Financial Markets Operations Management (54 page)

Read Financial Markets Operations Management Online

Authors: Keith Dickinson

In this chapter we have seen the importance of making our financial activities “open and transparent” to our various stakeholders. This requires us to maintain appropriate records of our activities, which, in our business world, include details and cash movements associated with:

- Our securities and derivatives transactions.

- Our income (coupons and dividends).

- Corporate actions activities.

- Maintenance of our open positions through margin payments.

We also noted that processes do change from time to time, including the requirement to centralise OTC derivatives clearing activities. It remains to be seen whether the trading of OTC derivatives will migrate to exchange in the foreseeable future.

| Issue | Closing Price |

| Charisma Energy Services | SGD Â 0.0590 |

| DBS Group Holdings Ltd | SGD 17.3000 |

| Global Logistic Properties | SGD Â 3.2600 |

| Jardine Cycle & Carriage | SGD 34.4200 |

| Singapore Airlines | SGD 10.3000 |

Source

: Singapore Stock Exchange â Market Information (

www.sgx.com

).

Reconciliation

Irrespective of what part of the company you are involved with, you will always need to know what your positions are, whether they are securities-related or cash-related. A problem arises when the position that you think you have either does not exist or indicates a different amount to what you actually have. In other words, you need to be sure that the position you think you have does actually exist. In this chapter you will see why you need to know this and how we can achieve it.

After reading this chapter you will:

- Understand the importance of maintaining an efficient reconciliation system;

- Be able to compare the different types of reconciliation and evaluate their strengths and weaknesses;

- Be able to perform a reconciliation and assess the effectiveness of the operational unit responsible;

- Be able to describe the regulatory requirements;

- Be able to take a manual reconciliation process and design an automated system.

As an example of a potential problem, your records show that you have USD 1,000.00 in your bank account. You receive a bank statement showing a credit balance of USD 1,000.00. You then make a payment of USD 900.00 on the assumption that you have sufficient funds in your account.

Thinking that you have a credit balance of USD 1,000.00, you are surprised when you receive a subsequent statement stating that you are several hundred US dollars overdrawn. In addition to being overdrawn, you will be liable for overdraft interest. Why are you overdrawn? What has gone wrong on your bank account?

This is where a reconciliation would have been helpful. A thorough investigation would have shown, for example, that you had recently issued a cheque for USD 350.00 but failed to book it into your records. Had you done so, your records would have shown a balance of USD 650.00 (not USD 1,000.00), and it would have been clear that making the payment of USD 900.00 would have taken your account into debit (i.e. overdrawn).

The fact that the cheque had not cleared only made the situation worse, as you looked at the bank balance before deciding to pay the USD 900.00.

Accurate and timely reconciliation will ensure that both the Front Office and Operations will know, with a high degree of confidence,

what

their asset balances are and, just as importantly,

where

these assets are being held.

We can consider the concept of reconciliation from two points of view:

- Comparing our

internal

records (our ledger) with those of an

external

entity (e.g. a bank statement, depot statement, broker statement, audit request, etc.); - Comparing

ownership

of an asset (proprietary, client) with its

location

(bank, counterparty, custodian, etc.).

Table 14.1

shows an example of

internal

versus

external

cash records.

TABLE 14.1

Internal vs. external cash records

| Ledger (Our Nostro Account) | Â | Bank Statement (ABC Bank) | ||

| Opening balance | USD 80,000.00 | Â | Opening balance | USD 80,000.00 |

| Â | Â | Â | less Cleared item(s) | USD (5,000.00) |

| Closing balance | USD 80,000.00 | Â | Closing balance | USD 75,000.00 |

Both opening balances agree (USD 80,000.00 credit).

Your ledger closing balance does not agree with the bank statement. There is a reconciliation break that needs investigation.

Having identified the reason, you should take corrective action, depending on the cause (as shown in

Table 14.2

).

- Pass the correct entries;

- Reverse the incorrect value date and backdate to the date of the payment;

- Either request the payee to refund you and make the payment on the correct value date or, more likely, alter the value date;

- Make an investigation into the unauthorised payment, referring the case to a higher level of authority in your organisation.

Corrective actions (a) to (c) will result in a reconciled ledger/bank balance. However, with action (d), the first step might be to pass an entry over Sundry Payments (or other temporary account) so that the ledger reconciles with the bank during your investigations (see

Table 14.3

).

