The Battle for Gotham (33 page)

Read The Battle for Gotham Online

Authors: Roberta Brandes Gratz

Tags: #History, #United States, #20th Century

6.3 Gratz Industries today in Long Island City. Mural was painted by a local youth organization.

David Rosencrans

.

The proximity to Manhattan was critical to the location choice, since our customers are mostly Manhattan based. And Long Island City was filled with the kind of suppliers we used, minutes away as unanticipated needs arose during the manufacturing process. This complex and delicate assortment of seemingly unrelated businesses enables all to network easily among themselves. Even the gas station next door to our present location has found need for our services and we for theirs. Time is money in any business, and these critical connections make this delicate economic network work.

Taking the business out of New York never tempted Donald. Fully one-third of the district’s businesses moved from Manhattan.

10

The upholsterer moved to Long Island City, too. Several of the businesses from Thirty-second Street closed for good, years earlier than they otherwise would have. Others scattered. Several left the state. Some would have evolved into different businesses, if not fatally disturbed. Undoubtedly, some of them would have disappeared naturally as their markets dried up or they sold out to larger companies, but, as can be observed today in similar types of buildings, new businesses would have moved in. Furthermore, just because a business might eventually close doesn’t justify closing it down before its time and denying the business owner the opportunity to sell profitably to a subsequent owner or to reinvent the business.

Many companies manage to reinvent themselves, as

New York Times

economics editor Catherine Rampell has demonstrated. With a combination of “perseverance, creativity, versatility and luck,” she notes, many companies have survived, and some, like IBM, have transformed themselves many times. Few remember, as she points out, for example, that radio was pronounced dead in 1953 with the advent of television. “But the industry revitalized itself by tapping into new markets,” such as “the youth music market, congregating around the car radio . . . longer-form news and talk radio.”

11

Gratz Industries reflects this pattern, and our production assortment continues to evolve. Some of it stays the same, like the classic modern furniture and Pilates equipment. Some of it continues in a different form; the cast of architects, industrial designers, and sculptors changes. New markets open up, like interior work for hotels, high-end retail stores, and restaurants in New York and abroad. And who could have predicted a renewed interest in Modernist furniture, giving us an opportunity to again manufacture Modernist pieces long out of production, or the global spread of Pilates, with our equipment in demand from Sweden to South America to Russia?

Some materials, like bronze, or processes, like chrome plating, are too costly to offer easily. And some items are more cost-effective to outsource. But all of these are normal adjustments in any business. Yet the skills of our twenty-five or thirty workers—machinists, welders, benders, polishers—remain applicable, as adjustments come along. And our pay scale and health insurance—as in all manufacturing—are probably double the pay of chain-store retail or tourist industry services, the kind of businesses whose job-creation ability is overpromised by city officials. And unlike chain stores and hotels, our profits stay in the local economy.

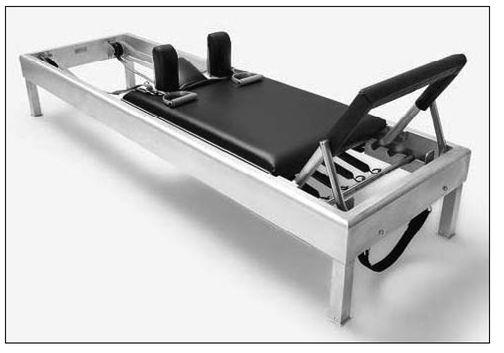

6.4 Pilates Classic Reformer is the primary piece of Pilates equipment. The whole Pilates line is now a major portion of our business.

Our employees mirror blue-collar New York. The city’s production workforce is 63 percent immigrant and 78 percent people of color, similar to ours. In classic manufacturing form, some employees come with one or no skills and learn new ones as they move along. A few have been with the company for ten, fifteen, even thirty years.

