The Gardens of Democracy: A New American Story of Citizenship, the Economy, and the Role of Government (8 page)

Authors: Eric Liu,Nick Hanauer

Tags: #Political Science, #Political Ideologies, #Democracy, #History & Theory, #General

BOOK: The Gardens of Democracy: A New American Story of Citizenship, the Economy, and the Role of Government

12.77Mb size Format: txt, pdf, ePub

If, however, we allow for the possibility that the other person in the transaction may still exist after the transaction, then we think differently. If we allow for the possibility that the other person will not only reciprocate vis-à-vis you but will also carry your behavior virally to others, then we must act differently. If we allow for the possibility that someone else’s problem is eventually your problem too, then we must act differently.

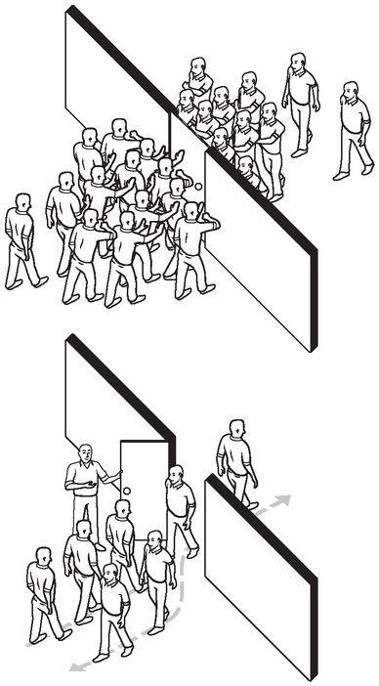

COUNTERINTUITION: Yielding = Advance

This possibility is called real life.

We acknowledge that this vision of true citizenship is challenging. The picture we paint here is not of the path of least resistance. Our vision requires people to lean forward and engage rather than lean back and let things happen. Left to themselves, many Americans—indeed, most humans—choose convenience over participation. But while it seems convenient to cede responsibility for the common good to the market or the state, that convenience is penny-wise and pound-foolish. It diminishes our feeling of enfranchisement, and our actual power. And while it seems inconvenient to show up and participate, that inconvenience pays dividends in material benefit and in the purposeful enjoyment of life. Why? Because participation, freely chosen rather than incentivized or delegated, springs from intrinsic motivation—and intrinsic motivation yields the kind of happiness that money can’t buy and laws can’t create.

To us, however, the most challenging aspect of what we call true citizenship is that it requires us to be continuously aware and alert to the ways in which both the market and the state tend to crowd out citizenship in ways that are gradual and often imperceptible, like the boiling of the proverbial frog.

We are not anti-market or anti-government. As our critics on both the left and the right will discover to their frustration in the pages to come, we are for both vibrant capitalism and an activist government. And we believe there is a vital role for both market and state in fostering true citizenship. That role consists not only in getting out of the way but also in designing choice architectures and signal-sending environments that crowd out the bad and crowd in the good. But ultimately, it all comes down to very intensely personal choices—to be mindful, continuously, of our power and obligation as sources of social contagion. To live with St. Paul’s words in our hearts—or not. To weed the bad and seed the good, like great gardeners.

Society becomes how

you

behave.

you

behave.

And whether the market and government reinforce great citizenship, or undermine it, will be the focus of the next two chapters of this book.

IV. True Capitalism

We’re All Better Off When We’re All Better Off

The efficient market hypothesis, market fundamentalism, and the costs of the prevailing idea of what an economy is—The alternative and evolutionary vision: the market as garden—Trickle-down economics and the war on the middle class—Middle-out economics, and the way forward

At the same time, this has been an era of radical economic inequality, at levels not seen since 1929. Over the last three decades, an unprecedented consolidation and concentration of earning power and wealth has made the top 1 percent of Americans immensely richer while middle-class Americans have been increasingly impoverished.

To most Americans and certainly most economists and policymakers, these two phenomena seem unrelated. In fact, traditional economic theory and contemporary American economic policy does not seem to admit the possibility that they are connected in any way.

And yet they are—deeply. In the following pages we aim to show that a modern understanding of economies as complex, adaptive, interconnected systems forces us to conclude that radical inequality and radical economic dislocation are causally linked: one brings and amplifies the other.

If we want a high-growth society with broadly shared prosperity, and if we want to avoid dislocations like the one we have just gone through, we need to change our theory of action foundationally. We need to stop thinking about the economy as a perfect, self-correcting machine and start thinking of it as a garden.

Traditional economic theory is rooted in a 19th- and 20th-century understanding of science and mathematics. At the simplest level, traditional theory assumes economies are linear systems filled with rational actors who seek to optimize their situation. Outputs reflect a sum of inputs, the system is closed, and if big change comes it comes as an external shock. The system’s default state is equilibrium. The prevailing metaphor is a machine.

But this is not how economies are. It never has been. As anyone can see and feel today, economies behave in ways that are non-linear and irrational, and often violently so. These often-violent changes are not external shocks but emergent properties—the

inevitable

result—of the way economies behave.

inevitable

result—of the way economies behave.

The traditional approach, in short, completely misunderstands human behavior and natural economic forces. The problem is that the traditional model is not an academic curiosity; it is the basis for an ideological story about the economy and government’s role—and that story has fueled policymaking and morphed into a selfishness-justifying conventional wisdom.

Even today, the debate between free marketeers and Keynesians unfolds on the terms of the market fundamentalists: government stimulus efforts are usually justified as a way to restore equilibrium, and defended as regrettable deviations from government’s naturally minimalist role.

