Nolo's Essential Guide to Buying Your First Home (25 page)

Read Nolo's Essential Guide to Buying Your First Home Online

Authors: Ilona Bray,Alayna Schroeder,Marcia Stewart

Tags: #Law, #Business & Economics, #House buying, #Property, #Real Estate

BOOK: Nolo's Essential Guide to Buying Your First Home

6.5Mb size Format: txt, pdf, ePub

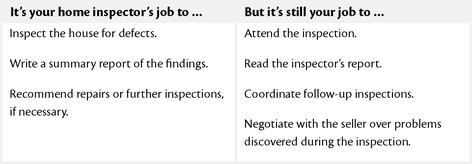

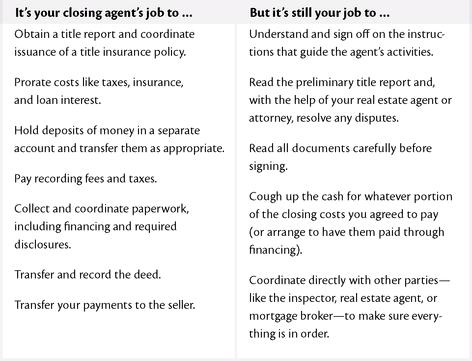

Who Does What

Home Inspector Interview QuestionnaireAsk potential inspectors the following questions, as well as anything specific to your situation, like whether the inspector has experience with historic or remodeled properties:Name of inspector and contact information (phone, email, etc.):Date of conversation:1. Do you work full time as a home inspector?2. How long have you been in the home inspection business?3. Are you affiliated with ASHI?4. How many home inspections have you done in the past year in this area?5. What kind of inspection report do you provide? Can I see an example?6. Do you have current, active liability insurance?7. What did you do before you were a home inspector?8. Can I accompany you on the inspection? Can I take photos or videos?9. Can you provide at least three names of recent clients who’ll serve as references?NOTES:Best Answers:1. Yes.2. The longer the better, but at least two years.3. Only acceptable answer is “Yes.” ASHI is the national organization with the most stringent professional standards.4. Should be a minimum of 15.5. Many inspectors have sample reports on their websites; you want as comprehensive report as possible, versus a short checklist. And you definitely want to see a sample report if there isn’t one on the inspector’s website.6. Only acceptable answer is “Yes.” Be sure to ask for a certificate of this compliance.7. Only acceptable answer is a building-related position, such as a contractor or building inspector.8. Only acceptable is “Yes” to the question of whether you can accompany the inspector. But whether you’ll be permitted to take photos or videos is a matter of the inspector’s own preference.9. Only acceptable answer is “Yes.”

Home Inspector Reference QuestionnaireHere’s what to ask the inspector’s references:Name of inspector:Name of reference:Date:1. How did you choose the inspector?2. Did you know the inspector before you worked together?3. What kind of inspection did you get and how much did it cost?4. Was the inspector responsive? Did the inspector return calls and emails promptly, follow through on promises, and meet deadlines?5. Did the inspector take the time to explain everything to you?6. Did you go along on the inspection? If not, why not? If so, how long did it take?7. What kind of report did you get?8. Are you happy with the home inspection services and report you got?9. Did the inspector keep you up to date, and explain everything in terms you understood?10. Would you work with the inspector again?OTHER COMMENTS:

A lot has to happen between signing the agreement to buy a house and closing the deal—it’s a process that usually takes at least a few weeks. You want to make sure that the house is in good shape, your financing is squared away, and that the seller doesn’t pull any surprises. And on the closing day, a number of documents need to be signed, and money transferred back and forth.

To take care of the many details, it makes sense to have a third party—in many states, a completely neutral third party—to make sure both of you are doing what you promised. That’s where the closing agent (sometimes called the “escrow agent,” “escrow officer,” “closing officer,” or “title agent”) comes in. Every state’s requirements for who can serve in this role are different. In states where attorneys handle the closing (such as Massachusetts and New York), you might not have one neutral intermediary, but instead two attorneys, yours and the seller’s, sharing the tasks.

Who Closing Agents AreEven though we call a closing agent a member of “your” team, the agent is really looking out for both you and the seller (unless you’re each using your own attorney). The closing agent acts as a check on both of you, to make sure you complete the transaction according to the terms of the purchase agreement. The agent usually works for a title or escrow company.

What Your Closing Agent Does for YouAlthough you may not meet your closing agent until you’re far into the purchase process—possibly until closing day—the agent will be working behind the scenes long prior to that. (You can meet your closing agent before then, if you want to—and if you have questions or envision some hairy complications, it’s a good idea to get in touch.) Expect your closing agent to:

How You’ll Pay the Closing Agent•

Arrange your title insurance.

The closing agent will order or perform (if he or she already works for a title company or is an attorney) a title search. The resulting report will show whether the seller is actually in a legal position to sell the property to you and whether any liens, easements, or other encumbrances affect ownership of the property (we’ll translate that gobbledygook in later chapters). After the seller clears up any title defects, the closing agent will help make sure you’re issued a title insurance policy.

•

Coordinate with lenders.

The closing agent is going to coordinate with two different sets of lenders: the seller’s lender(s), assuming the seller hadn’t already paid off the mortgage, and your mortgage lender(s). The closing agent will make sure the seller’s lenders are paid in full when the property is sold.

•

Establish an escrow or trust account.

The closing agent will keep any money you deposit in a separate bank account, called an escrow or a trust account, until the closing date, when the money will be transferred to the seller. The seller may also agree to deposit money there, for repairs. In states where both parties are represented by attorneys, the seller’s attorney opens this account.

•

Prorate expenses.

The closing agent will figure out who, between you and the seller, pays what proportion of any tax, interest, and insurance payments owing or paid during the time period around the sale.

•

Follow instructions.

The closing agent will follow written instructions prepared by you and the seller and make sure that all these tasks are accomplished by the date of closing.

•

Record the deed and pay the seller.

At the closing, the agent will transfer payment to the seller. Afterward, the closing agent will publicly record the new deed that transfers the property to you.

The closing agent is paid a fee that’s included in closing costs. In some locations, it’s customary for the buyer to pay the fee; in other locations, the seller; and elsewhere the fees are split. Your real estate agent should know the local custom, though you and the seller can negotiate something different.

Getting the Best Closing Agent Out ThereWho chooses the closing agent depends on local custom and how strongly you, as the buyer, feel about having a voice in the matter. The choice of a closing agent is usually made early on and spelled out in the purchase agreement. Often the closing agent is someone either the buyer’s or seller’s real estate agent knows, however. If you want to use a particular company or individual, mention it to your agent at the outset so it can be included in your offer.

Who Does What

TIPChoose a closing agent who’s conveniently located.

You’ll have to drive there at least once, for the closing, and maybe more often, for example, to sign a power of attorney or deliver an old divorce decree.

Other books

The Law of Becoming: 4 (The Novels of the Jaran) by Elliott, Kate

Choices by Ann Herendeen

Immortal Beauty by Thomas McDermott

Flower for a Bride by Barbara Rowan

GypsyDukeEpub by Unknown

High-Risk Fever by Lea Bronsen

Across The Sea by Eric Marier

The Guardians of the Halahala by Shatrujeet Nath

The H.D. Book by Coleman, Victor, Duncan, Robert, Boughn, Michael

Refund by Karen E. Bender