recognizing any revenue from deadbeat customers that it feared would not pay. Under the new policy, Openwave was able to recognize revenue immediately simply by concluding that the customer no longer was a deadbeat.

Investors who noticed this subtle management change to accelerate revenue would have recognized that Openwave’s actual business grew more slowly than reported. Openwave’s change in policy indeed reflected its desperation. Revenue growth slowed dramatically in the following years, and Openwave’s stock price, which spent much of the March 2006 quarter above $20, plummeted to $6 in July. Diligent investors who reviewed the company’s December 10-Q would have easily spotted this change in the revenue recognition footnote, as shown here. However, investors who relied only on the company’s quarterly earnings release and conference call may have missed the boat, as those disclosures were less revealing about the change in accounting.

OPENWAVE SYSTEMS REVENUE RECOGNITION CHANGE

DISCLOSURE, 12/05 10-Q

As of the quarter ended December 31, 2005, the Company

revised its policy regarding the determination factor for deferrals of revenue recognition

for arrangements deemed not probable for collection. Prior to the quarter ended December 31, 2005, the Company continued to defer revenue recognition on arrangements originally deemed not probable for collection until the receipt of cash from that arrangement. As of the quarter ended December 31, 2005, the

Company revised its policy such that revenue on arrangements previously deemed not probable for collection, which are subsequently deemed probable for collection is recognized in the period of the change in the assessment of collectibility

, rather than upon receipt of cash, provided all other revenue recognition criteria have been satisfied. This change in policy did not have a material impact for the quarter ended December 31, 2005. [Italics added for emphasis.]

Seller Induces Sale by Allowing an Exceptionally Long Time to Pay.

Rather than using a third-party institution for financing, some cash-strapped customers use financing provided by the seller itself. Investors should be cautious about seller-provided financing arrangements (including very generous extended payment terms), as they may indicate the acceleration of revenue into the current period, tepid customer interest in the product, or the buyers’ lack of ability to pay.

Watch for Seller-Provided Financing.

To accelerate revenue in recent years, a number of high-tech companies lend money to customers to enable them to pay for their products. In moderation, customer financing can be considered a sound selling technique; when it is abused, however, it can be a dangerous way to do business. As the technology bubble burst, the amount of financing provided by telecommunication equipment suppliers to their customers should have made investors nervous. At the end of 2000, these suppliers were collectively owed as much as $15 billion by customers, a 25 percent increase in a single year.

Watch for Companies That Offer Extended or Flexible Payment Terms.

Sometimes companies offer sweet payment terms in order to entice their customers to purchase additional products earlier than normal. While offering favorable payment terms to customers may be a completely appropriate business practice, it may also add a level of uncertainty to the eventual collectibility of receivables. Moreover, even when extending terms to creditworthy customers, overly generous terms may effectively shift sales that originally were slated for future periods into the current one. This shift would allow for unsustainably high near-term revenue growth and produce pressure to fill the void created in that later period.

Be Wary of Extended Payment Terms on New Products

. To stimulate sales of new products, a seller may allow customers to pay over an extended period of time. However, sometimes a lengthy payment term makes investors question whether revenue was accelerated into an earlier period. For example, during the September 1995 quarter, Chicago-based software seller System Software, Inc., started offering customers extended payment terms of

up to 14 months

on its new product. By enticing customers to “buy” the new products, the company may have pulled future-period sales into the current period, artificially inflating revenue and profits.

Sound the Alarm When New Extended Payment Terms Are Disclosed and DSO Jumps.

Investors should be particularly concerned about accelerated (or even improper) revenue recognition when a company begins extending very generous payment terms and DSO spikes. The deck materials supplier Trex Company, for example, provided extended payment terms to customers under what it called an “early buy program” in late 2004 and early 2005. As demand declined, it seemed that Trex enticed customers to accept products earlier than normal (without having to pay for them). This arrangement had minimal impact on the buyers’ total purchases, but allowed Trex to record revenue in an earlier period. A CFRA report at the time stated that these extended payment terms might have been needed to avoid reporting disappointing sales growth.