Unfair Advantage -The Power of Financial Education (5 page)

Read Unfair Advantage -The Power of Financial Education Online

Authors: Robert T. Kiyosaki

Tags: #Personal Finance, #unfair advantage, #financial education, #rich dad, #robert kiyosaki

In the introduction of

Rich Dad’s Prophecy

, I stated, “[Y]ou may have until 2010 to become prepared.” In spite of the warning, millions kept betting on the stock market and used their homes as ATMs (automatic teller machines), withdrawing money as the price of real estate went up. The book was actually written in 2001, yet my prediction for 2010 was pretty much on the money. I could not have made this prediction if I had not invested so much time on my financial education.

In 2006, at the height of the real estate boom, I was offered a real estate project for $260 million. The package was made up of five championship golf courses and a major 400-room luxury resort in Phoenix, Arizona, where we live. I did not buy the project. When I turned the project down, the seller said to me, “You’ll be sorry. In ten years, this package will be worth over $400 million.”

“I hope you’re correct, but the project does not make sense to me.” With that, I shut my brief case and left the room.

In 2006, I appeared on many programs, including a news segment with KTLA in Los Angeles, warning people that the market was about to collapse.

In 2006, Donald Trump and I published

Why We Want You to Be Rich

. The book was about the crash that was imminent and why the middle class would be wiped out. We began writing the book in late 2004. Our position was that poverty was about to increase. Millions in the middle class would move down the economic ladder. Given the choice between being rich or poor, we think being rich is better, hence the title of the book. Donald and I want you to be rich.

As you know, the market began to crash in 2007.

In 2008, with Wolf Blitzer sitting in for Larry, I went on CNN’s

Larry King Live

and predicted Lehman Brothers would go down.

In 2008,

Conspiracy of the Rich

was released. It was initially launched free as an online book. Writing

Conspiracy

was a trip because the book was being written as the world financial markets were crashing. The book is about the “Federal Reserve Bank,” which is not part of the federal government, has no reserves, and is not a bank. The Federal Reserve Bank was founded in 1913 and is the cause of the present financial crisis.

Conspiracy

also explained why this crisis is not just a financial crisis, why it is not an accident, and why it is not a new crisis. It has been brewing for years.

On September 15, 2008, as I predicted on CNN, Lehman Brothers filed for bankruptcy protection, the largest bankruptcy in U.S. history.

In 2009, the same 400-room luxury resort and five golf courses were again offered to us. This time Kim and I bought the package. Rather than pay $260 million, we paid $46 million, using pension-fund money to buy the property. The seller who wanted $260 million was bankrupt. The crash of 2007 made him poorer but was making us even richer. As stated in

Rich Dad’s Prophecy

, “[Y]ou may have until 2010 to become prepared.” Kim and I were prepared as deals began to float to the surface.

By 2010, a little over 20 years after starting her financial education in 1989, Kim personally had nearly 3,000 rental units. Her income per month is more than most people earn in years.

I continue to focus primarily on businesses, commercial buildings, oil wells, and my gold and silver mines. The mines were purchased in 1997 and 1999 for very little money because gold and silver prices were very low. We got great prices for those mines. After the mines were developed and proven to have large reserves of gold and silver, they were taken public through IPOs (initial public offerings) through the Toronto stock exchange, as prices of gold and silver climbed.

We also drilled for oil when oil prices were really low. Today, good economy or bad economy, people keep using oil, so we were not hurt in the crash. Most of Kim’s apartment units are in areas that produce oil, Oklahoma and Texas. As long as people use oil, people have jobs, and her apartments stay full. With their rent money, she buys more apartment houses.

Combined, Kim and I do very well and grow wealthier, even in a bad economy. On top of that, we earn more and pay even less in taxes, often paying zero taxes legally. This is the power of true financial education and the reason for this book. As Donald Trump and I stated in our book, “The middle class is disappearing. Given the choice between being rich or poor, we want you to be rich.” That is why financial education is important.

It’s Not Cool

As I shared at the beginning of this book, I thought long and hard about sharing with you our financial success, especially during this financial crisis. I know that millions of people have lost their jobs, their homes, and their businesses. I also know that it is not polite to talk about financial success in any situation. Bragging is never cool, especially about money.

