MONEY Master the Game: 7 Simple Steps to Financial Freedom (11 page)

Read MONEY Master the Game: 7 Simple Steps to Financial Freedom Online

Authors: Tony Robbins

Right now, I’m betting, the primary “money machine” in your life is

you.

You might have some investments, but let’s say you haven’t set them up with income in mind. If you stop working, the machine stops, the cash flow stops, your income stops—basically, your financial world comes to a grinding halt. It’s a zero-sum game, meaning that you get back just what you put into it.

Look at it this way: you’re an ATM of another kind—only in your case, the acronym might remind you of that lousy “time-for-money” trade. You’ve become an

Anti–Time Machine.

It might sound like the stuff of science fiction, but for many of you, it’s reality. You’ve set things up so that you give away what you

value

most (time) in exchange for what you

need

most (income)—and if you recognize yourself in this description, trust me, you’re getting the short end of the deal.

Are we clear on this?

If you stop working, you stop making money.

So let’s take

you

out of the equation and look for an alternative approach. Let’s

build a money machine to take your place

—and,

let’s set it up in such a way that it makes money while you sleep.

Think of it like a second business, with no employees, no payroll, no overhead. Its only “inventory” is the money you put into it. Its only product?

A lifetime income stream that will never run dry

—even if you live to be 100. Its mission? To provide a life of financial freedom for you and your family—or future family, if you don’t have one yet.

Sounds pretty great, doesn’t it? If you set up this

metaphorical machine

and maintain it properly, it will hold the power of a thousand generators. It will run around the clock, 365 days a year, with an extra day during leap years—and on the Fourth of July, too.

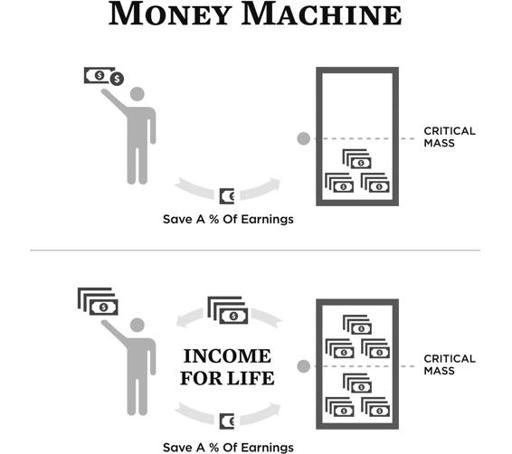

Take a look at the accompanying graphic, and you’ll get a better idea how it works.

As you can see, the “machine” can’t start working until you make

the most important financial decision of your life. The decision? What portion of your paycheck you get to keep. How much will you pay yourself—

off the top,

before you spend a single dollar on your day-to-day living expenses?

How much of your paycheck can you (or, more importantly, will you) leave

untouched,

no matter what else is going on in your life?

I really want you to think about this number, because the rest of your life will be determined by your decision to keep a percentage of your income today in order to always have money for yourself in your future.

The goal here is to enable you to step off the nine-to-five conveyor belt and walk the path to financial freedom. The way to start off on that path is to make this simple decision and begin to tap into the unmatched power of compounding. And the great thing about this decision is that

you

get to make it.

You

! No one else!

I can’t afford to waste my time making money.

—JEAN LOUIS AGASSIZ

Let’s spend some time on this idea, because the money you set aside for savings will become the core of your entire financial plan. Don’t even think of it as savings! I call it your

Freedom Fund,

because freedom is what it’s going to buy you, now and in the future. Understand, this money represents just a portion of what you earn. It’s for you and your family. Save a fixed percentage each pay period, and then invest it intelligently, and over time you’ll start living a life where your money works for you instead of you working for your money. And you don’t have to wait for the process to start working its magic.

You might say, “But Tony, where do I come up with the money to save? I’m already spending all the money I have.” We’ll talk about a simple yet extraordinary technique to make saving money painless. But in the meantime, let me remind you of my friend Angela, the one who realized she could drive a new car for half the money she was spending on her old car. Well, guess what she did with 50% of the money she was paying out? She put it

toward her Freedom Fund—her investment for life. When we started, she thought she couldn’t save anything; the next thing you know she was saving 10%. Then she even added an additional 8% from her savings on the cost of the car for short-term goals as well! But she never touches the 10% of her income that is locked in for her future!

In the end, it doesn’t matter how much money you earn. As we have seen, if you don’t set aside some of it, you can lose it all. But here you won’t just set it aside stuffed under your mattress. You’ll accumulate it in an environment you feel certain is safe but still offers the opportunity for it to grow. You’ll invest it—and, if you follow the Money Power Principles covered in these pages, you’ll watch it grow to a kind of tipping point, where it can

begin to generate enough in interest to provide the income you need for the rest of your life.

You might have heard some financial advisors call this pile of money a

nest egg.

It is a nest egg, but I call it your money machine because if you continue to feed it and manage it carefully, it will grow into a critical mass: a safe, secure pile of assets invested in a risk-protected, tax-efficient environment that earns enough money to meet your day-to-day expenses, your rainy-day emergency needs, and your sunset days of retirement spending.

Sound complicated? It’s actually pretty simple. Here’s an easy way to picture it: imagine a box you’ll fill with your investment savings. You’ll put money into it every pay period—a set percentage that

you

get to determine.

