Nolo's Essential Guide to Buying Your First Home (13 page)

Read Nolo's Essential Guide to Buying Your First Home Online

Authors: Ilona Bray,Alayna Schroeder,Marcia Stewart

Tags: #Law, #Business & Economics, #House buying, #Property, #Real Estate

BOOK: Nolo's Essential Guide to Buying Your First Home

8.11Mb size Format: txt, pdf, ePub

Aside from your available income, your lender’s main preoccupation will be with your credit history. Most lenders want to know whom they’ll be competing with to get your monthly dollars, how much you’re borrowing from those various sources, and how good you’ve been about paying money back in the past. You’ve probably undergone credit history checks before, like when you applied for a car loan or rented a new apartment.

Credit reporting bureaus exist to keep track of your borrowing habits. The three major companies are Equifax (

www.equifax.com

), Experian (

www.experian.com

), and TransUnion (

www.transunion.com

). They use a formula compiled by the Fair Isaac Corporation to calculate your “FICO” score (which we’ll call your “credit score”; but beware when you see this term other places, because anyone can compile a number and call it a “credit” score).

www.equifax.com

), Experian (

www.experian.com

), and TransUnion (

www.transunion.com

). They use a formula compiled by the Fair Isaac Corporation to calculate your “FICO” score (which we’ll call your “credit score”; but beware when you see this term other places, because anyone can compile a number and call it a “credit” score).

Managing your money is so easy!You just use your credit cards! You pay your

American Express with your Discover, your

Discover with your Visa, your Visa with your

MasterCard. Before they catch up with you,

you’re buried in a glorious crypt in Bel-Air!Camilla, character on TV series

The Naked Truth

Lenders use your credit score to decide whether to lend you money and, if so, how much and on what terms. If you’ll be financing your home jointly with others, the lender will look at each person’s credit score. Unfortunately, that means that if one of you has a low score, it will probably affect the terms of the loan offered to all of you. If any of you has serious skeletons in the financial closet, either clear out the closet, reconsider the joint purchase, or get creative with your financing strategies.

Getting Your Own Credit Report and ScoreThe best way to know exactly what prospective lenders will be looking at is to look at it yourself first. Federal law requires the three major consumer reporting companies (named above) to provide you with a free copy of your credit report once every 12 months.

CHECK IT OUTThe only authorized source for free credit reports:

Go to

www.annualcreditreport.com

. Other websites may advertise a “free report” but try to sell you something in the process. This site also links you directly to the websites for the big three reporting bureaus.

Being financially responsible left me with no credit history!

When Willow decided to buy her first house, she didn’t expect her lack of debt to create a problem. Willow explains, “I’d worked my way through school and taken out a student loan that I’d paid off almost immediately. And I’d always used a debit card instead of a credit card. As a result, I had to jump through all sorts of extra hoops, providing a letter from my old landlord showing that I paid the rent on time; showing records of my payments of phone bills, cable bills; and even having my parents add my name to their credit card account. (That last strategy worked faster than I expected—within one month, my credit score was the same as theirs.) Here I thought I’d been so good at controlling my finances, yet I discovered I’d been completely naïve when it came to creating a record of debt payments.”

It’s a good idea to ask all three agencies for your credit report. They sometimes have different information, and your lender may be looking at all three reports. You can do this simultaneously, but it means that you won’t be able to get another free report from any of them for another full year.

Federal law doesn’t require the agencies to give you your credit

score

, which is different from your report. You’ll probably have to pay extra to get the score (unless you live in a state like California that requires that consumers be given their scores for free when getting a mortgage). You can get your credit score either from the individual consumer reporting company websites or by going to

www.myfico.com

.

What Your Credit Score Meansscore

, which is different from your report. You’ll probably have to pay extra to get the score (unless you live in a state like California that requires that consumers be given their scores for free when getting a mortgage). You can get your credit score either from the individual consumer reporting company websites or by going to

www.myfico.com

.