Yet I decided to write about real-life investments. I want you to understand how we gained our financial education, how we use our education, and why it is an unfair advantage, especially in a declining economy. I write not to brag. I write to encourage people to learn, study, practice, and possibly see the world differently. There is a lot of money in the world. There are trillions of dollars looking for a home because governments of the world are printing trillions in counterfeit money, aka fiat currency. Governments do not want the world to go into a depression so they print more funny money. This is why the price of gold and silver go up and why savers are losers.

The problem is this phony money is in the hands of only a few people so the rich get richer, the poor and middle class grow poorer, the economy worsens, and the problem grows bigger.

In September 2010, poverty in America increased to nearly 15 percent of the population. This means that in less than a year, over 4 million people moved from the middle class into poverty, just as Donald Trump and I predicted. This is dangerous. This is not healthy.

At the risk of sounding like I was bragging, I decided to write this book about real-life investments. I believe it is uncool to know something and not share what I know. That would be greedy. I write because I believe we need real financial education before the world economy can truly recover. Ultimately, I write because I believe it is better to teach people to fish than to give people fish.

Poverty Sucks

Kim and I know what it feels like to be down and out, without money. Anybody who says, “I’m not interested in money,” is a moron. I can say from experience, “Poverty sucks.” In 1985, Kim and I were homeless for a short period, living in friends’ basements or spare rooms as we built our business. We moved many times. Kim should have left me, yet she pushed on, testing our commitment to achieving a better life together. I know she did not marry me for my money because I did not have any money. Once we began to have success with the process my rich dad taught me, we never stopped. Although the start was painful, the ups and downs of the educational process changed our lives into who we are today. Today we know: “Money does not make us rich. Knowledge does.” This is the power of real-life financial education and why knowledge is an unfair advantage.

What Is Unfair?

Since the stock-market crash of 1987, the world’s economy has gone through two major boom-and-bust cycles. Each boom and each bust made Kim and me stronger financially. In 1990 the economy was similar to 2010. Bad economies are great times to become rich. In 1990, during a very bad recession, Kim and I began our process of going from poor to rich.

The process has not changed. The only thing that changed is the number of zeros. Kim purchased her first investment property in Portland, Oregon, for $45,000. Again, I remind you, we had zero credit and most banks turned us down since we were self-employed and did not have steady jobs. To make matters worse, I had nearly a million dollars in debt dragging behind me. Interest rates were 9 percent to 14 percent for investors. On top of this, we had zero extra cash since all our extra cash was going into growing our international education company. I taught Kim what I knew about creative financing, and magically she came up with $5,000 to purchase the house (by having the seller help us find the credit for the mortgage). After acquiring the property, she earned $25 a month after all expenses, including the mortgage payment. In 1989, she was on her way. She was not rich, but her financial education had begun. It was no longer intellectual theory. It was real life.

Twenty years later, she and I purchased the $46 million resort with five golf courses, but Kim did most of the work. Again, the process is the same. She did not have the money, but she knew how to raise the money. The only change in the process is the number of zeros: $45,000 vs. $46,000,000. What increased was her financial education. Her real-life financial education was a long-term process of classes, seminars, study, reading, successes, failures, good times, bad times, crooks, con men, liars, cheats, mentors, bad partners, and great partners. As her knowledge increased, her confidence increased, risk went down, and the size of her investments increased. This is her unfair advantage today, and why she is qualified to write her book,

Rich Woman

, to encourage other women to take control of their financial future by gaining real-life financial education.

Why Were We Not Wiped Out?

FAQ

Millions of investors lost everything starting in 2007. How did you gain and not lose?

Short Answer

Financial education gave us the ability to not follow conventional financial wisdom.

FAQ

What did you know that others did not know? Why did you win even as the economy was crashing?

Very Short Answer

We kept playing

Monopoly.

Explanation

There are three priceless lessons in

Monopoly

. They are:

1st Lesson: Four green houses, one red hotel

The lesson is:

Start small. Dream big

. We both took classes and did small deals on weekends. We had a rule: We had to look at 100 properties before we bought one. With every deal we looked at, especially the bad ones, we got smarter. As you may know, most investments are bad investments, so you need to invest time looking for those rare great deals.