TABLE 14.2

Reconciled account â items (a) to (c)

| Ledger (Our Nostro Account) | Bank Statement (ABC Bank) | ||

| Opening balance | USD 80,000.00 | Opening balance | USD 80,000.00 |

| less Payment(s) | USD (5,000.00) | less Cleared items | USD (5,000.00) |

| Closing balance | USD 75,000.00 | Closing balance | USD 75,000.00 |

TABLE 14.3

Reconciled account with unauthorised payment â item (d)

| Ledger (Our Nostro Account) | Bank Statement (ABC Bank) | ||

| Opening balance | USD 80,000.00 | Opening balance | USD 80,000.00 |

| less Unauthorised payment | USD (5,000.00) | less Cleared items | USD (5,000.00) |

| Closing balance | USD 75,000.00 | Closing balance | USD 75,000.00 |

Table 14.4

shows an example of ownership versus location for securities.

TABLE 14.4

Reconciled bond position

| BNP 2.50% Bonds due 30 June 2025 | |||

| Ownership | Quantity | Quantity | Location |

| Trading desk | EUR 5,000,000.00 | EUR (5,000,000.00) | SGSS |

| Clients' accounts | EUR 150,000.00 | EUR (150,000.00) | BNYM |

| Totals: | EUR 5,150,000.00 | EUR (5,150,000.00) | Â |

In this example, the total ownership is split between our own assets (the trading desk's proprietary position) and those of our clients. The assets are located at two custodian banks (Société Générale Securities Services and Bank of New York Mellon).

What you have seen in the above examples are straightforward reconciliations of cash and non-cash assets. It is important to appreciate that the reconciliation process tends to compare the trade-dated position in the company's ledger with the actual (i.e. settled) position as recorded by the external entity (e.g. the custodian or bank).

In order to be more thorough, we must collect data that relate to the following:

- Non-cash assets

- Individual trades per asset;

- Traded position per asset (i.e. total of individual trades per asset);

- Trades that are open (i.e. traded but have not yet reached the intended settlement date);

- Trades that have failed to settle (i.e. trades that have reached the intended settlement date);

- Positions subjected to other movements (e.g. corporate actions and securities lending and borrowing activities);

- Trades that have settled;

- Settled position per asset (i.e. total of settled trades per asset).

- Individual trades per asset;

- Cash

- Items recorded as receipts by the company in its ledger but not credited by the bank, e.g. cheques received from clients but which the company has yet to pay in at the bank or, alternatively, credits still in the bank's clearing system.

- Items recorded as payments by the company in its ledger but not debited by the bank, e.g. cheques issued to a supplier which have not been presented for payment or have been presented but not yet cleared.

- Items deducted by the bank but not recorded in the company's ledger, e.g. bank charges which the company has yet to enter into the ledger.

- Items credited by the bank but not recorded in the ledger by the company.

- Items recorded as receipts by the company in its ledger but not credited by the bank, e.g. cheques received from clients but which the company has yet to pay in at the bank or, alternatively, credits still in the bank's clearing system.

We will take a look at some examples later in this chapter. In the meantime, we need to consider the different types of reconciliation, remembering that we are always comparing “our” position with “their” position.

There are five basic types of reconciliation, as shown in

Table 14.6

.

TABLE 14.6

Reconciliation types

| Type | Involves | Comments |

| 1. Trade-by-trade | Individual trades | Front Office positions vs. Operations' positions |

| 2. Traded position | Totals of trades recorded within a trading book/for a client | Front Office positions vs. Operations' positions |

| 3. Open trades | Individual trades | Operations' positions vs. custodian/broker/counterparty |

| 4. Depot position | Totals of securities positions held within a trading book/for a client | Operations' positions vs. custodian |

| 5. Cash position | Cash balances and movements within a nostro account | Operations' positions vs. custodian/bank |

Types 1 and 2 in

Table 14.6

are

internal

reconciliations that ensure the dealers' blotters agree with the settlement systems in the Operations Department.

Types 3, 4 and 5 are

external

reconciliations:

- Type 3 handles both the asset and the cash counter-value;

- Type 4 handles non-cash assets only;

- Type 5 handles cash only.

The reconciliation of a securities portfolio can be performed by reconciling all the securities as at the same date, e.g. 30 June. This is known as the

total count method

. This is the more usual, standard method used in most organisations.

There is an alternative method, known as the

rolling stock method

, where a particular security is reconciled on one date and other particular securities reconciled on other dates. However, all the securities have to be fully reconciled during a reasonable period, typically six months.