Whatever that number is, you’ve got to stick to it. In good times and bad. No matter what. Why? Because the laws of compounding punish even one missed contribution.

Don’t think of it in terms of what you can afford to set aside—that’s a sure way to sell yourself short. And don’t put yourself in a position where you can suspend (or even invade) your savings if your income slows to a trickle some months and money is tight.

What percentage works for you? Is it 10%? Or 15%? Maybe 20%? There’s no right answer here—only

your

answer. What does your gut tell you? What about your heart?

If you’re looking for guidance on this, experts say you should plan to save at least a minimum of 10% of your income, although in today’s economy many agree 15% is a far better number, especially if you’re over the age of 40. (You’ll find out why in section 3!)

Can anybody remember when the times were not hard and money not scarce?

—RALPH WALDO EMERSON

By now you might be saying, “This all sounds great in theory, Tony, but I’m spread thin enough as it is! Every penny is accounted for.” And you wouldn’t be alone. Most people don’t think they can afford to save. But frankly, we can’t afford not to save. Believe me, all of us can find that extra money if we

really

have to have it right now for a real emergency! The problem is in coming up with money for our

future

selves, because our future selves just don’t seem real. Which is why it’s still so hard to save even when we know that saving can make the difference between retiring comfortably in our own homes or dying broke with a tiny bit of financial support from the government.

We’ve already learned how behavioral economists have studied the way we fool ourselves about money, and later in this chapter I’ll share some of the ways we can trick ourselves into doing the right thing automatically!

But here’s the key to success: you have to make your savings automatic.

As Burton Malkiel told me during our visit, “The best way to save is when you don’t see the money in the first place.” It’s true. Once you don’t even see that money coming in, you’ll be surprised how many ways you find to adjust your spending.

In a few moments I’ll show you some great, easy ways to automate your

savings so that the money gets redirected before it even reaches your wallet or your checking account. But first, let’s look at some real examples of people living from paycheck to paycheck who managed to save and build real wealth even when the odds were against them.

DELIVERING MILLIONS

Theodore Johnson, whose first job was with the newly formed United Parcel Service in 1924, worked hard and moved his way up in the company.

He never made more than $14,000 a year, but here’s the magic formula: he set aside 20% of every paycheck he received

and

every Christmas bonus, and put it into company stock.

He had a number in his head, a percentage of income he believed he needed to save for his family—just as you will by the end of this chapter—and he committed to it.

Through stock splits and good old-fashioned patience,

Theodore Johnson eventually saw the value of his UPS stock soar to over $70 million by the time he was 90 years old.

Pretty incredible, don’t you think? And the most incredible part is that he wasn’t a gifted athlete like Mike Tyson or a brilliant director like Francis Ford Coppola—or even a lofty corporate executive. He ran the personnel department. But he understood the power of compounding at such an early age that it made a profound impact in his life—and, as it turned out, in the lives of countless others. He had a family to support, and monthly expenses to meet, but to Theodore Johnson, no bill in his mailbox was more important than the promise of his future. He always paid his Freedom Fund first.

At the end of his life, Johnson was able to do some beautiful, meaningful things with all that money. He donated over $36 million to a variety of educational causes, including $3.6 million in grants to two schools for the deaf, because he’d been hard of hearing since the 1940s. He also set up a college scholarship fund at UPS for the children of employees.

—

Have you heard the story of Oseola McCarty from Hattiesburg, Mississippi—a hardworking woman with just a sixth-grade education who toiled for 75 years washing and ironing clothes? She lived simply and was always careful to set aside a portion of her earnings. “I put it in savings,” she

explained of her investment philosophy. “I never would take any of it out. I just put it in. It just accumulated.”

Oh, boy, did this woman’s money accumulate.

At 87 years old, McCarty made national news when she donated $150,000 to the University of Southern Mississippi to start a scholarship fund.

This woman didn’t have the compelling screen presence of a Kim Basinger or the distinctive musical talent of a Willie Nelson, but she worked hard and knew enough to see that her money worked hard, too.

“I want to help somebody’s child go to college,” she said—and she was able to do just that, on the back of her good diligence. There was even a little left over for a small luxury item: she bought an air conditioner for her house.

All the way at the other end of the spectrum, we see the rousing example of Sir John Templeton, one of my personal role models and one of the greatest investors of all time. I had the privilege of meeting John and interviewing him several times over the years, and I’m including our last interview in our “Billionaire’s Playbook.” Here’s a little background. He didn’t start out as “Sir John.” He came from humble beginnings in Tennessee. John had to drop out of college because he couldn’t afford the tuition, but even as a young man, he recognized the incremental power of compounded savings.

He committed to setting aside 50% of what he earned,

and then he took his savings and put it to work in a big way. He studied history and noticed a clear pattern.

“Tony, you find the bargains at the point of maximum pessimism,”

he told me. “There’s nothing—

nothing

—that will make the price of a share go down except the pressure of selling.” Think about it. When things are going well in the economy, you might get multiple offers on your house and you’ll hold out for the highest price. In bull markets, it’s hard for investors to get a good deal. Why? When things are going well, it’s human nature to think they’re going to continue going well forever! But when there’s a meltdown, people run for the hills. They’ll give away their homes, their stocks, their businesses for next to nothing. By going against the grain, John, a man who started with practically nothing, became a multibillionaire.