When you get your credit score, it will be a number somewhere between 300 and 850—the higher the better. If your score is in the 700s, it’s considered pretty strong. Most people are in the 600s or 700s. A higher number tells the lender you pay your debts on time, have limited sources of revolving credit, and have an established record of using credit prudently, making you a good credit risk. A lower number means you look more risky—perhaps because you have enough revolving credit that if you maxed it all out you couldn’t pay all your bills plus a mortgage; you’ve missed payments in the past; or you’ve never used any credit source, so the lender doesn’t know what to make of you.

A low score doesn’t always mean no one will lend you money. But the lender will expect you to pay more for that privilege, probably in the form of higher interest. (If your credit is less than perfect, you can clean it up, as we’ll discuss below.)

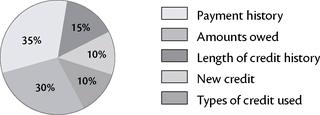

CHECK IT OUTWhat makes up a FICO score?

It includes your payment history (35% of the score), how much you currently owe (30%), how long you’ve been a borrower (15%), whether you have any new credit accounts (10%), and the types of credit you use (10%). To learn more, go to

www.myfico.com

, a Fair Isaac website for consumers.

What Makes Up Your Credit Score

Get ready: Your credit report may go on for

literally

pages and pages. Focus on making sure the most critical information is mistake-free, particularly these bits of data:

Correcting Credit Errorsliterally

pages and pages. Focus on making sure the most critical information is mistake-free, particularly these bits of data:

•

Name, Social Security Number, and addresses.

Especially if your name is a common one, you may have multiple aliases. And an address you don’t recognize may mean someone with the same name is incorrectly listed on your report.

•

Creditors.

Make sure you actually borrowed money from the creditors that appear, and that the amounts borrowed are accurate. Keep in mind that some types of loans, like student loans, can be sold or transferred. In that case, all creditors that have held the loan will appear, but the pre-transferred or sold accounts should no longer be designated “open.”

•

Open credit lines.

Make sure any lines of credit you’ve closed are no longer shown as open. Different reporting companies use different terminology, so if you’re not sure, call to clarify.

•

Collections and judgments.

Make sure any collections actions or judgments are reflected accurately.

•

Late payments.

These notations will usually indicate a late payment of 30, 60, or 90 days. Make sure they’re accurate.

Credit reporting mistakes happen frequently. Inaccuracies in the report affect your score, and if your score drops, so does the likelihood of you getting the best possible loan. You’ll want to spot and correct any errors before a lender sees your report, not after you’ve applied for a loan and been rejected.

All manner of mistakes are possible—from bits of credit history that aren’t yours to a false claim that you paid a bill late. To correct such errors, contact the reporting agency in writing. If all three agencies misreported the information, you’ll have to contact all three. Each agency may have a different procedure and forms to use for disputing the report. When you discuss issues over the phone, make sure to document conversations, including the date and name of the person you spoke with. Finally, if you have any documentation that supports your claim, send a copy with an explanatory cover letter.

The credit reporting agency has 30 days to investigate your complaint and give you its findings. If it can’t verify that its version of events is correct, the agency is supposed to remove the information from your file. If it won’t, you have the right to place a statement in your file giving your version of what happened.

Sometimes you can also work directly with your current and former creditors to correct inaccuracies or solve problems. If you’re willing to pay the disputed amount, or the creditor is willing to settle for a lesser amount—which it sometimes is—the creditor may also agree to clear the item from your credit history. Likewise if you have proof of an error, it may be faster to go directly through the creditor than to correct it through the reporting bureau.

CHECK IT OUTNeed help patching up your credit?

See

Credit Repair

, by Robin Leonard and John Lamb (Nolo). It offers plain-English explanations and over 30 forms and letters to help you negotiate with creditors, get positive information added to your credit record, and build a financial cushion.

Other books

A Tale of Two Vampires by Katie MacAlister

Gargoyle Knight: A Dark Urban Fantasy by Massa, William

Violence Begets... by Pt Denys, Myra Shelley

Words Unspoken by Elizabeth Musser

Talking to the Dead by Barbara Weisberg

Crash Into You by Roni Loren

Mystery of the Mixed-Up Zoo by Charles Tang

Deadly Ties by Vicki Hinze

His Christmas Captive by Caitlin Crews

SEALs of Honor: Cooper by Dale Mayer