The Reconciliation Department must have systems and controls in place to mitigate the risk of missing one or more positions in the rolling stock method from occurring.

We will perform two reconciliations: the first a nostro (bank) reconciliation and the second a depot reconciliation.

Cononley Supplies Ltd has, today, received its bank statement, which shows the balance at the close of business on 31/MMM/YYYY as GBP 4,290.00. The accountant cannot understand this, as its own records indicate the balance should only be GBP 2,700.00.

We will prepare a bank reconciliation using our ledger (see

Table 14.8

) and the corresponding bank statement (see

Table 14.9

) to explain the difference(s).

TABLE 14.8

Ledger statement

| Ledger as at 31 MMM YYYY | |||||

| Date | Credits | Amount | Date | Debits | Amount |

| 01 MMM | Balance b/d | GBP 2,000.00 | 02 MMM | Purchases | GBP Â Â 400.00 |

| 08 MMM | V. Carlton | GBP 1,000.00 | 06 MMM | Purchases | GBP Â Â 200.00 |

| 11 MMM | T. Horton | GBP Â Â 750.00 | 10 MMM | Wages | GBP Â Â 500.00 |

| 28 MMM | B. Radley (a) | GBP Â Â 600.00 | 30 MMM | Utility bill | GBP Â Â 200.00 |

| Â | Â | Â | 30 MMM | Purchases (b) | GBP Â Â 350.00 |

| Â | Â | Â | 31 MMM | Balance c/f | GBP 2,700.00 |

| Â | Total: | GBP 4,350.00 | Â | Total: | GBP 4,350.00 |

TABLE 14.9

Bank statement

| Bank Statement as at 31 MMM YYYY | |||||

| Date | Details | Note | DR | CR | Balance |

| 01 MMM | Opening balance | Â | Â | GBP 2,000.00 | GBP 2,000.00 |

| 08 MMM | Cheque 01234 | Â | GBP (200.00) | Â | GBP 1,800.00 |

| 10 MMM | Cash | (c) | GBP (500.00) | Â | GBP 1,300.00 |

| 12 MMM | Insurance premium | (c) | GBP (300.00) | Â | GBP 1,000.00 |

| 13 MMM | Credit | Â | Â | GBP 1,750.00 | GBP 2,750.00 |

| 15 MMM | Cheque 01233 | Â | GBP (400.00) | Â | GBP 2,350.00 |

| 25 MMM | Credit | (d) | Â | GBP 2,150.00 | GBP 4,500.00 |

| 30 MMM | Electricity company | Â | GBP (200.00) | Â | GBP 4,300.00 |

| 31 MMM | Bank charges | (c) | GBP (10.00) | Â | GBP 4,290.00 |

| 31 MMM | Closing balance | Â | Â | Â | GBP 4,290.00 |

This is the procedure:

- Check that the opening balances of the ledger and the bank statement agree. In this example, they do and we can, therefore, proceed.

Tick off the entries which are common to both records. Note: a credit on the bank statement may be made up of a number of cheques received from various customers, e.g. on 13 MMM, the credit of GBP 1,750.00 was made up of cheques received from:

- V. Carlton    GBP 1,000.00

- T. Horton   Â

GBP Â Â Â 750.00 - Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â GBP 1,750.00

Also note that cheques are not necessarily presented for payment in the order in which they were issued, so you may have to search for common entries.

- V. Carlton    GBP 1,000.00

At most, you will be left with four sets of unmatched items. The letters (a) to (d) can be referenced back to the notes in the ledger and bank statement:

- Items recorded as receipts by the company in its ledger but not credited in the bank statement, e.g. cheques received from suppliers but which the company has yet to pay in at the bank or, alternatively, bank giro credits still in the bank's clearing system.

- Items recorded as payments by the company in its ledger but not deducted in the bank statement, e.g. cheques issued to a supplier which have not been presented for payment.

- Items deducted in the bank statement but not recorded in the ledger by the company, e.g. standing orders and bank charges which the company may easily forget.

- Items credited in the bank statement but not recorded in the ledger by the company.

Items (c) and (d) may, therefore, need entering in the ledger to bring it up to date. It is also possible, however, that (c) and (d) represent items credited or debited in error by the bank, which would need to be brought to the bank's attention.

The next step is to draw up a bank reconciliation statement, i.e. start with the bank statement balance and work towards the cashbook balance (see

Table 14.10

) by entering the unmatched items.

