Nolo's Essential Guide to Buying Your First Home (12 page)

Read Nolo's Essential Guide to Buying Your First Home Online

Authors: Ilona Bray,Alayna Schroeder,Marcia Stewart

Tags: #Law, #Business & Economics, #House buying, #Property, #Real Estate

BOOK: Nolo's Essential Guide to Buying Your First Home

9.94Mb size Format: txt, pdf, ePub

It makes sense that these four items have their own acronym, PITI, because for some homebuyers (usually those whose down payment is less than 20%), all four must be paid straight to the mortgage lender each month. The lender turns around and pays the appropriate party. The lender’s rationale is that if you don’t pay these bills (or your mortgage) and the lender gets the property, it doesn’t want to get stuck with your tax or insurance bill, too.

TIPPITI is paid differently when you buy a condo or co-op.

Instead of paying the lender, you may have to pay your community association or co-op board for your portion of the mortgage and real estate taxes (on a co-op), or for insurance on the jointly owned parts of the property (on either a condo or a co-op).

Added together, your total PITI may come to a lot more than your current monthly rent. That makes owning a home look like an expensive proposition. But it’s not an apples-to-apples comparison. First, remember that your mortgage payments typically reduce your loan principal, so your payment is building equity, not just going into a black hole. Second, your interest payments and property taxes are tax-deductible.

EXAMPLE:

Mieko and Lyle buy a house for $250,000, putting down $25,000 and financing the remainder with a mortgage. Not only are their monthly mortgage payments $1,350 a month, but the mortgage lender also collects $450 each month to pay their homeowners’ insurance and annual property taxes, for a total monthly payment of $1,800. The money for the tax and insurance bills is held in an escrow account, which the lender draws on to pay the bills when due. At the end of the first year, Mieko and Lyle will be able to deduct about $15,800 from their taxable income: $2,400 for property taxes and about $13,400 for interest paid on the mortgage.

Up-Front CostsMieko and Lyle buy a house for $250,000, putting down $25,000 and financing the remainder with a mortgage. Not only are their monthly mortgage payments $1,350 a month, but the mortgage lender also collects $450 each month to pay their homeowners’ insurance and annual property taxes, for a total monthly payment of $1,800. The money for the tax and insurance bills is held in an escrow account, which the lender draws on to pay the bills when due. At the end of the first year, Mieko and Lyle will be able to deduct about $15,800 from their taxable income: $2,400 for property taxes and about $13,400 for interest paid on the mortgage.

Until now, we’ve been talking about costs associated with the house itself. But you’ll also have to spend some pretty serious cash at the beginning to make the sale happen. (Sort of like paying first and last month’s rent.) Particularly if you’re trying to save up for a decent-sized down payment, you’ll need to plan for the following additional up-front costs:

Recurring Costs•

Closing costs.

An array of miscellaneous and sometimes aggravating charges—for everything from couriers to loan points (discussed below) to insurance premiums—are lumped into a category called “closing costs.” These vary across the country, but are usually 2% to 5% of the house purchase price. If you don’t have that much, you can often finance closing costs as part of your mortgage, but of course, then you pay interest on them.

•

Points.

Borrowers often agree to pay a “loan origination fee” or “points” to obtain a specific loan. Each point is 1% of the loan principal (so one point on a $100,000 loan is $1,000). Paying points can lower your interest rate, so you pay less in the long term. But you’ll probably need to pay the cash up front (although points can be amortized into your loan—meaning added on, with interest accruing).

•

Moving costs.

How high these will go depends on how far you’re moving, how much stuff you have, and whether you use a professional moving company.

•

Service setup costs.

You may have to pay fees to set up cable, phones, DSL, and similar services in your new home.

•

Emergency fund.

It’s a good idea (and sometimes a lender requirement) to have a couple months’ worth of PITI payments saved, in case something goes unexpectedly awry.

•

Remodeling costs.

If you buy a fixer-upper or a planned remodel, you might need thousands of dollars in cash early on, just to make the place livable. Estimate high for these expenses—they’re almost always more than anyone expected.

Yes, there’s more. Whether new or old, your house will need regular maintenance—gutters cleaned and trees trimmed regularly, a paint job every few years, new appliances when the old ones die, and so on. If you buy in a common interest development, your own maintenance costs may go down, but you’ll have to pay monthly dues and sometimes special assessments for unanticipated projects like resurfacing a damaged parking lot. While not part of your PITI, all of these expenses will affect your monthly cash flow.

TIPAdjust your deductions.

