Read Understanding Business Accounting For Dummies, 2nd Edition Online

Authors: Colin Barrow,John A. Tracy

Tags: #Finance, #Business

Understanding Business Accounting For Dummies, 2nd Edition (47 page)

Business balance sheets are not vetted by the accountant to make sure no secrets are being disclosed that would harm national security. The term ‘classified' applied to a balance sheet does not mean restricted or top secret; rather, the term means that assets and liabilities are sorted into basic classes, or groups, for external reporting. Classifying certain assets and liabilities into current categories is done mainly to help readers of the balance sheet more easily compare total current assets with total current liabilities for the purpose of judging the short-term solvency of the business.

Solvency refers to the ability of a business to pay its liabilities on time. Delays in paying liabilities on time can cause very serious problems for a business. In extreme cases, a business could be thrown into

bankruptcy

- even the threat of bankruptcy can cause serious disruptions in the normal operations of a business, and profit performance is bound to suffer. If current liabilities become too high relative to current assets - which are the first line of defence for paying those current liabilities - managers should move quickly to raise additional cash to reduce one or more of the current liabilities. Otherwise, a low current ratio will raise alarms in the minds of the outside readers of the business's financial report.

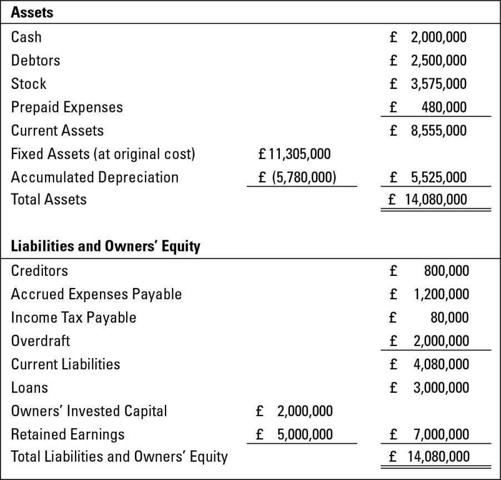

Figure 6-3 presents the

classified

balance sheet for the same company. What's new? Not the assets, liabilities, and owners' equity accounts and their balances. These numbers are the same ones shown in Figure 6-1. The classified balance sheet shown in Figure 6-3 includes the following new items of information:

The first four asset accounts (cash, debtors, stock, and prepaid expenses) are added to give the £8,555,000 subtotal for

current assets.

The £5,000,000 total debt of the business is divided between £2,000,000 short-term notes payable and £3,000,000 long-term notes payable.

The first four liability accounts (accounts payable, accrued expenses payable, income tax payable, and short-term notes payable) are added to give the £4,080,000 subtotal for

current liabilities.

Figure 6-3:

Example of an external (classified) balance sheet for a business.

Current (short-term) assets

Short-term,

or

current,

assets are

Cash

Marketable securities that can be immediately converted into cash

Operating assets that are converted into cash within one

operating cycle

Operating cycle

refers to the process of putting cash into stock, selling products on credit (which generates debtors) and then collecting the receivables in cash. In other words, the operating cycle is the ‘from cash - through stock and debtors - back to cash' sequence. The term

operating

refers to those assets that are directly part of making sales and directly involved in the expenses of the company.

Current (short-term) liabilities

Short-term,

or

current

, liabilities are those non-interest-bearing liabilities that arise from the operating activities of the business, as well as interest-bearing overdrafts that have a maturity date one year or less from the balance sheet date. Current liabilities also include any other liabilities that must be paid within the upcoming financial period.

Current liabilities are generally paid out of current assets. That is, current assets are the first source of money to pay the current liabilities when those liabilities come due. Thus, total current assets are compared against total current liabilities in order to compute the

current ratio.

For the balance sheet shown in the preceding section, you can compute the current ratio as follows: