Financial Markets Operations Management (13 page)

Read Financial Markets Operations Management Online

Authors: Keith Dickinson

There are several types of swap depending on the underlying asset type. Each one of these swap types complies with our above definition; see

Table 2.51

for some examples.

TABLE 2.51

Types of swap

| Underlying Asset | OTC Swap | Definition |

| Equity | Equity swap | The performance of shares or a stock market index swapped with financing (e.g. LIBOR) |

| Interest rate | Interest rate swap | A fixed IRS swapped with a floating interest rate (e.g. 3m Euribor) or floating vs. floating (e.g. 1m LIBOR vs 6m LIBOR) |

| Credit | Credit default swap | CDS: the CDS buyer makes a series of payments (“fee”) to the CDS seller who will compensate the buyer only in the event of a loan default or other credit event |

| Foreign exchange | Currency swap | Swap the principal amount plus interest in one currency with that of another. There are variations as to the structures used. |

| Commodity | Commodity swap | Similar in concept to a fixed/floating IRS. A floating (spot) price for a commodity (e.g. crude oil) is swapped for a fixed price in the same commodity. |

We have seen that of all the OTC derivative types, interest rate swaps are by far the greatest component. Used for both hedging and speculating purposes, there are several types of interest rate swap (IRS) (see

Table 2.52

).

TABLE 2.52

Types of interest rate swap

| Leg 1 | Leg 2 | Currency | |

| Fixed | for | Floating | Same currency |

| Fixed | for | Floating | Different currencies |

| Floating | for | Floating | Same currency |

| Floating | for | Floating | Different currencies |

| Fixed | for | Fixed | Different currencies |

We will examine the first of these, fixed for floating in the same currency, in more detail.

Here, ABC Corporation is using an IRS to hedge an existing position. The notional amount of the IRS will be USD 10 million, the term of the contract will be five years and ABC will want to end up in a situation where it pays a fixed rate of interest overall. In theory, ABC Corporation would need to find a counterparty with the opposite requirement, i.e. the counterparty has a fixed interest liability, believing that interest rates will go down. In practice, however, ABC Corporation would approach a swap dealer, who would act either as a principal or as a broker.

ABC will receive a floating rate of interest to partially or fully offset the existing floating rate loan and pay a fixed rate of interest. ABC is referred to as the

receiver

. The swap bank will therefore be the

payer

of fixed-rate interest.

The contract terms of the IRS might look something like those in

Table 2.53

.

TABLE 2.53

Contract terms of ABC's interest rate swap

| Receiver | ABC Corporation | Receives “fixed” |

| Payer | Swap Bank | Pays “fixed” |

| Fixed rate | 1.60% p.a. | 30/360. Payable semi-annually on |

| Floating rate | 6-month LIBOR plus 50 bp | 30/360. Payable semi-annually on |

| Notional | USD 10,000,000 | |

| Term | 5 years |

(Please note that the rates quoted above are illustrative only. When the swap transaction is executed, the swap will be priced in such a way that the net present value of the transaction is zero.)

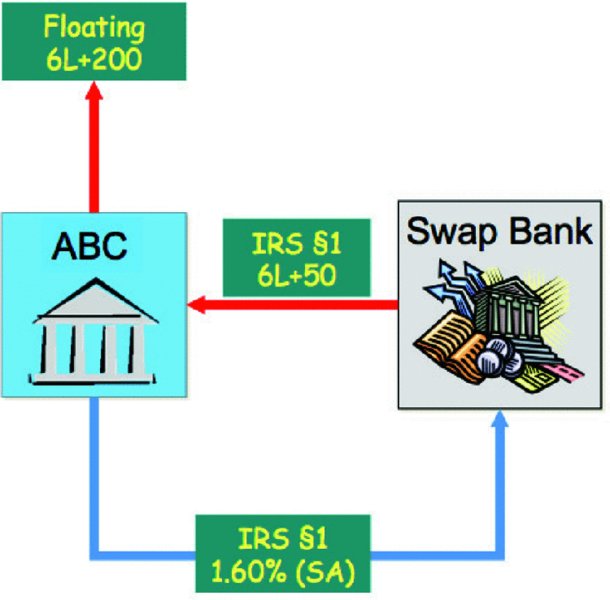

Through this IRS transaction, ABC Corporation has effectively changed from a floating interest rate situation into a fixed rate one. We know that ABC is currently paying 6L+200 and we can use a “plumbing diagram” (see

Figure 2.9

) to track the interest flows and calculate the new interest rate for ABC.

