The Long Tail (6 page)

Authors: Chris Anderson

Books were becoming cheaper and more plentiful—what more could anyone want?

Again, Bezos asked himself that very question:

I was sorting through these things. If you used the Web in 1994, with the primitive browsers and the technology that was available at the time, it was a pain. The browser was always crashing and things didn’t work right and your bandwidth was tiny, even if you had the best modem available at the time.

I concluded that given the technology at the time if you could do something any other way, that other way would be preferable to doing it on the Web. You didn’t want to do apparel on the Web, even though it was the best category, because apparel you could do very effectively through catalogs and through stores. This was my criteria: picking a category where you could substantially improve the customer experience along a dimension that could only be done on the Web.

It turns out that selection is a very important customer experience driver in the book category. It also turns out that you can’t have a big book catalog on paper; it’s totally impractical. There are more than 100,000 new books published every year, and even a superstore can’t carry them all. The biggest superstores have 175,000 titles and there are only about three that big. So that became the idea: let Amazon.com be the first place where you can easily find and buy a million different books.

What this quant had zeroed in on was an opportunity in what appeared to be a very mature book industry. Although there were lots of publishers, most distribution was handled by just two wholesalers, which had warehouses strategically placed around the country to serve any need.

That suggested a great opportunity for a virtual retailer.

Although 175,000 titles sounds like a lot, Bezos knew the inventory of even the largest superstores was just a tiny fraction of the books available. And being able not only to search for book titles but also to read reviews would clearly make it easier for customers to find what they really wanted.

At the time, there were at least 1.5 million English-language books in print—even the superstores carried just 10 percent of them. Today, the online database Books in Print lists upward of 6.1 million titles. Bezos also knew that more and more publisher catalogs were popping up online, offering academic books, trade books, self-published books, and more. There was no reason why Amazon couldn’t offer all of them.

What the Internet presented was a way to eliminate most of the physical barriers to unlimited selection. The bricks-and-mortar superstores had scale, but they still had to deal with the economics of shelves, walls, staff, locations, working hours, and weather. Because they were bigger and more efficient than the independent booksellers, superstores could offer more selection. However, even their business model hit the wall long before the supply of available titles did.

Today online shopping has passed catalog shopping and now accounts for about 5 percent of American retail spending. It’s still growing at a whopping 25 percent a year, and is well on track to fulfill Bezos’s original prediction that online retail would eventually reach around 15 percent of total retail, which would give it more than a tenth of the $12 trillion American economy.

One of the largest categories is the online sites of the bricks-and-mortar giants. Bn.com complements Barnes & Noble’s brand with a Web site that offers selection on a par with Amazon. Discount cards work equally in both channels, and you can get same-day delivery in Manhattan where B&N has several superstores. If a store doesn’t have a book in stock, the clerks are still able to satisfy a customer request by ordering it for them online. Likewise for the online side of Wal-Mart, Best Buy, and innumerable other retailers: The unlimited shelf space of the Web retail allows them to offer their customers more variety and convenience, cementing brand loyalty with existing customers and extending it to new ones who may or may not be near a physical store.

LONG TAILS EVERYWHERE

From purely virtual retailers such as eBay to the online side of traditional retailing, the virtues of unlimited shelf space, abundant information, and smart ways to find what you want—Bezos’s original vision—have proven every bit as compelling as he thought. And as a result, there are now Long Tail markets practically everywhere you look.

Just as Google is finding ways to tap the Long Tail of advertising, Microsoft is extending the Tail of video games into small and cheap games that you can download on its Xbox Live network. Open-source software projects such as Linux and Firefox are the Long Tail of programming talent, while offshoring taps the Long Tail of labor. Meanwhile, the Internet has enabled the longest, er, tail of pornography for every possible taste and kink.

More esoteric examples include the proliferation of microbrews as the “Long Tail of beer” (indeed, Anheuser-Busch has created a division called “Long Tail Libations” to sell niche drinks), the growth of customized T-shirts, shoes, and other clothing as the “Long Tail of fashion,” and the growth of online universities as the “Long Tail of education.”