As the number of New York businesses employing these kind of workers diminishes, the opportunities disappear for blue-collar workers and the immigrants who keep coming. Yet these employees live in neighborhoods around the city, support local stores, send their kids to local schools, fill church pews, and volunteer in civic activities. They are not suburban commuters. They pay local taxes. None would find a place on Wall Street or in the tourist industry to which the city so heavily caters.

INDUSTRIAL SPACE IS BEING NIBBLED AWAY

In recent years, Long Island City has gone through a number of zoning changes that have eroded its status as the heart of industrial New York. City Hall and the Planning Department, through several administrations, have devalued and dismissed the importance of this district. Such a view can only be based on ignorance. Notes Professor Sassen, “City agencies don’t understand this aspect of the economy. Misunderstanding continues since the 1980s that we need only luxury office buildings. New York has steadily been getting rid of or shrinking industrial zones. They fail to distinguish between what can leave the city and what benefits from being in the city.” Sassen is a world-renowned economist known for her specialized knowledge and understanding of urban economies, with several books to her credit. She is called upon and listened to in cities around the globe, but the message she has been delivering to New York for several decades has fallen on deaf ears. She has repeated these messages many times over the years, noting years ago, for example, that the “ripple (or ‘multiplier’) effects of manufacturing in the regional economy are as much as one third larger than those of comparable service sector activities.” Her voice is not alone.

A 2003 report,

Engine Failure

, by the Center for an Urban Future and funded by the Rockefeller Foundation, suggested a dramatic shift by the city away from traditional FIRE (finance, insurance, and real estate) businesses, large-scale commercial properties, and policies that increase real estate costs and overwhelm small businesses with multiple permits and diminished services. A “doomed strategy,” the report labeled existing policies. And this was before the biggest wave of upzonings that priced out so many. While large firms shed jobs and small ones add them, New York “has become one of the worst environments for entrepreneurs and growing firms,” the report said.

What city shapers value in Long Island City and other industrial neighborhoods is the proximity to the East River waterfront with its views of the New York Harbor and Manhattan’s East Side. Real estate is king in New York. That manufacturing is “dying,” “dead,” or “going overseas” is the usual false justification for rezoning. Reality is more nuanced and not as simplistic. If you repeat an untruth often enough, however, and it gets repeatedly quoted in the press, the unknowing public believes it. The erroneous notion is promoted that space for industry is protected under the upzonings and through other nonzoning policies. Those other protections don’t work, however, and enforcement of the so-called protections is lax.

In fact, these planners cling to the pre-World War II idea of questionable validity that there is no manufacturing in the future of New York and only the FIRE and service (some say “servant”) economy is appropriate for the city. No matter how many times the city loses

all

the financial job gains of recent years each time it experiences a recession, officials continue to pursue an all-out effort to revive the same financial sectors and ignore the industrial. Often they cite amazing statistics for vacant industrial space, but it is always a lie. The lie is this: counted in those statistics are underwater and marshlands, airports and low-density space near airports, public transportation yards, water and sewer services, and solid waste disposal and other unusable sites. This becomes the rationale for a policy of continuous upzoning of industrial neighborhoods.

Upzoning, the method by which the local government increases what a developer can build, inevitably drives up the cost of industrial space. This is not rocket science; this process never fails. If you zone for high-rise development and offer incentives as well, it will happen. No comparable incentives exist for property owners to retain a manufacturing use

.

Predictably, slowly but surely, industrial space is being lost. As it diminishes, nibble by nibble, the cost of creative production in New York becomes increasingly prohibitive. The death of industry becomes a self-fulfilling prophecy. Long Island City is only one example.

A 1991 study of Long Island City commissioned by the Public Development Corporation under Carl Weisbrod and produced by planner John Shapiro describes in great detail its strength as an industrial area, identifies the threat posed by greater commercial development, and encourages retaining industry. Three major recommendations were made to spur new office development but reduce the risk to manufacturing:

• Upzone close to the subways and provide incentives to stimulate new office development in a concentrated and limited core.