Once you know the details of your mortgage, work with a financial professional to change your withholdings to account for your lower tax liability, freeing up more money for other expenses.

Once you understand what you’ll be paying for, and that you’ll probably need a mortgage to make it happen, the obvious question is, how much can you borrow? To know that, you need to understand how lenders think. Just as you’re trying to get the best loan, lenders are looking for the best borrowers.

Without knowing you personally, lenders need some criteria to figure out how risky it is to lend you money. If you make your payments, they’ll turn a profit, either in interest or by selling your loan on the secondary market (more on that in Chapter 6). If you don’t, they’ll have to chase you down for the cash or sell the property to try to get it.

One of the criteria that lenders use is the comparison between your income and your debt load, called your “debt-to-income” ratio. They also look at your track record for paying previous debts, or your credit history, discussed below.

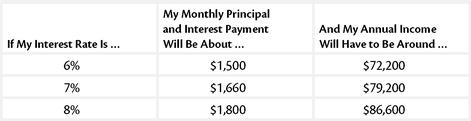

If You Get a Loan for $250,000 …Assuming you’re an average buyer (with about $450 per month in debt obligations) and you buy an average house (with average property taxes and insurance costs), here’s about what you can expect to pay on a $250,000 loan:

The concept of “debt-to-income ratio” isn’t as complicated as it sounds. The lender simply looks at your household’s gross monthly income, then makes sure that your combined minimum debt payments—for your PITI (including any community association fees), credit card, car, student loan, and others—don’t eat up more than a certain percentage of that amount. The idea is to make sure you have enough cash left over for your mortgage payment.

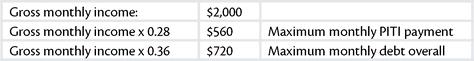

Maximum Acceptable Ratios: The 28/36 RuleHow high can your debt-to-income ratio go? Traditionally, lenders have said that your PITI payment shouldn’t exceed 28% of your gross monthly income, and your overall debt shouldn’t exceed 36%. (Your gross monthly income means the amount you earn before taxes and other monthly withdrawals, plus income from all other sources, like royalties, alimony, or investments.)

EXAMPLE:

Fernando and Luz have a gross annual income of $90,000 ($7,500 per month) and a moderate amount of existing debt. If they plan to spend 28% of their gross monthly income on PITI, they’ll pay $2,100 each month. Assuming they spend about $300 of that on taxes and insurance, they can borrow about $285,000 using a 30-year, fixed rate loan at 6.5% interest.

Fernando and Luz have a gross annual income of $90,000 ($7,500 per month) and a moderate amount of existing debt. If they plan to spend 28% of their gross monthly income on PITI, they’ll pay $2,100 each month. Assuming they spend about $300 of that on taxes and insurance, they can borrow about $285,000 using a 30-year, fixed rate loan at 6.5% interest.

Khanh and May also have an gross annual income of $90,000, but they’re debt-free, so they can spend 36% of their gross monthly income on PITI. Spending the same on taxes and insurance, they can borrow about $330,000 using a 30-year, fixed rate loan at 6.5% interest. With the same income but a higher debt-to-income ratio, Khanh and May can spend a lot more money on a house than Fernando and Luz.

Calculating Your Own Debt-to-Income RatioAll you need to figure out your own debt-to-income ratio is your combined gross monthly income figure plus that of anyone buying with you. This will tell you approximately what a lender will say you can afford to spend each month on a mortgage payment. See the sample Debt-to-Income Ratio Worksheet below.

CD-ROMYou’ll find a blank version of the “Debt-to-Income Ratio Worksheet” in the Homebuyer’s Toolkit on the CD-ROM included in this book.

Debt-to-Income Ratio Worksheet

CHECK IT OUTReady to run some numbers?

Online affordability calculators show how a traditional lender will use your debt-to-income ratio to set your maximum monthly mortgage payment. Find such calculators at

www.nolo.com/calculators

,

www.hsh.com

, and

www.interest.com

. Make sure any calculator you use factors in the amount of your down payment, your income and your debts, and your estimated taxes and insurance.

Other books

Torment by David Evans

Wild Flame by Donna Grant

Never Stopped Loving You by Keri Ford

OUTNUMBERED volume 1: A Zombie Apocalypse Series by Robert Schobernd

That's Not English by Erin Moore

Moon of the Terrible (Seasons of the Moon) by Reine, SM

Tailchaser's Song by Tad Williams

Some of My Best Friends Are Black by Tanner Colby

Quinn (The Beck Brothers #3) by Large, Andria

Turquoise Girl by Thurlo, David