Financial Markets Operations Management (37 page)

Read Financial Markets Operations Management Online

Authors: Keith Dickinson

In Chapter 6: Securities Depositories (CSDs and ICSDs), we looked at the two organisations that were established to look after the Eurobond market. The fact that Euroclear Bank (EB) and Clearstream Banking Luxembourg (CBL) were located in Brussels, Belgium and Luxembourg respectively was, in some ways, irrelevant, as the Eurobond was not a type of security domiciled in either country.

CBL's and EB's typical types of client have always included sell-side organisations (e.g. member firms of the International Capital Market Association â dealers, market makers, broker/dealers, investment banks, etc.) together with investment fund distributors and providers. It is not the usual practice for an institutional client to be a direct participant of the ICSDs.

Both expanded into equity and domestic bond markets through a network of depositories, custodian banks and local CSDs. In

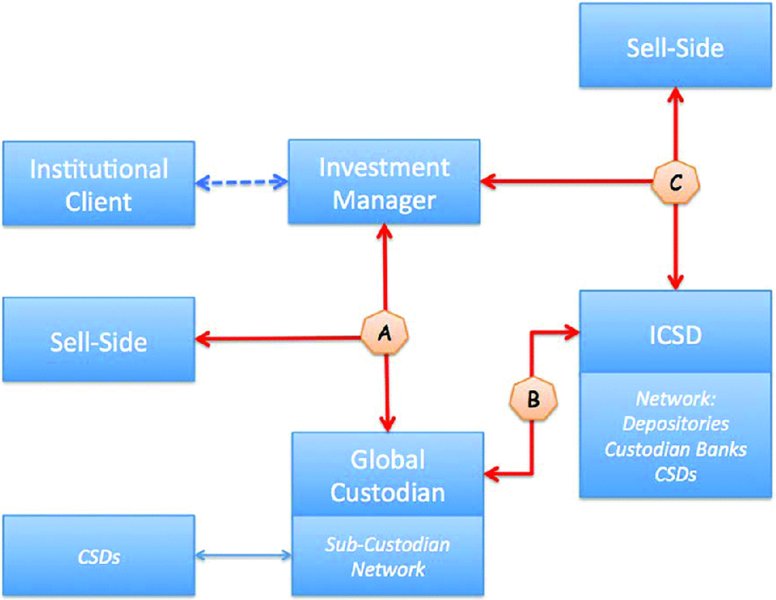

Figure 10.7

we can see that there are two options available. The investment manager and sell-side firms can either:

- Have indirect links to the ICSD (B) by using the global custodian (A), or

- Have direct links to the ICSD (C).

FIGURE 10.7

Links with the ICSDs

It is possible to appreciate that there is a blurring of the distinction between a global custodian (and its links to the local CSDs through its network of sub-custodians) and an ICSD (which traditionally handled Eurobonds, foreign bonds and global bonds).

However, differences do remain:

- Whilst both ICSDs have become banks (as are the majority of global custodians), they are still regarded as being part of the market infrastructure (similar to the CSDs).

- Institutional clients can appoint a global custodian, as we have seen already, but would not be a direct participant of an ICSD.

- A global custodian is effectively an intermediary that provides a wider range of services to its clients than provided by the ICSDs.

- The ICSDs' payment and settlement instruction deadlines are absolute whilst the global custodians' deadlines can be more flexible. (This is mainly because the global custodians have to allow themselves more time to meet their sub-custodians' internal deadlines and those of the CSDs.)

Furthermore, both ICSDs differ in the way they use CSDs. As shown in

Table 10.12

, the Euroclear group controls a number of European CSDs, with Clearstream controlling just two (again, in Europe) â see

Table 10.13

.

TABLE 10.12

Euroclear group

| Group Member | Market |

| Euroclear Bank | ICSD services offering a single entry point for more than 40 securities markets |

| Euroclear Belgium | Domestic CSD in Belgium (formerly CIK) |

| Euroclear Finland | Domestic CSD in Finland (formerly APK) |

| Euroclear France | Domestic CSD in France (formerly SICOVAM) |

| Euroclear Nederland | Domestic CSD in the Netherlands (formerly NECIGEF) |

| Euroclear Sweden | Domestic CSD in Sweden (formerly VPC) |

| Euroclear UK & Ireland | Domestic CSD in the United Kingdom (formerly CREST Co) |

| Euroclear UK & Ireland | Domestic CSD in Ireland (formerly CREST Co) |

TABLE 10.13

Clearstream

| Group Member | Market |

| Clearstream Banking Luxembourg | ICSD services offering a single entry point for more than 50 securities markets |

| LuxClear | Domestic CSD in Luxembourg |

| Clearstream Banking Frankfurt | Domestic CSD in Germany (formerly Deutsche Börse Clearing) |

Both ICSDs look to the following third parties for services:

- Securities information vendors for pricing, income, corporate actions, etc.;

- Depository services such as custody, settlement in local markets, income and corporate actions processing;

- Cash correspondent banks for payment instructions and links to national cash-clearing systems;

- Fund transfer agents who process fund orders;

- Communication networks that support the ICSDs' processing services.