Fortunately, as we’ve described above, it is now possible to understand and describe economic systems as complex systems like gardens. And it is now reasonable to assert that economic systems are not merely similar to ecosystems ; they are ecosystems, driven by the same types of evolutionary forces as ecosystems. Eric Beinhocker’s

The Origin of Wealth

is the most lucid survey available of this new complexity economics.

The Origin of Wealth

is the most lucid survey available of this new complexity economics.

The story Beinhocker tells is simple, and not unlike the story Darwin tells. In an economy, as in any ecosystem, innovation is the result of evolutionary and competitive pressures. Within any given competitive environment—or what’s called a “fitness landscape”—individuals and groups cooperate to compete, to find solutions to problems and share the gains from those solutions. The most successful strategies for cooperation spread and multiply. Throughout, minor initial advantages get amplified and locked in—as do disadvantages. Whether you are predator or prey, spore or seed, the opportunity to thrive compounds and then

concentrates.

It bunches. It never stays evenly spread.

concentrates.

It bunches. It never stays evenly spread.

Like a garden, the economy consists of an environment and interdependent elements—sun, soil, seed, water. But far more than a garden, the economy also contains the expectations and interpretations all the agents have about what all the

other

agents want and expect. And that invisible web of human expectations becomes, in an ever-amplifying spiral, both cause and effect of external circumstances. Thus the housing-led financial crisis. Complexity scientists describe it in terms of “feedback loops.” Financier George Soros has described it as “reflexivity.” What I think you think about what I want creates storms of behavior that change

what is.

other

agents want and expect. And that invisible web of human expectations becomes, in an ever-amplifying spiral, both cause and effect of external circumstances. Thus the housing-led financial crisis. Complexity scientists describe it in terms of “feedback loops.” Financier George Soros has described it as “reflexivity.” What I think you think about what I want creates storms of behavior that change

what is.

Traditional economics holds that the economy is an equilibrium system; that things tend, over time, to even out and return to “normal.” Complexity economics shows that the economy, like a garden, is never in perfect balance or stasis and is always both growing and shrinking. And like an untended garden, an economy left entirely to itself tends toward unhealthy imbalances. This is a very different starting point, and it leads to very different conclusions about what the government should do about the economy.

Einstein said, “Make everything as simple as possible, but not too simple.” The problem with traditional economics is that it has made things too simple and then compounded the error by treating the oversimplification as gospel. The bedrock assumption of traditional economic theory and conventional economic wisdom is that markets are perfectly efficient and therefore self-correcting. This “efficient market hypothesis,” born of the machine-age obsession with the physics of perfect mechanisms, is hard to square with intuition and reality—harder for laypeople than for economic experts. And yet, like a dead hand on the wheel, the efficient market hypothesis still drives everything in economic policymaking.

Consider that if markets are perfectly efficient then it

must

be true that:

must

be true that:

–The market is always right.

–Markets distribute goods, services, and benefits rationally and efficiently.

–Market outcomes are inherently moral because they perfectly reflect talent and merit and so the rich deserve to be rich and the poor deserve to be poor.

–Any attempt to control market outcomes is inefficient and thus immoral.

–Any non-market activity is inherently suboptimal.

–If you

can

make money doing something not illegal, you

should

do it.

–As long as there is a willing buyer and seller, every transaction is moral.

–Any government solution, absent a total market failure, is a bad solution.

But, of course, markets properly understood are not actually efficient. So-called balances between supply and demand, while representing a fair approximation, do not in fact really exist. And because humans are not rational, calculating, and selfish, their behavior in market settings is inherently imperfect, unpredictable, and inefficient. Laypeople know this far better than experts.

Markets are a type of ecosystem that is complex, adaptive, and subject to the same evolutionary forces as nature. As in nature, evolution makes markets an unparalleled way of effectively solving human problems. But evolution is purpose-agnostic. If the market is oriented toward producing junk and calling it good GDP, market evolution will produce ever more marketable junk.

As complex adaptive systems, markets are not like machines at all but like gardens.

This means, then, that the following must be true:

As complex adaptive systems, markets are not like machines at all but like gardens.

This means, then, that the following must be true:

–The market is often wrong.

–Markets distribute goods, services, and benefits in ways that often are irrational, semi-blind, and overdependent on chance.

–Market outcomes are not necessarily moral—and are sometimes immoral—because they reflect a dynamic blend of earned merit and the very unearned compounding of early advantage or disadvantage.

–If well-tended, markets produce great results but if untended, they destroy themselves.

–Markets, like gardens, require constant seeding, feeding, and weeding by government and citizens.

–More, they require judgments about what kind of growth is beneficial. Just because dandelions, like hedge funds, grow easily and quickly, doesn’t mean we should let them take over. Just because you can make money doing something doesn’t mean it is good for the society.

–In a democracy we have not only the ability but also the essential obligation to shape markets—through moral choices and government action—to create outcomes good for our communities.

Other books

Legend of Mace by Daniel J. Williams

Alex's Angel by Natasha Blackthorne

Charred Tears (#2, Heart of Fire) by Ford, Lizzy

Endurance by Jay Lake

The Dutch Girl by Donna Thorland

Pemberley by Emma Tennant

Russian Amerika by Stoney Compton

Look to the Lady by Margery Allingham

EDGE OF SUSPENSE: Thrilling Tales of Mystery & Murder by Flowers, R. Barri

Closing the Ring by Winston S. Churchill