Nolo's Essential Guide to Buying Your First Home (27 page)

Read Nolo's Essential Guide to Buying Your First Home Online

Authors: Ilona Bray,Alayna Schroeder,Marcia Stewart

Tags: #Law, #Business & Economics, #House buying, #Property, #Real Estate

BOOK: Nolo's Essential Guide to Buying Your First Home

9.59Mb size Format: txt, pdf, ePub

You can’t be certain of the interest rate and the exact terms of your mortgage until you’ve selected and applied for it. But knowing what affects the rate will help you view all options with a critical eye.

All About PointsNo, this isn’t some obscure score in the homebuying game. A point is a loan fee equal to 1% of the principal on the loan (so one point on a $100,000 mortgage is $1,000). Points are added to the cost of some mortgages in exchange for a lower interest rate. You probably won’t be offered more than two or three points on a loan, because the lender would have to significantly reduce your interest rate to make it financially beneficial to you.

Since points are paid up front, they’re a major source of immediate profit for the lender, and if your loan is resold on the secondary market, points are often the

main

source of the lender’s profit. That doesn’t mean they’re bad for you—in fact, the lowered interest rate means it’s often beneficial to get a loan with points, particularly if you have the cash, are planning to stay in your place for awhile, and don’t plan to refinance soon. (You may

need

the lower interest rate, because you don’t qualify for a loan at the higher rate.) If you want to pay points but don’t have the cash up front, you may be able to amortize the points into your loan. That means they’ll be added to the principal and paid off over the life of your loan. Of course, that also means you’ll be paying interest on that money.

main

source of the lender’s profit. That doesn’t mean they’re bad for you—in fact, the lowered interest rate means it’s often beneficial to get a loan with points, particularly if you have the cash, are planning to stay in your place for awhile, and don’t plan to refinance soon. (You may

need

the lower interest rate, because you don’t qualify for a loan at the higher rate.) If you want to pay points but don’t have the cash up front, you may be able to amortize the points into your loan. That means they’ll be added to the principal and paid off over the life of your loan. Of course, that also means you’ll be paying interest on that money.

EXAMPLE:

Kelly and Brit need a $450,000 mortgage. They have two options, both 30-year fixed rates: one at 7.5% interest with no points, and one at 7% interest with two points.

Kelly and Brit need a $450,000 mortgage. They have two options, both 30-year fixed rates: one at 7.5% interest with no points, and one at 7% interest with two points.

If they take the first loan, their monthly principal and interest payments will be approximately $3,146. If they keep this house and loan for 30 years, they’ll pay about $682,722 in interest, plus the $450,000 principal, for a total of about $1.13 million.

With the second loan, Kelly and Brit are going to have to cough up $9,000 right away, to pay the points. Their monthly payments will be $2,994—around $150 less per month. Over the life of the 30-year loan, they’ll pay around $636,791 in interest and points, which, plus the $450,000 principal, comes to about $1.09 million. The second loan offers them a long-term savings of almost $46,000.

But what if they don’t keep the house for the full 30 years? If they decide to take the loan with points but a lower interest rate, it will take Kelly and Brit a long time before their lowered interest makes up for the $9,000 they paid. To figure out how long, they divide the $9,000 in points by the $150 in monthly savings. The answer is 60 months, or five years.

As you can see in the example, if Kelly and Brit choose the loan with two points and then stay in their place for more than five years, they’ll start to see some serious savings. On the other hand, if two years after choosing the loan with points, they decide that the cottage that seemed so charming is actually too small for their two dogs and three cats, they will, upon selling, say goodbye to the extra money that they spent by taking the loan with points ($5,400, because they’ve recouped $3,600 of the originally $9,000 in the first two years, when their monthly mortgage payments were $150 less). It sort of makes that loan … pointless. Not exactly, but you get our bad joke. The longer you plan to stay, the more seriously you should consider a loan with points.

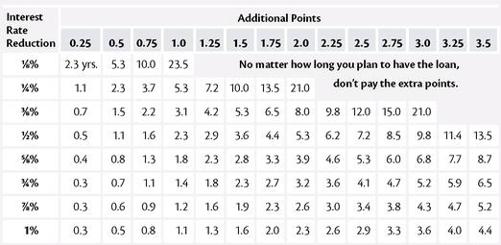

To do this calculation with your own numbers, use the table below or an online mortgage calculator.

When to Pay Additional Points for a Lower Interest Rate

Use this chart to determine how many years you should stay in a house to recoup the cost of points.

CHECK IT OUTReady to run some numbers?