It doesn’t have to be real estate investing. It could be stocks, or a business. The lesson is that most people, especially men, jump into a market, create a big splash, and try to make a killing. Usually, they are the ones who are killed.

Give yourself at least five to ten years to learn and gain from experience. If you like real estate, start with real estate. If you like stocks, start with stocks. If you are interested in business, start in business. Know that you will make mistakes, so make small mistakes, learn, and keep dreaming big.

2nd Lesson: One house-$10, Two houses-$20, Three houses-$30

The lesson is:

cash flow

. More houses—more cash flow. Red hotel—extreme cash flow. In the world of money and financial education,

cash flow is the single most important word.

Cash is always flowing. It is either flowing in, or it is flowing out. For most people, they work hard and the cash flows out. True financial education trains you to have cash flowing in. Financially educated investors must know the difference between cash flow and capital gains. Most uneducated investors invest for capital gains. That is why amateurs say such things as:

“The value of my house went up.”

“The price of my stock went up so I sold it.”

“Do you think investing in the emerging markets is smart?”

“I’m investing in gold because the price is going up.”

“You should rebalance your portfolio.”

“My net worth has increased.”

“I invest in antique cars because they increase in value.”

Simply put, the people who lost during this financial crisis were people who invest primarily for capital gains. Most of them bet on the price of something going up. When the market crashed, their wealth crashed, and for many, their net worth went negative.

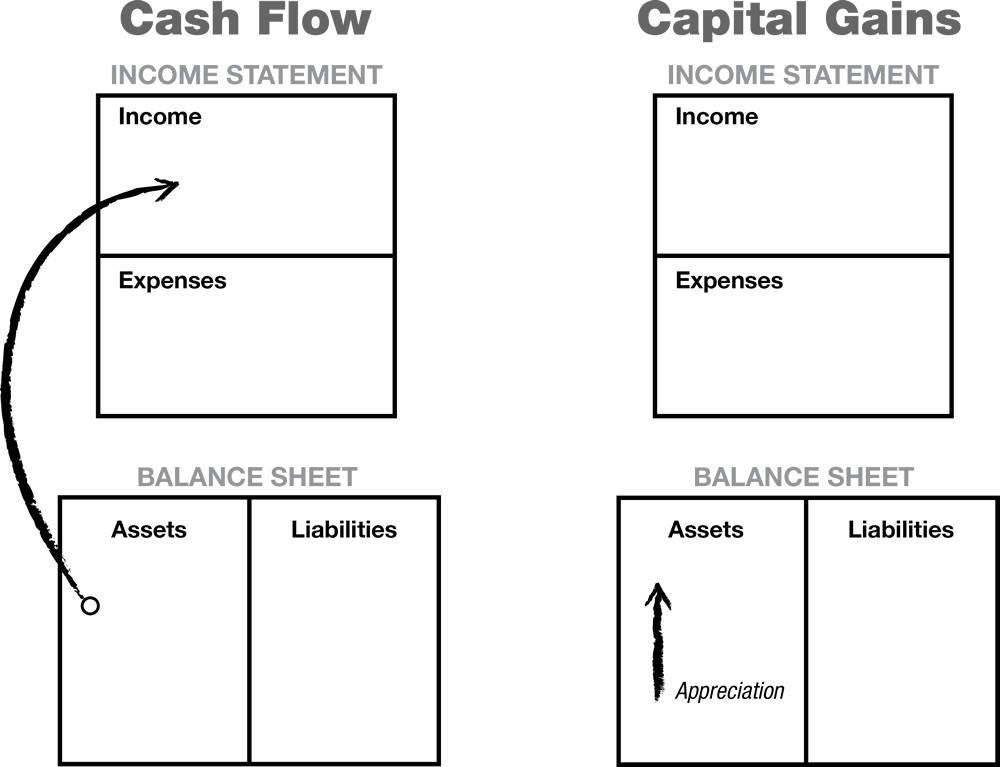

To make things very simple, the diagrams below illustrate the differences between cash flow and capital gains.