Finally, to give an idea of how broadly the theory has been applied, consider this analysis of the “Long Tail of national security” by John Robb, a military analyst who runs the Global Guerrillas Web site:

Traditionally, warfare (the ability to change society through violence) has been limited to nation-states, except in rare cases. States had a monopoly on violence. The result was a limited, truncated distribution of violence. That monopoly is on the skids due to three trends:

- A democratization of the tools of warfare. Niche producers (for example: gangs) are made possible by the dislocation of globalization. All it takes to participate is a few men, some boxcutters, and a plane (as an example of simple tools combined with leverage from ubiquitous economic infrastructure).

- An amplification of the damage caused by niche producers of warfare. The magic of global guerrilla systems disruption which turns inexpensive attacks into major economic and social events.

- The acceleration of word of mouth. New groups can more easily find/train recruits, convey their message to a wide audience, and find/coordinate their activities with other groups (allies).

The result: a Long Tail has developed. New niche producers of violence have flourished. Demand for the results these niche suppliers can produce has also radically increased. Big concepts (such as a struggle between Islam and the U.S.), not championed by states, have supercharged niche suppliers like al Qaeda and its clones.

MAKE IT, GET IT OUT THERE, AND HELP ME FIND IT

The theory of

the Long Tail can be boiled down to this: Our culture and economy are increasingly shifting away from a focus on a relatively small number of hits (mainstream products and markets) at the head of the demand curve, and moving toward a huge number of niches in the tail. In an era without the constraints of physical shelf space and other bottlenecks of distribution, narrowly targeted goods and services can be as economically attractive as mainstream fare.

But that’s not enough. Demand must follow this new supply. Otherwise, the Tail will wither. Because the Tail is measured not just in available variety but in the people who gravitate toward it, the true shape of demand is revealed only when consumers are offered infinite choice. It is the aggregate sales, use, or other participation of all those people in the newly available niches that turns the massive expansion of choice into an economic and cultural force. The Long Tail starts with a million niches, but it isn’t meaningful until those niches are populated with people who want them.

Collectively, all of this translates into six themes of the Long Tail age:

- In virtually all markets, there are far more niche goods than hits. That ratio is growing exponentially larger as the tools of production become cheaper and more ubiquitous.

- The costs of reaching those niches is now falling dramatically. Thanks to a combination of forces including digital distribution, powerful search technologies, and a critical mass of broadband penetration, online markets are resetting the economics of retail. Thus, in many markets, it is now possible to offer a massively expanded variety of products.

- Simply offering more variety, however, does not shift demand by itself. Consumers must be given ways to find niches that suit their particular needs and interests. A range of tools and techniques—from recommendations to rankings—are effective at doing this. These “filters” can drive demand down the Tail.

- Once there’s massively expanded variety and the filters to sort through it, the demand curve flattens. There are still hits and niches, but the hits are relatively less popular and the niches relatively more so.

- All those niches add up. Although none sell in huge numbers, there are so many niche products that collectively they can comprise a market rivaling the hits.

- Once all of this is in place, the natural shape of demand is revealed, undistorted by distribution bottlenecks, scarcity of information, and limited choice of shelf space. What’s more, that shape is far less hit-driven than we have been led to believe. Instead, it is as diverse as the population itself.

Bottom line: A Long Tail is just culture unfiltered by economic scarcity.

HOW LONG TAILS EMERGE

None of the aforementioned happens without one big economic trigger: reducing the costs of reaching niches. What causes those costs to

fall? Although the answer varies from market to market, the explanation usually involves one or more of three powerful forces coming into play.