These websites have calculators that allow you to figure out whether a points or no-points loan works best for you:

If you’re not sure how long you’ll stay in a place, you may just have to guesstimate. If you want flexibility and think it’s possible you’ll move in the next few years, get a no-points loan. But if you expect to stay put for awhile, a loan with points might be worth it. And if you hate guessing, you can also compromise—points aren’t all or nothing. There are many choices between zero points and several (broken down by eighths of a percentage point, even).

A final advantage to points it that they’re tax-deductible in the year you pay them. In slow markets, sellers sometimes pay for points as an incentive to the buyer, and you can even deduct those. In the first year, when money is tight, this might be a significant advantage.

Watch Out for Prepayment PenaltiesMany loans come with prepayment penalties, which don’t permit you to pay your debt off early without paying a fee. Read loan terms carefully—this may be buried in the fine print. (It will also be included on your Truth in Lending (TIL) disclosure statement, a form your lender is required to give you.) Prepayment penalties can limit your flexibility to refinance or sell your home—a particular drag if interest rates drop.Many loans with prepayment penalties limit the length of time you’re bound by this restriction (usually five years or less), limit the amount of the penalty (state laws often impose these limits), or make exceptions for refinancing or selling the property. Still, prepayment penalties are usually worth avoiding altogether.

There are two major players in the mortgage game, both of whom can help you get the loan you need. You may work with a mortgage broker, who will help you find the best available mortgage from among a variety of lenders. Or you may go straight to a lender (sometimes called a mortgage banker), which will probably mean fewer options, but possibly a better deal. For more information on choosing a mortgage broker or lender, look back at Chapter 5.

Narrowing the Field: Which Type of Mortgage Is Best for You?Mortgages come in two basic flavors: fixed rate mortgages and adjustable rate mortgages (also called ARMs). There are many variations on these two types, and some are better for certain kinds of buyers than others. Though you’ll discuss your unique situation with your broker or lender, you can first educate yourself about the options.

CHECK IT OUTMortgages have their own lingo—use the following glossaries if you need help decoding:•

www.mtgprofessor.com

(click “Glossary”)•

www.bankrate.com

(click “Glossary”)•

www.fanniemae.com

(under “For Home Buyers & Homeowners,” click “Resources,” then “Key Mortgage and Foreclosure Terms”).

If you like predictability and stability, you’ll probably like fixed rate mortgages. The interest rate is set when you get the loan and never changes. If you borrow $250,000 at 6% interest, you’ll continue to pay 6% interest until you’ve paid off the loan.

TIPDespite the fixed rate, you’re not actually paying the same amount of interest each month.

That’s because in the early years of your loan when the principal is at its largest, you technically owe more interest. But the lender calculates your payment so it’s the same amount each month (the loan is “amortized”). The way amortization shakes out, the interest you owe makes up a greater portion of your early monthly payments. As you gradually start to reduce the principal, less interest accrues, and so more of your payment goes to reducing principal.

Beyond buyers who crave predictability, fixed rate mortgages are good for those who want to stay put long term, particularly if interest rates are low. Even if interest rates go sky-high, you’ll have a fixed rate you can live with. You pay a premium for this stability, because fixed rate mortgages usually have higher starting interest rates than ARMs. That protects lenders who are stuck giving you a nice low rate for the full term of the loan, even when interest rates increase and other buyers are paying them more.

A drawback of fixed rate mortgages is that they aren’t usually assumable. That means that if someone buys your house before it’s paid off, taking over your mortgage payments isn’t an option. The buyer will have to get a new mortgage, choosing from what’s then available. Most buyers expect this, but assumable mortgages can, in certain markets, make your house more saleable.

The Gold Standard: 30-Year FixedUntil pretty recently, the ultimate in predictability and stability was the 30-year fixed rate loan. It allows borrowers to finance their home purchase at a fixed interest rate and pay it off over a full 30 years. These loans make sense for people who plan to live in their homes for several years. (Of course, you don’t have to stay in your house that long.)

Other books

A Writer's People by V. S. Naipaul

And Never Let Her Go by Ann Rule

THE FBI THRILLERS COLLECTION Books 1-5 by Catherine Coulter

Wreckers or Checkers: In It to Win It by H. M. Montes

Fearless: No. 2 - Sam (Fearless) by Francine Pascal

A Choice of Victims by J F Straker

The Unbelievers by Alastair Sim

Steel Victory (Steel Empire Book 1) by J.L. Gribble

Taming the Demon by Doranna Durgin

Denying Ecstasy (The Guardians of the Realms Series) by Setta Jay