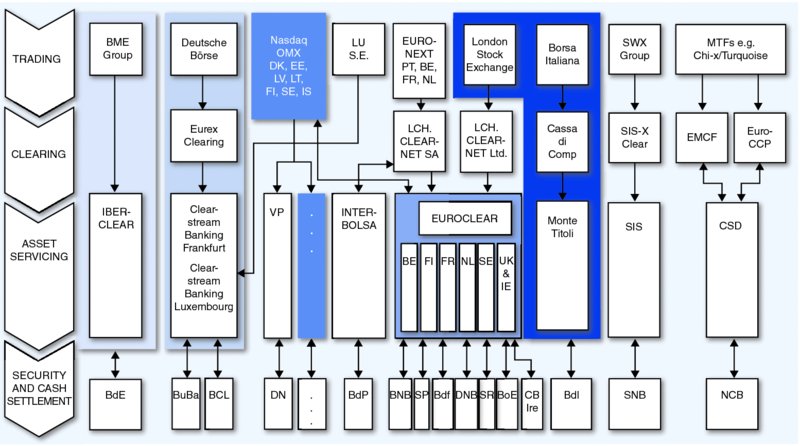

We have seen before that the European landscape is fragmented (see

Figure 10.8

)

4

compared with the USA where the clearing and settlement infrastructure is centred on the DTCC (equities and corporate bonds) and Federal Reserve System (US government securities).

FIGURE 10.8

Fragmented European landscape

With the merger of some European CSDs into the Euroclear group (see above) and Link Up Markets (the joint venture to facilitate message exchange amongst several other CSDs â Austria, Cyprus, Denmark, Germany, Greece, Norway, Spain, Switzerland and South Africa in March 2009), it does not seem possible to harmonise clearing and settlement across Europe.

In 2001 the Giovannini Group

5

identified 15 barriers that prevented efficient cross-border clearing and settlement within the European Union. The T2S project will help remove six of these barriers:

- National differences in information technology and interfaces.

- National clearing and settlement restrictions that require the use of multiple systems.

- Differences in national rules relating to corporate actions, beneficial ownership and custody.

- The absence of intra-day settlement finality.

- Practical impediments to remote access to national clearing and settlement systems.

- National differences in operating hours/settlement deadlines.

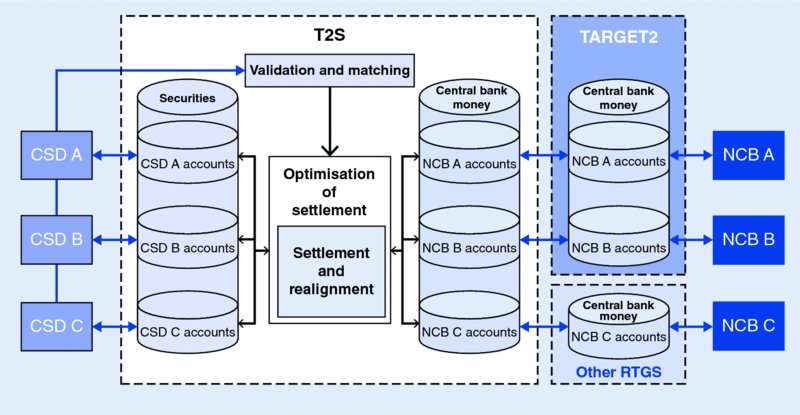

Target2Securities (T2S) is the project owned and managed by the Eurosystem

6

with the objective of removing the barriers, inefficiencies and costs found in the current fragmented landscape and replacing them with a single system.

T2S will neither become a CSD nor replace the existing CSD arrangements. Instead, T2S will be integrated with the Eurozone payment system (Target2) using a single IT system with a single set of standards and a single operational framework. T2S will provide DVP through real-time gross settlement in central bank money.

The general objectives of T2S are:

- To reduce risk in the European post-trade environment;

- To streamline the European settlement process;

- To enhance freedom of choice in the European securities settlement industry;

- To reduce the cost of settling securities transactions in Europe.