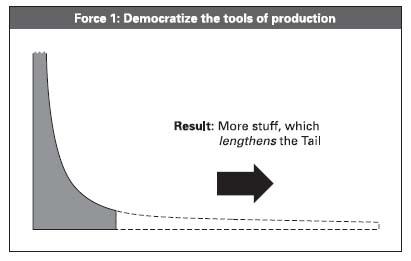

The first force is

democratizing the tools of production

. The best example of this is the personal computer, which has put everything from the printing press to the film and music studios in the hands of anyone. The power of the PC means that the ranks of “producers”—individuals who can now do what just a few years ago only professionals could do—have swelled a thousandfold. Millions of people now have the capacity to make a short film or album, or publish their thoughts to the world—and a surprisingly large number of them do. Talent is not universal, but it’s widely spread: Give enough people the capacity to create, and inevitably gems will emerge.

The result is that the available universe of content is now growing faster than ever. This is what extends the tail to the right, increasing the population of available goods manyfold. In music, for instance, the number of new albums released grew a phenomenal 36 percent in 2005, to 60,000 titles (up from 44,000 in 2004), largely due to the ease with which artists can now record and release their own music. At the same time, bands uploaded more than 300,000 free tracks to MySpace, extending the tail even further.

The second force is

cutting the costs of consumption by democratizing distribution.

The fact that anyone can make content is only meaningful if others can enjoy it. The PC made everyone a producer or publisher, but it was the Internet that made everyone a distributor.

At its most dramatic this is the economics of bits versus atoms, the difference between fractions of pennies to deliver content online and the dollars it takes to do it with trucks, warehouses, and shelves. Still, even for physical goods, the Internet has dramatically lowered the costs of reaching consumers. Over decades and billions of dollars, Wal-Mart set up the world’s most sophisticated supply chain to offer massive variety at low prices to tens of millions of customers around the world. Today anybody can reach a market every bit as big with a listing on eBay.

The Internet simply makes it cheaper to reach more people, effectively increasing the liquidity of the market in the Tail. That, in turn, translates to more consumption, effectively raising the sales line and increasing the area under the curve.

The third force is

connecting supply and demand,

introducing consumers to these new and newly available goods and driving demand down the Tail. This can take the form of anything from Google’s wisdom-of-crowds search to iTunes’ recommendations, along with word-of-mouth, from blogs to customer reviews. The ef

fect of all this for consumers is to lower the “search costs” of finding niche content.

In economics, search costs refer to anything that gets in the way of finding what you want. Some of those costs are non-monetary, such as wasted time, hassle, wrong turns, and confusion. Other costs actually have a dollar figure, such as mistaken purchases or paying too much for something because you couldn’t find a cheaper alternative. Anything that makes it easier to find what you want at the price you want lowers your search costs.

We’ll go into this more later in the book, but other consumers are often the most useful guides because their incentives are best aligned with our own. Netflix and Google tap consumer wisdom collectively by watching what millions of them do and translating that into relevant search results or recommendations.

Consumers also act as guides individually when they post user reviews or blog about their likes and dislikes. Because it’s now so easy to tap this grassroots information when you’re looking for something new, you’re more likely to find what you want faster than ever. That has the economic effect of encouraging you to search farther outside the world you already know, which drives demand down into the niches.

The other thing that happens when consumers talk amongst them

selves is that they discover that, collectively, their tastes are far more diverse than the marketing plans being fired at them suggest. Their interests splinter into narrower and narrower communities of affinity, going deeper and deeper into their chosen subject matter, as is always the case when like minds gather. Encouraged by the company, virtual or not, they explore the unknown together, venturing farther from the beaten path.

The explosion of these technologies that connect consumers is what drives demand from the head to the tail. In other words, the third force further increases demand for the niches and flattens the curve, shifting its center of gravity to the right.

Think of each of these three forces as representing a new set of opportunities in the emerging Long Tail marketplace. The democratized tools of production are leading to a huge increase in the numbers of producers. Hyperefficient digital economics are leading to new markets and marketplaces. And finally, the ability to tap the distributed intelligence of millions of consumers to match people with the stuff that suits them best is leading to the rise of all sorts of new recommendation and marketing methods, essentially serving as the new tastemakers.

In a nutshell, all of that looks like this:

The next three chapters will explore these new business opportunities in detail.