FIGURE 2.9

IRS plumbing diagram

We can see that paying the current rate and receiving the floating leg eliminates the six-month LIBOR rate, leaving a net 150 bp as a cost. Add that to the fixed leg of 1.60% and we arrive at a total fixed interest rate of 3.10% p.a. for ABC (as shown in

Table 2.54

).

TABLE 2.54

Total fixed interest rate for ABC

| Details | Pay/Receive | Interest | ± | Basis Points | Balance |

| Current rate | Paying | 6L | + | 200 | â(6L+200) |

| Floating leg | Receiving | 6L | + | 50 | â150 |

| Fixed leg | Paying | 1.60% | â | â3.10% |

Let us assume that Swap Bank has a second counterparty/client, XYZ Inc., which has a loan and is paying 1.80% fixed. XYZ enters into an IRS transaction with Swap Bank on the terms shown in

Table 2.55

.

TABLE 2.55

Terms of XYZ's interest rate swap

| Receiver | Swap Bank | Receives “fixed” |

| Payer | XYZ Inc | Pays “fixed” |

| Fixed rate | 1.58% p.a. | 30/360. Payable semi-annually on |

| Floating rate | 6-month LIBOR plus 50 bp | 30/360. Payable semi-annually on |

| Notional | USD 10,000,000 | |

| Term | 5 years |

The other types of swap follow the same general principles as the fixed/floating IRS but with characteristics unique to the swap type.

OTC derivatives are privately negotiated contracts transacted away from an exchange. This has the advantage of enabling users to tailor their transactions to suit their situation. Unlike the transparency of exchange-traded derivatives, OTC derivatives are opaque to the market and the

regulators. This situation is changing with the move to centrally clear the more straightforward, vanilla-type contracts. Whether this will lead to the contracts being traded on an exchange remains to be seen.

One disadvantage of OTC is that the terms and conditions of every transaction must be clearly stated in the transaction confirmation; even down to the granular level of specifying day-count conventions.

The ISDA Bookstore (

www.isda.org/publications/pubguide.aspx

) contains a wide range of publications that cover the ISDA Master Agreement, definitional booklets and confirmations and regulatory documentation.

Financial products can be issued for a particular purpose and subsequently traded.

The cash markets are divided into short-term and long-term products and these are issued by governments (and their various agencies), supranational organisations and corporations to enable them to satisfy their particular financial requirements.

We tend to refer to the issuance and trading of short-term products as the money markets and these include:

- Cash loans/deposits;

- Commercial paper;

- Certificates of deposit;

- Bankers' acceptances;

- Treasury bills;

- Bills of exchange.

By contrast, we refer to the longer-term products as the securities markets and these include:

- Equities (ordinary shares/common stock);

- Debt (corporate bonds, treasury bonds, supranational bonds);

- Hybrids (preference shares, convertible bonds, equity warrants).

Securities are traded for cash settlement, as payment is expected in full and within a few days following the trade date.

Derivatives are financial contracts that derive their value from underlying assets such as equities, bonds, interest rates, stock market indices, etc. Derivative contracts are not issued by

the issuers of the underlying assets; rather, they are issued either by an exchange (exchange-traded derivatives â ETDs) or privately between two counterparties (OTC derivatives).

There are four types of derivative contract:

- Forwards (OTC);

- Futures (ETD);

- Options (ETD and OTC);

- Swaps (OTC).

This market is changing; OTC derivative contracts are becoming more transparent as they are increasingly being reported to a trade repository and cleared through a central clearing house system. ETDs have always been traded on an exchange and cleared centrally.

Derivative contracts are either exercised (into the underlying assets or cash) or closed out prior to the last trading day. In the meantime, the financial risks associated with these products are covered, depending on the product type, by a system of margin calls, premium payments and collateral exchanges. The full economic value of the contract is not settled on the trade date.