As shown in

Figure 10.9

, the T2S system will integrate: “â¦Â both securities accounts and cash accounts on a single IT platform, so that only one interface will be necessary between the CSDs and the T2S platform. T2S will accommodate both the market participants' securities accounts, held at either one or multiple CSDs, and their dedicated central bank cash accounts, held with their respective national central bank. The dedicated cash accounts will be used exclusively for settlement purposes in T2S and will be linked to the participants' cash accounts held in TARGET2 or another non-euro central bank RTGS account.”

7

FIGURE 10.9

Integrated model â T2S and Target2

The first migration wave of CSDs is scheduled to start in June 2015, as noted in

Table 10.14

.

TABLE 10.14

T2S migration waves

| First Wave 22 June 2015 | Second Wave 28 March 2016 | Third Wave 12 September 2016 | Fourth Wave 6 February 2017 |

| Bank of Greece Securities Settlement System (BOGS) | Euroclear Belgium | Clearstream Banking (Germany) | Centrálny depozitár cenných papierov SR (CDCP) (Slovakia) |

| Depozitarul Central (Romania) | Euroclear France | KELER (Hungary) | Eesti Väärtpaberikeskus (Estonia) |

| Malta Stock Exchange | Euroclear Nederland | LuxCSD (Luxembourg) | Euroclear Finland |

| Monte Titoli (Italy) | Interbolsa (Portugal) | Oesterreichische Kontrollbank (Austria) | Iberclear (Spain) |

| SIX SIS (Switzerland) | National Bank of Belgium Securities Settlement Systems (NBB-SSS) | VP Lux (Luxembourg) | KDD â Centralna klirinÅ¡ko depotna družba (Slovenia) |

| VP Securities (Denmark) | Lietuvos centrinis vertybinių popierių depozitoriumas (Lithuania) |

Source:

ECB (online) T2S Spotlight. “When will T2S be available to the market?” Available from

http://www.ecb.europa.eu/paym/t2s/about/press/html/index.en.html

. [Accessed Thursday, 11 September 2014]

There is plenty of information on the ECB's website (

www.ecb.europa.eu/paym/t2s/ html/index.en.html

) plus there are several YouTube videos, of which three are particularly useful:

- YouTube (online) “T2S Benefits”. Available from

http://www.youtube.com/watch?v= wPmeHjA1VeQ&list=PL347E929CBF4A76F7

. Published by ECB Euro 8 May 2012. - YouTube (online) “T2S and Beyond” (Conference on securities settlement in 2020) Frankfurt 4â5 October 2011. Available from

http://www.youtube.com/watch?v=ORCu KWh21JY&list=PL347E929CBF4A76F7

. Published by ECB Euro 8 May 2012. - YouTube (online) “How is the T2S Community preparing for wave 1?” (Panel Session) 25 June 2014. Available from

http://www.youtube.com/watch?v=AVF2BaWGv81&index=8&list=PL347E929CBF4A76F7

. Published by ECB Euro 25 June 2014.

In this chapter we have looked at custody in terms of the forms of securities (registered and bearer) and what that means in terms of the safekeeping of securities.

We saw that ownership of registered securities is reflected on the issuer's register, which is maintained by a registrar or transfer agent. Securities can be registered in the name of one of the following entities:

- The actual beneficial owner;

- The custodian bank;

- A nominee name.

Remember that whoever's name is in the register is the legal owner; using a nominee or a custodian bank transfers legal ownership to that entity. The investor, as the beneficial owner, must trust the nominee/custodian bank to pass the benefits of ownership on to the investor as and when received from the issuer.

We then considered the three ways in which securities can be held in custody:

- Custody in a local market â suitable for those investors that tend to invest in their local markets and perhaps a few cross-border markets as well.

- Custody in the global markets â for globally invested institutions that might choose to use a single global custodian to handle their assets.

- Custody in the Euro markets â for institutions that are focused on the international bond markets.

Not only do the global custodians have access to many markets through their network of sub-custodians, but they also offer a wide range of services. These include the basic services, such as settlement, safekeeping and reporting, and value-added services, such as investment accounting, derivatives clearing and securities lending.

In the Euro markets, the two international central securities depositories (Clearstream Banking Luxembourg and Euroclear Bank) have serviced their participants' requirements for new issuance, settlement, safekeeping and credit-related (securities and cash financing) services. Both ICSDs have expanded their services to include equities through their links to local CSDs and investment funds.

Finally, we explained how the Eurozone is harmonising the fragmented settlement situation in Europe by developing T2S. T2S is an integrated model that will enable participants to settle trades in central bank money on a DVP basis across the participating CSDs and the Target2 payment system.