Read Understanding Business Accounting For Dummies, 2nd Edition Online

Authors: Colin Barrow,John A. Tracy

Tags: #Finance, #Business

Understanding Business Accounting For Dummies, 2nd Edition (116 page)

What's in an Auditor's Report

The audit report, which is included in the financial report near the financial statements, serves two useful purposes:

It reassures investors and creditors that the financial report can be relied upon or calls attention to any serious departures from established financial reporting standards and generally accepted accounting principles (GAAP).

It prevents (in the large majority of cases, anyway) businesses from issuing sloppy or fraudulent financial reports. Knowing that your report will be subject to an independent audit really keeps you on your toes!

The large majority of audit reports on financial statements give the business a clean bill of health, or a

clean opinion.

At the other end of the spectrum, the auditor might state that the financial statements are misleading and should not be relied upon. This negative audit report is called an

adverse opinion.

That's the big stick that auditors carry: They have the power to give a company's financial statements an adverse opinion, and no business wants that. Notice that we say here that the audit firms ‘have the power' to give an adverse opinion. In fact, the threat of an adverse opinion almost always motivates a business to give way to the auditor and change its accounting or disclosure in order to avoid getting the kiss of death of an adverse opinion. An adverse audit opinion, if it were actually given, states that the financial statements of the business are misleading, and by implication fraudulent. The LSE and the SEC do not tolerate adverse opinions; they would stop trading in the company's shares if the company received an adverse opinion from its auditor.

Between the two extremes of a clean opinion and an adverse opinion, an auditor's report may point out a flaw in the company's financial statements - but not a fatal flaw that would require an adverse opinion. These are called

qualified opinions.

The following section looks at the most common type of audit report: the clean opinion, in which the auditor certifies that the business's financial statements conform to GAAP and are presented fairly.

True and fair, a clean opinion

If the auditor finds no serious problems, the audit firm states that the accounts give a true and fair view of the state of affairs of the company. In the US, the auditor gives the financial report an

unqualified opinion,

which is the correct technical name, but most people call it a

clean opinion.

This expression has started to make its way in UK accounting parlance as the auditing business becomes more international. The clean-opinion audit report runs to about 100 words and three paragraphs, with enough defensive, legal language to make even a seasoned accountant blush. This is a clean, or unqualified, opinion in the standard three-paragraph format:

In our opinion:

the financial statements give a true and fair view of the state of affairs of the company and the Group at 22 February 2003 and of the profit and cash flows of the Group for the year then ended;

the financial statements have been properly prepared in accordance with the Companies Act 1985; and

those parts of the Directors' remuneration report required by Part 3 of Schedule 7A to the Companies Act 1985 have been properly prepared in accordance with the Companies Act 1985.

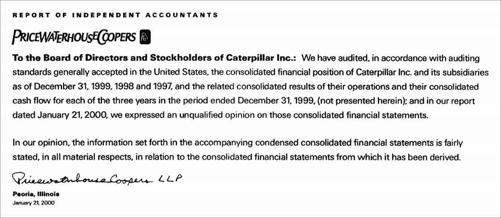

Figure 15-1 presents a clean opinion but in a

one

-paragraph format - given by PricewaterhouseCoopers on Caterpillar's 1999 financial statements. For many years, Price Waterhouse (as it was known before its merger with Coopers) was well known for its maverick one-paragraph audit report.

Figure 15-1:

A one-paragraph audit report.

The following summary cuts through the jargon and shows you what the audit report really says.

1st paragraph

We did the audit, but the financial statements are the responsibility of management; we just express an opinion of them.

2nd paragraph

We carried out audit procedures that provide us a reasonable basis for expressing our opinion, but we don't necessarily catch everything.

3rd paragraph

The company's financial statements conform to GAAP and are not misleading.

Other kinds of audit opinions

An audit report that does

not

give a clean opinion may look very similar to a clean-opinion audit report to the untrained eye. Some investors see the name of an audit firm next to the financial statements and assume that everything is okay - after all, if the auditor had seen a problem, the cops would have pounced on the business and put everyone in jail, right? Well, not exactly.

How do you know when an auditor's report may be something other than a straightforward, no-reservations clean opinion?

Look for a fourth paragraph

; that's the key. Many audits require the audit firm to add additional, explanatory language to the standard, unqualified (clean) opinion.

One modification to an auditor's report is very serious - when the audit firm expresses the view that it has substantial doubts about the capability of the business to continue as a going concern. A

going concern

is a business that has sufficient financial wherewithal and momentum to continue its normal operations into the foreseeable future and would be able to absorb a bad turn of events without having to default on its liabilities. A going concern does not face an imminent financial crisis or any pressing financial emergency. A business could be under some financial distress, but overall still be judged a going concern. Unless there is evidence to the contrary, the auditor assumes that the business is a going concern.

But in some cases, the auditor may see unmistakable signs that a business is in deep financial waters and may not be able to convince its creditors and lenders to give it time to work itself out of its present financial difficulties. The creditors and lenders may force the business into involuntary bankruptcy, or the business may make a pre-emptive move and take itself into voluntary bankruptcy

.

The equity owners (shareholders of a company) may end up holding an empty bag after the bankruptcy proceedings have concluded. (This is one of the risks that shareholders take.) If an auditor has serious concerns about whether the business is a going concern, these doubts are spelled out in the auditor's report.

Auditors also point out any accounting methods that are inconsistent from one year to the next, whether their opinion is based in part on work done by another audit firm, on limitations on the scope of their audit work, on departures from GAAP (if they're not serious enough to warrant an adverse opinion), or on one of several other more technical matters. Generally, businesses - and auditors, too - want to end up with a clean bill of health; anything less is bound to catch the attention of the people who read the financial statements. Every business wants to avoid that sort of attention if possible.