• Invest in the subways, sidewalks, roadways, and open space to attract office tenants.

• Create more restrictive zoning in the industrial ring—“manufacturing sanctuaries”—to reduce real estate speculation, preserve space for manufacturing, and prevent the conversion pressures from spreading.

Adam Friedman, former head of the New York Industrial Retention Network whose mission is to assist the survival of the threatened industrial sector, endorsed these recommendations and added a few innovative ones as well. In an op-ed article in

Newsday

in 2001, Friedman suggested, “If a developer prefers to create a building without manufacturing uses, he could pay an assessment fee that goes into a fund to help manufacturers purchase their buildings, to subsidize their relocation or to encourage the development of new rental properties for manufacturers. Developers could also purchase the unused development rights on industrial properties in the surrounding areas, allowing them to build more in the core.”

12

Not unexpectedly, the city did (1) and (2) but not (3) and ignored NYIRN’s suggestions. Speculation that his article predicted is exactly what happened, clearly what the planners wanted. Manufacturers were priced out and continue to be. In addition, it actually hurt the commercial development by dispersing it beyond the core. Without density in the core, it was harder to attract restaurants, shops, and other desired amenities.

Friedman also wisely suggested creating a new “balanced mixed-use” district that would deny conversions to residential use if 50 percent of a block was already converted. Lots of less than six thousand square feet, he added, could be converted to residential. Those ideas as well were ignored. It seems that it’s okay for government to intervene to encourage office and residential development and give tax breaks to big box retailers, but it is beyond the role of government to preserve the conditions that foster manufacturing.

I, too, testified at that Planning Commission hearing on behalf of Gratz Industries. Picking up on some of Friedman’s ideas and adding some of my own, I said:

Create manufacturing sanctuaries. Assess new office or residential developments with a manufacturing retention fee. Assess, as well, current property owners whose property values will jump considerably. Use the money to help manufacturers either buy their building or underwrite the predictable rent increase that will follow your upzoning. Where possible encourage development of new manufacturing space but require its rent to be affordable in a manner similar to requirements of a percentage of new residential apartments be kept affordable.

Give incentives to manufacturers, like my husband, to retain their manufacturing business. This city knows how to offer gargantuan financial incentives to big new developments. Only modest ones are required here. And you know inevitably incentives will be offered to new development in this area. Why not offer it to those who don’t sell their industrial property for another use?

And why not think along the lines of farm trusts and land conservancies who buy the development rights from land to retain agriculture and open space? Gratz Industries would be the first in line to entertain such a proposal, one that would guarantee beyond our ownership that our space would remain industrial.

INDUSTRY NURTURED AND SUSTAINED NEW YORK

For its eighty years of existence, Gratz Industries has represented the kind of small, individualized manufacturing resource that once sustained New York. The city’s once-booming economy was almost entirely based on just this kind of small and medium-size manufacturer. Collectively, the city’s manufacturers produced a dizzying and endless array of goods shipped around the globe. Until the 1980s, even while the city was losing jobs, tax collections from industrial New York underwrote the bulk of the city’s budget for public services.

New York was never the classic smokestack city dominated by a single large industry like steel in Pittsburgh and Youngstown, automobiles in Detroit, Boeing in Seattle, rubber in Akron, or Kodak in Rochester. What heavy industry New York had was gone by the 1940s, notes sociologist and professor Robert Fitch, such as “chemical plants, slaughterhouses, animal-fat rendering plants.” Instead, small production and processing industries formed the bulwark of New York’s economy. As Fitch observes further: “The whole form of industrial life was practically invented in New York City. As early as the 1940s the city’s chief manufacturers were not producing standard, assembly-line products. . . . They were a bunch of little guys practicing ‘agglomeration’ economies—the cost savings that result from businesses locating next to each other . . . small inventories, design driven, relying on ‘external’ rather than ‘internal’ economies of scale. Instead of savings from long production runs, capital savings arise from not having to sink capital in expensive equipment available nearby.”

13