TABLE 14.10

Bank statement reconciled to ledger

| Bank Reconciliation Report as at 31 MMM YYY | ||

| Â | GBP | GBP |

| Balance per bank statement | GBP 4,290.00 | |

| (a) add items not credited | Â | GBP 600.00 |

| Â | sub-total: | GBP 4,890.00 |

| (b) less cheques not presented | Â | GBP (350.00) |

| Â | sub-total: | GBP 4,540.00 |

| (c) add back outgoings not entered into ledger: | Â | |

| Insurance premium | GBP 300.00 | Â |

| Bank charges | GBP 10.00 | GBP 310.00 |

| Â | sub-total: | GBP 4,850.00 |

| (d) less receipts not entered in the ledger as per bank statement | GBP (2,150.00) | |

| Â | Total: | GBP 2,700.00 |

The total of GBP 2,700.00 reconciles with the ledger balance carried-forward figure.

Conversely, we can draw up a bank reconciliation statement starting with the cashbook balance and working towards the bank statement balance (see

Table 14.11

).

TABLE 14.11

Ledger to bank statement

| Bank Reconciliation Report as at 31 MMM YYYY | ||

| Â | GBP | GBP |

| Balance per ledger | GBP 2,700.00 | |

| (a) less items not credited | Â | GBP (600.00) |

| Â | sub-total: | GBP 2,100.00 |

| (b) add cheques not presented | Â | GBP 350.00 |

| Â | sub-total: | GBP 2,450.00 |

| (c) less outgoings not entered into ledger: | Â | |

| Insurance premium | GBP (300.00) | Â |

| Bank charges | GBP (10.00) | GBP (310.00) |

| Â | sub-total: | GBP 2,140.00 |

| (d) add receipts not entered in the ledger as per bank statement | GBP 2,150.00 | |

| Â | Total: | GBP 4,290.00 |

The total of GBP 4,290.00 reconciles with the bank balance closing figure.

You manage assets for your client Threshfield Investors and you want to reconcile the depot positions against your client's custodian, Big Bank plc. (see

Table 14.12

).

TABLE 14.12

Depot reconciliation

| Asset | Depot Position | Custodian Position | Difference | Position Reconciles Y/N |

| BARC:LSE | 1,200 | 1,200 | 0 | Yes |

| BP:LSE | 400 | 600 | 200 | No |

| GSK:LSE | 200 | 200 | 0 | Yes |

| HSBA:LSE | 400 | 0 | â400 | No |

| RDSB:LSE | 100 | 100 | 0 | Yes |

| VOD:LSE | 2,400 | 1,200 | â1,200 | No |

It would appear that three positions do not reconcile (i.e. there is a reconciliation break). We need to investigate the reason why these breaks have occurred. For this we need more information. Investigations show that the transactions listed in

Table 14.13

have problems.

TABLE 14.13

Transaction problems

| Asset | Details | Quantity | Problem |

| BARC:LSE | Our purchase | 500 | CSEC |

| BARC:LSE | Our sale | 500 | USEC |

| BP:LSE | Our sale | 200 | Open trade |

| HSBA:LSE | Our purchase | 400 | CSEC |

| VOD:LSE | 1:1 bonus issue | 1,200 | Bonus shares not yet received |

CSEC: Counterparty does not have availability.

USEC: You do not have availability.

Please note that, even though the BARC:LSE position does reconcile (i.e. there is zero difference in

Table 14.12

), there are two outstanding trades that compensate each other (see

Table 14.13

).

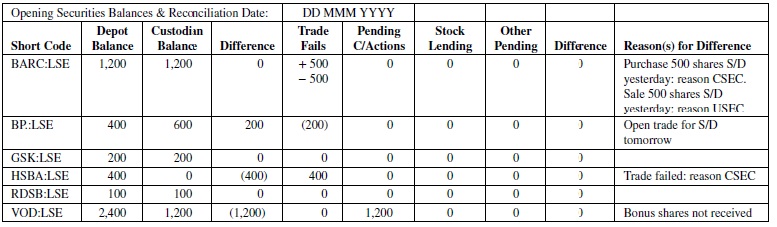

The complete reconciliation report is shown in

Figure 14.1

.

FIGURE 14.1

Securities Reconciliation Report

This portfolio does reconcile, although there are breaks that need to be chased in order to ensure prompt settlement. The expected receipt date for the bonus shares would already have been notified to the Corporate Actions Department.